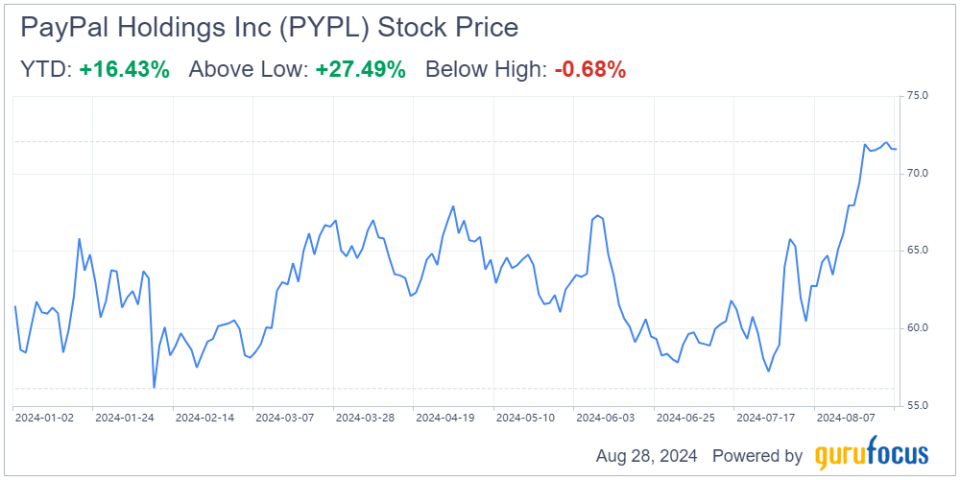

One of the most compelling opportunities in the market right now is payment processing giant PayPal Holdings Inc. (NASDAQ:PYPL). Despite being battered over the past few years and losing investor confidence, the stock has started to rebound, beginning its bull run with a 5% increase since the end of July.

With this recent rally, the company’s performance is now almost on par with the S&P 500 index, achieving 17% year-to-date returns compared to the index’s 18% gain. Earlier this year, like many value stocks, PayPal faced pressure, overshadowed by the strong generative artificial intelligence-driven rally. However, my primary focus is on PayPal’s transaction revenue and margins, where I see early signs of an inflection point with the release of the company’s second-quarter results. I believe this positive trend will continue as the company’s beaten-down valuation and new growth strategies continue to attract investor interest. While some longtime shareholders might be disheartened by the stock’s dramatic 80% decline over the past three years, others are taking this opportunity to invest at lower levels amid this recent bull run.

In my view, PayPal is still too young to be dismissed as a stagnant stock, especially given the continued growth in digital payments and the buy now, pay later trend. During the height of the Covid-19 pandemic, the stock’s price surged ahead of revenue growth, but it has since plummeted and is now down about 75% from its all-time highs. With a newly appointed CEO, Alex Chriss, at the helm, I am confident that PayPal’s best days are still ahead. Therefore, I’m reiterating my buy rating on the stock, particularly as its low valuation continues to mitigate downside risk.

Refocusing on core strengths

PayPal has been on an acquisition spree over the past several years, aiming to enhance its payment services through a variety of acquisitions, from coupon platforms to logistics companies. However, these acquisitions have not significantly strengthened its primary capability: facilitating secure and seamless transactions between merchants and consumers.

As a result, the company found itself spread too thin, with too many initiatives distracting from its core operations. Chriss acknowledged this issue during a conference in March, emphasizing the need to refocus on the company’s core strengths. Under new management, PayPal has begun divesting non-core businesses that do not directly enhance its payment services, starting with the sale of Happy Returns to UPS (NYSE:UPS). I expect this divestment strategy to continue, which could improve PayPal’s profitability by shedding businesses that have been more of a drag on performance than a benefit.

Braintree’s growing success

Despite broader challenges, PayPal’s unbranded solutionsparticularly Braintreehave shown exceptional performance. In the second quarter, the company’s unbranded solutions segment experienced 19% year-over-year growth, following a 26% increase in the first quarter. This growth has been largely driven by Braintree’s success. PayPal has aggressively priced its services to undercut competitors and capture market share from established players like Adyen (ADYEY) and Stripe. While this approach has temporarily compressed margins, it holds the promise of long-term market share gains.

Although Braintree’s market share still trails behind more established competitors like Stripe in market share, this gap represents a significant growth opportunity if PayPal continues to execute its strategy of underpricing to gain ground. Furthermore, Braintree is undergoing several operational optimizations to better compete with industry leaders. Unlike its competitors who have their own payment processing systems, Braintree currently relies on Fiserv (NYSE:FI) for this service. However, this reliance suggests Braintree has the potential to follow in its competitors’ footsteps by developing its own processing system. Doing so could create opportunities for future cost-cutting and help alleviate some of the margin pressures resulting from its aggressive pricing strategy.

Much of the bearish sentiment surrounding PayPal stems from the slowdown in its growth rates in recent years. While it is true the company can no longer report the nearly 20% annual revenue growth it once enjoyed, I do not see this as an indication of a broken business model. Instead, I view it as a company that, while not growing at the previous breakneck speed, still demonstrates solid performance. The company’s second-quarter results underscore this point, with PayPal not only surpassing estimates for both revenue and earnings per share, but also showing year-over-year growth in its top- and bottom-line figures. Specifically, revenue increased by 8.20% to $7.9 billion, while the operating margin expanded from 15.40% to almost 17.90%, showcasing strong operational leverage. This led to an adjusted earnings per share increase from $1.16 to $1.19 year over year.

Source: PayPal Investor Relations

Beyond the strong earnings, it is essential to examine additional metrics like the number of active accounts. While the total number of active accounts has shown some stagnation, declining slightly from 431 million in the second quarter of 2023 to 429 million in the most recent quarter, a more critical metric in my view is the number of monthly active accounts. Encouragingly, this figure increased from 217 million in the prior-year quarter to 222 million, representing 2.30% growth.

Alongside this growth in active accounts, PayPal’s active transactions per account rose 11% to 60.90. Together with a total payment volume increase of 11%, these metrics facilitated the company’s overall top-line growth of 8%. Although the overall number of active accounts remains relatively flat, the increased engagement among these accounts is driving up the number of monthly active users and transaction frequency. This, coupled with the rise in total payment volume, indicates the company’s core user base is becoming more valuable even as the total number of active accounts stagnates.

In terms of margins, PayPal has seen its gross margin decline from a peak of 58% in 2021, during the height of the pandemic, to a low of 45% in the first quarter of 2024. This margin compression is largely due to the company’s aggressive push to capture market share in its unbranded solutions segment, particularly with Braintree. However, I believe that once PayPal achieves its desired market position and begins to increase prices, margin improvements will follow.

Signs of this recovery are already visible in the second-quarter results, where the company’s transaction margin dollars showed strong growth. PayPal recorded its strongest quarter of transaction margin dollar growth in three years with an 8% increase to $3.60 billion, primarily driven by Branded Checkout growth. Though the overall margin trend remains downward, this robust growth led to an 80 bais points quarter-over-quarter expansion in transaction margin to 45.80%, possibly signaling the metric is nearing a bottom. Consequently, the second-quarter non-GAAP operating profit stood at $1.50 billion, reflecting a 19% margin, up 3 percentage points.

While 2024 is seen as a transition and turnaround year under Chriss, I support the emphasis on operational efficiencies and streamlining efforts. Early signs suggest the turnaround is gaining traction, particularly with improvements in financial metrics that indicate a path toward restoring margins to previous levels.

One of the most compelling reasons to invest in PayPal, in my opinion, is its strong free cash flow. In the second quarter, the company generated $1.1 billion in free cash flow, marking 31% year-over-year growth. This impressive growth was driven by strength in international transactions, an increase in monthly active accounts and a higher transaction per active account figurewhich translated into a free cash flow margin of 14%.

As a result of this momentum and ongoing transaction strength, PayPal raised its free cash flow guidance to $6 billion, an increase of $1 billion from its previous guidance in the first quarter. The company also boosted its stock buyback target to $6 billion, representing a 20% increase from its previous guidancea positive note for shareholders.

The company ended the period with over $18 billion in cash reserves, while its debt stood at about $12 billion, resulting in a net cash position of approximately $6 billion. This healthy cash generation and sizable cash reserves provide PayPal with considerable capital allocation flexibility, enabling it to support its turnaround strategy. With these resources at its disposal, I believe PayPal is well-positioned to execute its growth plans and navigate the challenges ahead.

Thoughts on valuation

Despite the various growth catalysts and the recent bull run, PayPal’s stock is still trading at an attractive valuation. Currently, shares trade at a forward price-earnings ratio of 14.20, well below the peer average of 31, which is compelling when compared to other financial technology companies. For context, Visa (NYSE:V) trades at a multiple of 24, Mastercard (NYSE:MA) at 31.40 and Adyen at 37.60. Given these comparisons, I find PayPal’s valuation to be particularly appealing.

By the end of 2024, I anticipate Paypal’s price-earnings ratio could expand to at least 18, which I consider a conservative estimate, especially since it traded at similar multiples even after the pandemic hype subsided in late 2022, implying a price target of approximately $91, representing a potential upside of around 25% from the current stock price. Even assuming a modest forward growth of 7% to 9% without any multiple expansion, the stock appears positioned to deliver annual returns of approximately 10% to 12% through growth and earnings yield alone. Should PayPal exceed these expectations, the growth potential could be substantially higher.

Source: Valueinvesting.io

However, I do not rely solely on valuation ratios to confirm a stock’s feasibility. To gain a more comprehensive perspective, I used a discounted cash flow analysis using conservative estimates on a five-year growth exit. For my revenue growth trajectory assumption, I rely on Wall Street estimates, projecting a 5% revenue compound annual growth rate over the next five years, which I believe is fairly conservative. This assumption gives me more comfort considering Statista’s projections indicate a 9.52% growth rate for the global digital payments industry for 2024 to 2028, well above my assumptions.

I also factor in a modest margin expansion, in line with the trend of increasing transaction margins and improving margins within the unbranded solutions segment, particularly driven by Braintree, expected to materialize in the coming years. Using a discount rate of 8.20% and a conservative terminal growth rate of 1%, the DCF analysis yields a fair value of approximately $88. This suggests a potential upside of about 22%, offering a solid margin of safety relative to the company’s growth potential.

Closing thoughts

In my view, PayPal is navigating a significant turnaround, driven by its renewed focus on core strengths and strategic growth in unbranded solutions like Braintree. The stock’s current undervaluation, coupled with improving financial metrics and a promising growth outlook, makes it an attractive investment opportunity. As the company continues to execute its strategy under new leadership, I believe it is well-positioned to deliver substantial returns, offering investors a chance to capitalize on the upside potential while mitigating downside risks.

This article first appeared on GuruFocus.