Wedbush Securities Managing Director of Equity Research Moshe Katri joins Yahoo Finance Live to discuss the latest developments with PayPal.

Video Transcript

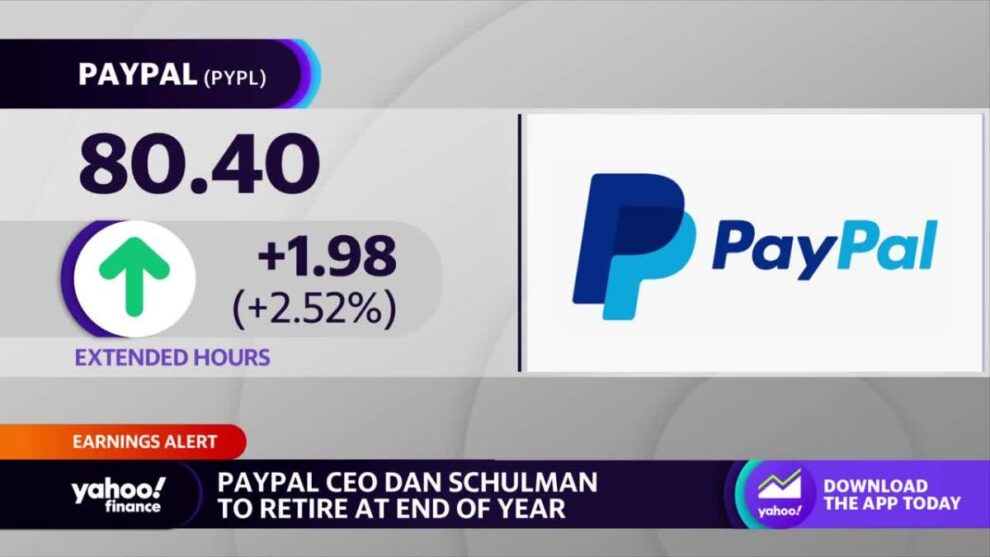

SEANA SMITH: Let’s take a look at PayPal. Shares up just about 2 and 1/2% here following their fourth quarter results. Adjusted EPS coming in better than expected. Revenue a bit light there. But in terms of their guidance, their full year guidance for 2023 coming in better than expected for adjusted EPS of 4.87.

Let’s talk about all this when it comes to Paypal’s earnings with Moshe Katri of Wedbush Securities. He covers the IT, services, and payment space there. Moshe, it’s great to have you here. So let’s start with the big headline, one of the big headlines of this afternoon. President and CEO Dan Schulman planning to leave PayPal at the end of the year. What’s your reaction to that? He’s been there for 8 and 1/2 years?

MOSHE KATRI: Yeah, I would say wildly expected. In general, you’ve seen a leadership vacuum at PayPal during the past few years. This was a company that’s been running without really having a permanent CFO. And there’s been an expectation that maybe with the encouragement of the active investor here, you’ll see a leadership change at the CEO level as well. So this is definitely within expectations.

DAVE BRIGGS: And what do you make of the numbers?

MOSHE KATRI: Better than feared. More than anything else, the sentiment getting into the quarter was actually relatively negative, anywhere from competitive concerns as Apple Pay taking share, discretionary spending moderating, which is something that we’ve heard from the networks and from some of the other fintech players. They obviously beat on earnings, just given the fact that they’ve been focusing more on cost efficiencies. Some of the numbers on the metric on the top line side were a bit lighter. You know, revenue’s a bit lighter. TPV volume is a bit lighter.

But look, this was a company that’s trading at very attractive multiples. They’re doing a good job, I think, relatively on the monetization side of the business, and they can do a lot more. And I’m assuming in this market, it kind of makes sense for people to kind of own it, especially given the active investor involvement here.

SEANA SMITH: Yeah, and given that active investor involvement from Elliott Management, Elliott Investment Management, we certainly have seen some improvement in terms of margins, some cost cutting initiatives from PayPal. Do you think there’s more room for cuts going forward?

MOSHE KATRI: I think there is more room to cut– for cuts, specifically in terms of technology budgets. I’m assuming a lot of the work is getting done still on-site. These days, you can probably shift towards a global delivery model, so you can probably save there. And then on top of that, you can probably get scale from better monetization of the merchant side of the business and also from the user base. So, yeah, from our perspective, you can probably extract some more cost efficient cost efficiencies in the model.

But, again, for the stock to really work in the long-term, you have to see better growth rates. And better growth rates is really a function of monetization efforts on both sides of the platforms.

DAVE BRIGGS: Recently cut 2,000 jobs, about 7%. You mentioned Apple Pay. How significant is Apple Pay, is Google Pay cutting into their market share?

MOSHE KATRI: There’s been some concerns given some of the data that came out a couple of months ago that Apple Pay is taking some share on the user side and also on the brand that check on the– branded check-out part of the business. We need to see some more data to actually substantiate that kind of assumption. But you could actually see that Apple Pay’s numbers continue to look very, very strong in terms of volume growth.

And then on the flip side of it, Paypal’s volume growth has been relatively stagnant. So but we need to probably see another quarter or two of data to kind of get that trend kind of substantiated.

SEANA SMITH: You say we need better growth rates. Is it possible for PayPal, for a company like them to do that in this current economic environment when so many consumers are pulling back on spending?

MOSHE KATRI: Yeah, so let’s think about this. You have roughly 450 million users on the consumer side of the business. And at this point, it’s an ecosystem of digital banking if you think and it’s– if you think about this. And it’s about your ability to cross-sell some of those digital banking products into that user base. So that’s on one part of the platform.

On the second one, you have north of 30 million merchants that you’re catering to. And again, it’s an ecosystem of products and services that you’re kind of selling into. And if you’re able to, kind of, under the right leadership to do a better job on monetizing these products into those users, both on the consumer side and merchant side of the business, you can probably grow revenues irrespective of what’s going on with consumer spending.

DAVE BRIGGS: This is a company that’s trading basically at, as I look at it, 2018 levels. It was a $308 stock, $360 billion market cap now trimmed to around 90. Is this a company that’s dying, that’s growing, that’s maturing? How would you describe your sense of where it’s headed?

MOSHE KATRI: Yeah, so let’s look at PayPal maybe two three years ago pre-pandemic. This was when e-commerce growth was roughly about 10%. During the pandemic, e-commerce growth went to 25%. And then– and this is probably when you got to that $300 level. And then during the past year and a half, you’ve been kind of normalizing growth back to pre-pandemic levels on e-com to roughly that 9%, 10% level.

So that kind of explains that kind of round trip that you’re talking about. And this is why monetization is going to be so important in order for these guys to kind of show better growth rates down the road. So it’s more of a round trip in terms of what happened pre-pandemic, during the pandemic, and then post-pandemic to e-commerce growth.

DAVE BRIGGS: Very well said, Moshe Katri from Wedbush. Good to see you, sir. Thank you.