(Bloomberg) — Investors are debating whether the rebound in US stocks will stick, but corporate America is taking no chances and turning to a favorite old method for juicing the market: Buying back billions of dollars of their own stock.

Most Read from Bloomberg

At least $21 billion in fresh share repurchase programs have been unveiled this week alone, with PayPal Inc. leading the charge and authorizing a new $15 billion buyback plan as it works with Elliott Investment Management to turn around its struggling shares. Moderna Inc., Airbnb Inc. and Marriott International Inc. have also added to or unveiled new programs in the last three days, following a slew of others, including Chevron Corp., Charles Schwab Corp. and Exxon Mobil Corp. that did it last week.

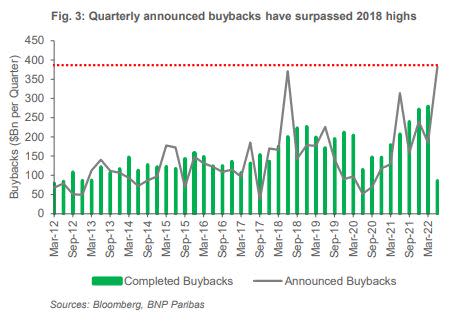

Altogether buyback announcements for the second quarter earnings season have already surpassed 2018 highs, when companies said they planned to repurchase almost $400 billion of their own shares, according to data compiled by BNP Paribas. And the announcements may not be over yet, with more than 50 S&P 500 members still set to report earnings this week.

The strategy is working. At least for the ones with the largest programs.

PayPal and Moderna saw outsize share price jumps following their buyback announcements, adding 9.3% and 16% respectively on Wednesday. Shares of Charles Schwab Corp., which announced a $15 billion buyback plan last week, are up 10% since then.

“Buybacks should provide another flow tailwind,” Maxwell Grinacoff, BNP Paribas equity derivatives strategist, wrote in a note on Monday. Announced buybacks have hit the highest in more than a decade, Maxwell added.

For Wall Street strategists schooled in the logic of “buy low, sell high,” buybacks this year likely make complete sense. Companies like PayPal and Moderna have slumped more than 25% amid a boom-to-bust cycle for pandemic winners turned losers. By scooping up shares at a lower value, the company can theoretically resell them later on in a secondary offering, ideally at a higher price, to help raise additional capital.

Smaller companies or less hefty programs don’t always give a meaningful boost to shares. The S&P 500 Buyback Index, which tracks 100 stocks with the highest buyback ratio, has underperformed the broader market since the start of May, falling about 3% compared to a nearly unchanged S&P 500.

One notable exception this season among companies known for supporting robust buybacks are banks. JPMorgan Chase & Co. and Citigroup Inc. announced they would be pausing current share repurchase programs in order to help meet higher capital requirements following the Federal Reserve stress test.

“In the here and now, investors like it when their favorite companies buy back shares. Speculators like it too, because there is a large buyer whom you know will be active in the market,” said Steve Sosnick, chief strategist at Interactive Brokers LLC. “It is quite reasonable to think that buyback announcements have been a key trigger to the recent rally.”

(Updates pricing throughout.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment