The FIRE movement naysayers are right. Retiring early is nearly impossible if you have kids. Don’t be fooled by the people without kids telling you how you, too, can retire in your 30s or 40s and live a life of leisure.

They have no idea how much it costs and how much energy it takes to raise kids, especially in an expensive metropolitan area like San Francisco, New York, Washington, D.C., Boston, LA…you know, where half the U.S. population lives.

Even for those who claim to have retired early with kids, chances are high one or both parents are making side-hustle money out of necessity, one spouse is working a full-time job, or the couple has had to drastically cut their lifestyle to the bare bones.

Read: These are the bad things about early retirement that no one talks about

I left my finance job in 2012 at the age of 34 with about $80,000 a year in passive investment income. At the time, I thought $80,000 was absolutely enough to live a middle-class early retirement lifestyle even in San Francisco. With a nice severance package that paid out all my deferred stock and cash compensation for the next five years, surely, I was set for life.

I was wrong and I’m not afraid to admit it. In retrospect, retiring without children is like a walk in the park compared with retiring with children. Let me explain in more detail.

The year everything changed

In 2017, my view about money changed because my wife and I were blessed with a baby boy after years of trying. We began to feel like our now roughly $200,000 a year in gross investment income was no longer enough to both stay jobless in San Francisco.

Our already onerous $1,620 a month health care premiums jumped to $1,765 a month after our son was born. I don’t know about you, but spending over $21,000 a year for health care premiums alone when none of us regularly need medical help seems kind of absurd.

Read: Early retirement sounds amazing, but it can take a toll on your mental health

With the additional costs for diapers, clothes, toys, occasional babysitting to keep our sanity, preschool tuition, and potentially private grade school tuition down the road, our budget quickly exploded.

You can counter by saying that private grade school is a waste of money. We don’t entirely disagree. We are hoping to send our son to public grade school because we find paying $30,000 to $45,000 a year in private grade school tuition to be ridiculous.

But the problem with the San Francisco public school system is that it is based on a lottery system for social engineering purposes. Even if you pay $30,000 a year in property taxes, your child has no guarantee of getting into your neighborhood public school. You could end up with your eighth choice and have to drive 35 minutes across town.

If you can’t get your kid into a well-ranked public school, you will be forced to pay private school tuition or move. But how many people really have the job flexibility to just get up and move to a lower-cost area of the country? The trend is happening thanks to technology, but the opportunities are not yet ubiquitous. Even if you do have job flexibility like we do, it’s hard to move away from friends and family.

Read: She’s 63 and lives by the beach in Mexico: ‘I can’t imagine living in the U.S. again’

Then one day, I got an email from a Realtor who confirmed our suspicions that $200,000 was barely enough. According to the California Association Of Realtors (CAR), to afford a median-priced home in San Francisco now requires a household income of at least $343,400.

Read: This budget shows how a $350,000 salary barely qualifies as middle class

A $200,000 annual FIRE budget to raise a family

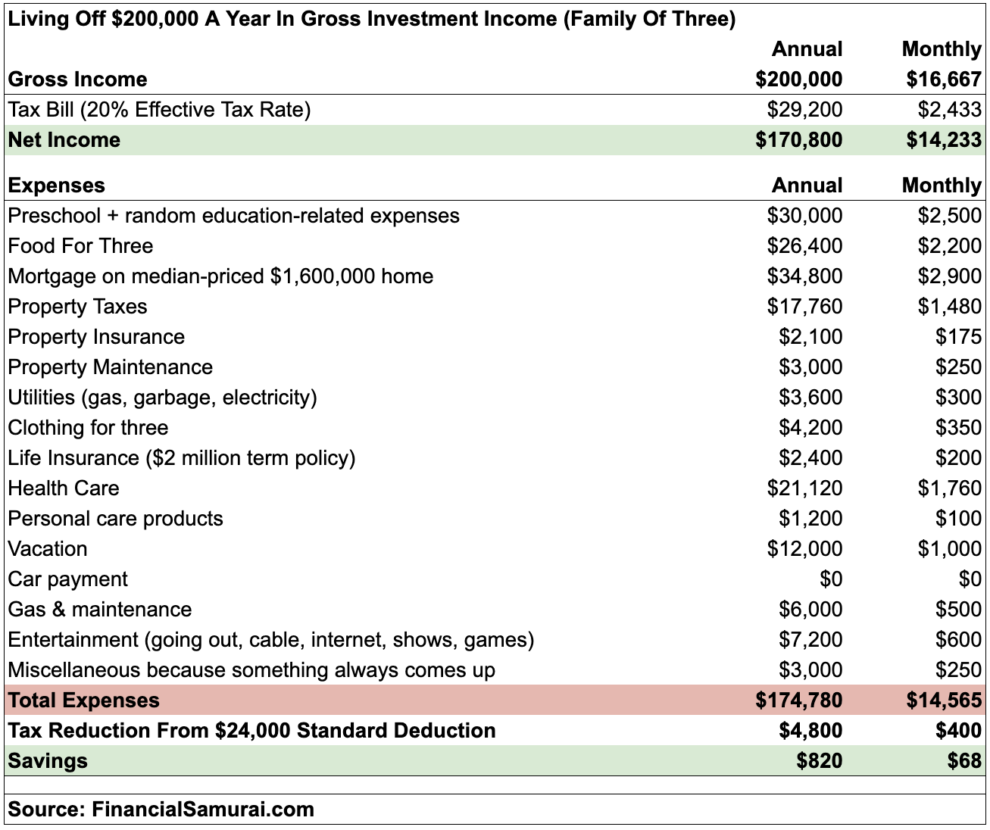

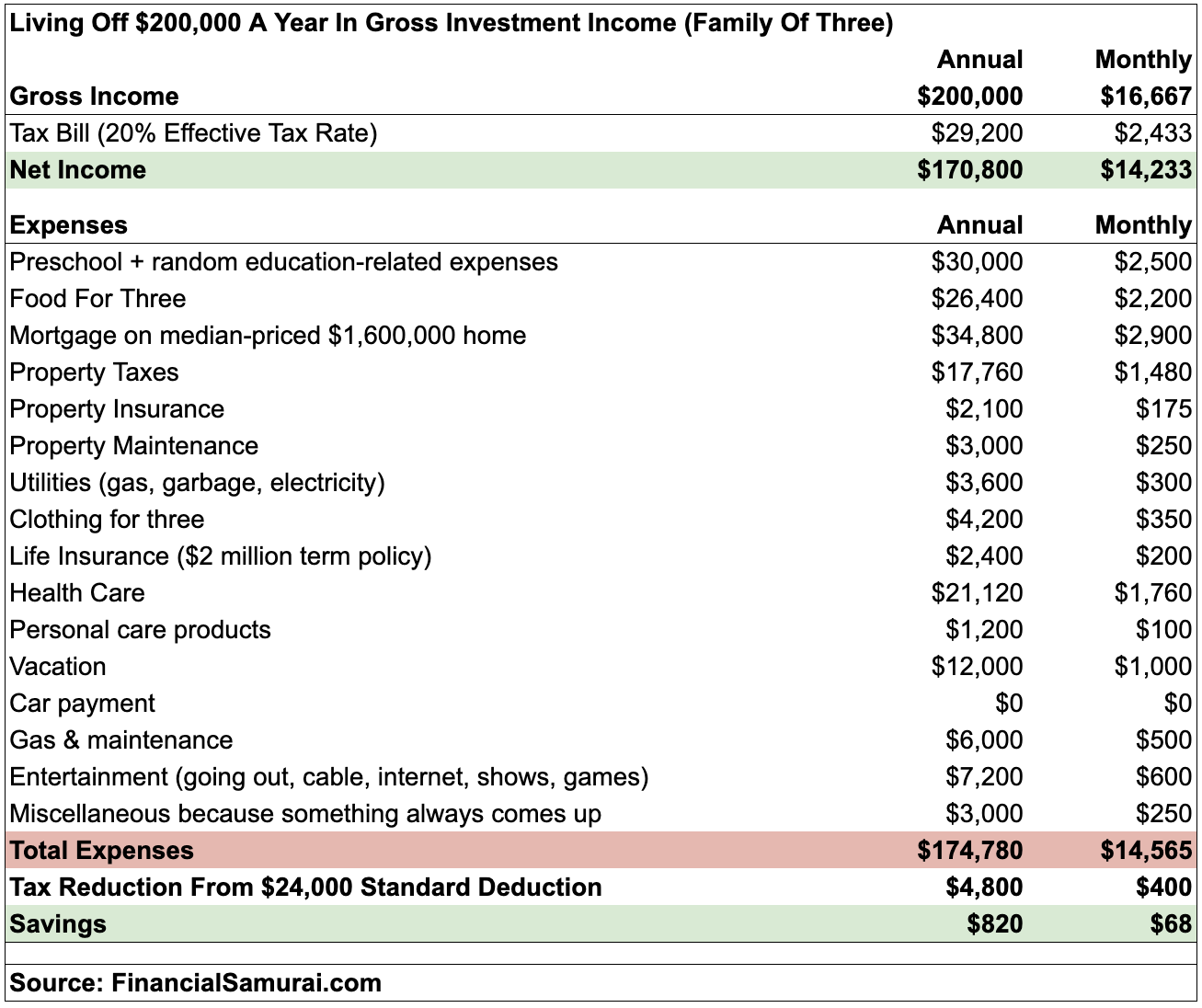

Let’s pretend for a minute that the $343,400 figure is absolutely wrong. Let me share with you a realistic budget on how quickly $200,000 a year in investment income goes for a family of three in an expensive coastal city. Investment income is mostly taxed at a more favorable rate than W2 income.

As you can see from the budget, this family of three is only left with about $820 a year in cash flow. Luckily for them, they already own a median-priced $1.6 million home and all the expenses that go along with it.

The main category they could cut down on is vacation spending. But flying anywhere nice in the country will cost roughly $1,500 in flights alone for three people during peak season. Then they’ve got to pay for a place to stay and spend money on food and activities.

The other category people might squawk about is food. But food is more expensive in big cities. Going out for a rubber chicken sandwich and a drink will easily cost $15 to $20 in a place like New York City. And yes, grocery prices are higher, too, because grocery store rents are higher.

But here’s the real kicker. What if the family wants to have another child? If they do, their budget will eventually go up by at least another $2,000 a month after tax due to preschool. $24,000 a year after tax requires $30,000 a year in gross investment income at a 20% effective tax rate.

If the parents are unlucky enough for both kids to get rejected from a quality public school, tuition for private grade school could easily run $6,000 to $8,000 after-tax a month for the next 13 years. Maybe the $343,400 figure is right after all.

All parents simply want the best for their children because they love them more than anything in the world. It is in our DNA to provide everything we possibly can for our children. Otherwise, our species would not survive.

Read: Why FIRE when you can do this instead?

The capital needed to be FIRE parents

One of the main reasons why there is so little transparency from early retirees about their net worth or how much retirement income they make is simply because they don’t have enough to retire early.

The best definition of financial independence is having enough investment income to cover your desired life’s living expenses so you can do whatever you want. If you don’t have enough investment income, you’re just fooling yourself.

Here’s how much capital you need based on various returns or withdrawal rates to generate $200,000 / $100,000 a year in investment income:

At 1.5%: $13,333,333 / $6,666,666

At 2%: $10,000,000 / $5,000,000

At 3%: $6,666,666 / $3,333,333

At 4%: $5,000,000 / $2,500,000

At 5%: $4,000,000 / $2,000,000

At 6%: $3,333,333 / $1,666,666

At 7%: $2,857,142 / $1,428,571

At 8%: $2,500,000 / $1,250,000

Anybody who is truly retired will likely have a more conservative portfolio than the average working person. After all, the last thing an early retiree wants to do is go back to work, especially if they want to take care of their children full time.

Even if you can reduce your budget to $100,000 a year by home schooling your kids or getting lucky enough to send them to a good public school, amassing $1.25 million to $6.67 million is still a lot. According to a tri-annual Economic Policy Institute report, the median retirement balance for Americans between 56 and 61 is under $20,000.

It’s hard to have both

If you want to retire early, don’t have kids. Use all your spare energy to aggressively save and build your after-tax retirement income portfolio that spits out passive income you can actually use. Your 401(k) and IRA usually cannot be touched without a 10% penalty before age 59½.

If you want or have kids and still want to retire early, you will likely have to drastically change your lifestyle and be OK with not giving your children every opportunity possible. Since doing both is almost impossible, very few people with kids, including myself, are truly retired or can stay retired.

After seven years of early retirement, I’ve finally given up. No, I’m not going back to work full-time to make up for my whopping ~$100,000 retirement income gap to live a middle-class lifestyle in San Francisco as deemed by the CAR Housing Affordability Index.

In order to get to $343,400 a year, I’ve decided to spend more time focusing on entrepreneurship. For too long I’ve treated Financial Samurai, the personal finance site I started in 2009 like a hobby. It’s time to see if I can shake some pennies out of my site while my boy attends preschool for $2,000 a month.

If all else fails, we will relocate to Honolulu in 2022 when our boy is eligible for kindergarten. Honolulu’s median home price is about $835,000, or 47% lower than San Francisco’s median home price. Meanwhile, private school at $25,000 a year is about 30% to 45% cheaper as well. With great weather all year and a wonderful family culture, Honolulu doesn’t sound like a bad idea at all.

Sam Dogen started Financial Samurai in 2009 to help people achieve financial freedom sooner. He spent 13 years working in investment banking and retired at age 34 in San Francisco. Everything Dogen writes is based on firsthand experience.