Here’s what investors should consider.

2021 seems like a long time ago because so much has happened since. But just three years ago, economic stimulus sent stocks to the moon, only to come crashing back to Earth in 2022. Enthusiastic investors pushed stock valuations through the roof. For example, the popular lending platform Upstart Holdings peaked with a market cap of $32 billion, trading for a whopping 48 times sales. The company is worth $3.7 billion today with a more modest valuation of 7 times sales. Upstart wasn’t worth the premium; however, some companies are.

Amazon has traded with a premium valuation for decades, and investors have been richly rewarded to the tune of 7,000% over 20 years. But what about Palantir (PLTR -2.80%)? Is its premium valuation warranted?

There’s a lot to like

When Palantir stock traded for less than $10 per share in 2022, investors criticized the company for being unprofitable, using too much stock-based compensation, and struggling to grow commercially. These concerns have been put to rest. Here are the charts that tell the tale.

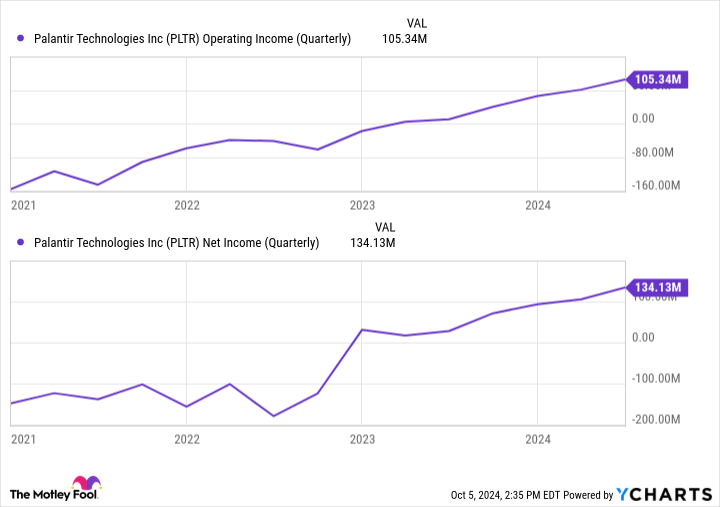

Palantir reported record operating and net income in the second quarter of 2024. As you can see below, both have risen steadily and significantly.

PLTR Operating Income (Quarterly) data by YCharts

The $134 million in net income came on an impressive 20% margin, while the operating margin was 16%, which is also solid and growing fast.

Stock-based compensation (SBC), which dilutes existing shareholders by increasing the number of shares available, is declining. As depicted below, the increase in outstanding shares has largely leveled off as SBC has declined.

PLTR Average Diluted Shares Outstanding (Quarterly) data by YCharts

The decline is even starker when measured as a percentage of revenue. SBC for the last 12 months was 20% of sales; it was 33% in 2022.

Finally, the company’s increase in commercial customers and sales is impressive. Palantir released its artificial intelligence (AI) platform AIP and is selling it aggressively. The program aggregates data from multiple sources and allows users to use the data to make smarter decisions. For instance, a distribution company that expects downtime in one location (perhaps severe weather is forecast) can use AIP to determine the best alternatives to get customers products as well as the impact on revenue and margins.

Commercial revenue hit $307 million in Q2 with 33% year-over-year overall growth and 55% growth in the United States. Government sales were also strong, at $371 million, with 23% growth.

It’s easy to see why investors are exuberant, but has it gone too far?

Palantir investors should be cautious

Palantir stock has increased 520% since the beginning of 2023, reaching an all-time high of $40 per share. Investors who bought back then are sitting on terrific gains, but new investors should be extremely cautious. The price-to-sales ratio, shown below, is approaching 2021 tech bubble levels and is significantly higher than that of other fast-growing tech companies.

PLTR PS Ratio data by YCharts

CrowdStrike and Cloudflare are reasonable comparisons as they also have gross margins over 75% and revenue growth of 30% or more. They trade for 21 and 19 times sales, respectively. CrowdStrike’s valuation peaked at 29 times sales before the outage incident.

To put it in perspective, Palantir would need to grow its 2023 sales at the current rate of 27% through the end of 2026 before the valuation would drop to 20 times sales at the current price. Even if the company executes flawlessly and the stock market and economy remain strong, investors still don’t have a margin of safety. If 2021 taught us anything, it’s that valuations do matter in the long run. Palantir is a great company, but the price is too high for my money.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon and CrowdStrike. The Motley Fool has positions in and recommends Amazon, Cloudflare, CrowdStrike, Palantir Technologies, and Upstart. The Motley Fool has a disclosure policy.