Over the past few years, PayPal (NASDAQ:PYPL) has been a popular choice for investors due to its high business quality and strong growth prospects. As one of the companies best positioned to benefit from the surge in e-commerce and peer-to-peer payments, PayPal’s stock traded at elevated levels for several years, reflecting its perceived value as a high-growth business.

However, despite the anticipated increase in competition, which put pressure on the company’s take rate, PayPal’s fortunes changed.

Following the abrupt end of the hyper-bullish pandemic-driven scenario, the stock fell into a period of underperformance, becoming what many saw as a value trap.

Today, the investment thesis for PayPal is different, centered on moderate growth and an attractive valuation relative to its return potential. In this article, I will explore the reasons behind the extended bearish sentiment on PayPal and how recent results suggest a gradual shift in investor outlook.

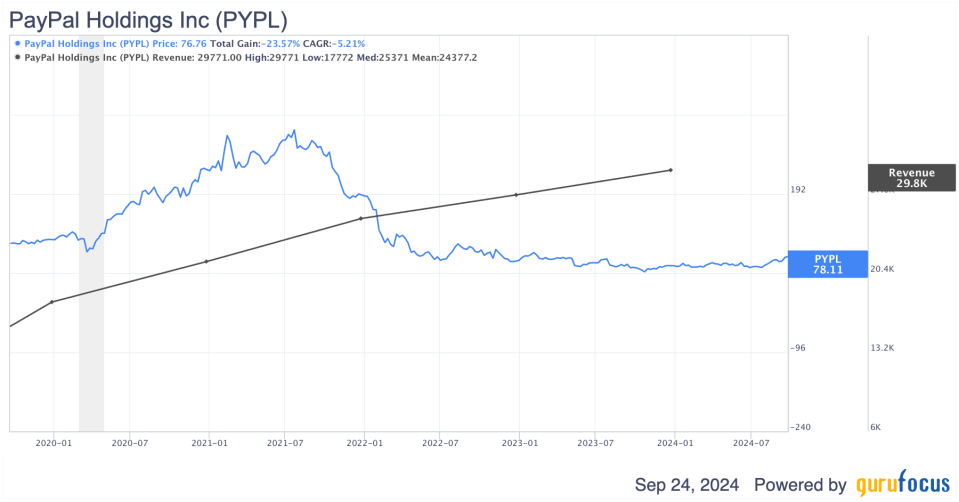

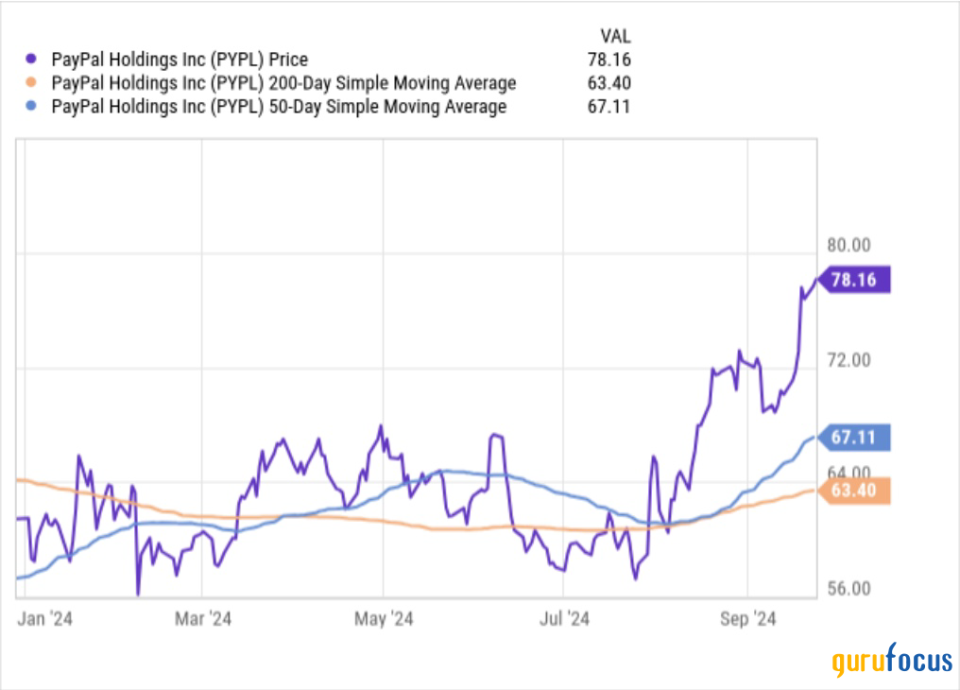

Since peaking in 2021, PayPal shares have experienced a staggering 75% decline. A few years ago, during the COVID-19 pandemic, PayPal positioned itself as a major beneficiary, with revenues rising by 20% and 18% between 2020 and 2021, while operating income grew by 22% and 25%, respectively.

However, everything changed after July 2021, when PayPal shares began a significant sell-off. The company’s revenue growth slowed, particularly as the e-commerce boom driven by the pandemic began to normalize. Throughout 2021, PayPal reported several earnings misses and lowered its forward guidance, raising investor concerns about headwinds such as increased competition and slowing consumer spending in digital payments.

The digital payments industry became highly competitive, with players like Apple’s (NASDAQ:AAPL) Apple Pay, Alphabet’s (NASDAQ:GOOGL) Google Pay, and emerging fintech companies (such as Adyen (ADYEY) and Square (SQ)) gaining market share. This competitive pressure cast doubt on PayPal’s ability to maintain its market dominance. In 2022, PayPal’s revenues declined by 2%, and in 2023, it managed to grow by only 1%.

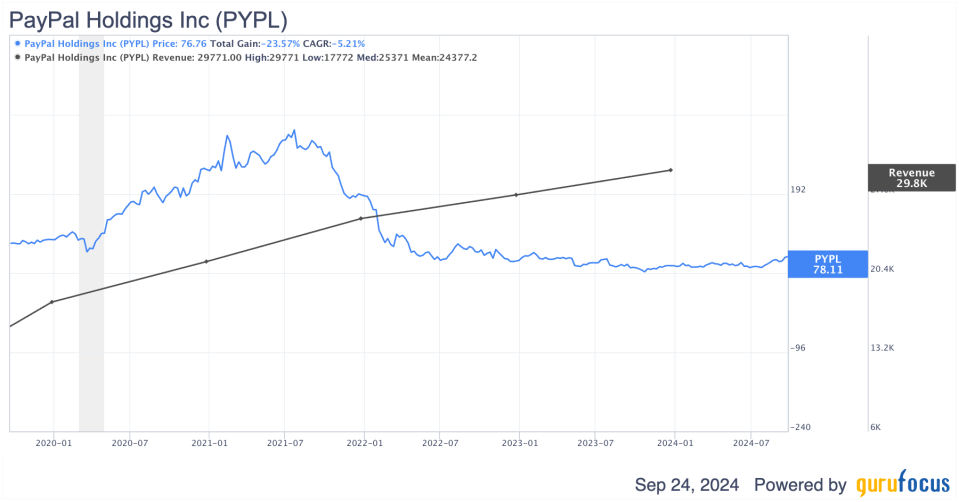

All of this occurred while PayPal was trading at inflated valuations, including a P/E ratio exceeding 90x, as illustrated in the graph below. It became evident that PayPal, once valued as a high-growth stock, no longer aligned with a bullish investment thesis. Consequently, a massive sell-off in PayPal shares ensued and continues to this day. However, circumstances may be changing now.

Source: YCharts

Investor confidence in PayPal has slowly been returning over the last twelve months. The company is currently trading at a market cap of $79.9 billion, with an enterprise value of $75.7 billion when accounting for cash, debt, and investments on the balance sheet.

Over the past year, PayPal generated $31 billion in revenue, $4.4 billion in net income, and $6.7 billion in free cash flow. As a result, PayPal’s stock is now valued at under 16x earnings and just 10.8x free cash flow. This level of valuation is typically associated with companies that are not experiencing growth; however, PayPal is indeed growing, albeit at a slower pace than during the pandemic.

In its most recent quarter reported in August (Q2), PayPal reported revenue growth of 8%. Additionally, the company’s adjusted earnings per share, which now includes stock-based compensation, is projected to grow by 10% this year. At first glance, this suggests that PayPal stock is strongly undervalued. If earnings continue to grow at this rate, the payback period would be under nine years. However, several challenges must be considered.

The first challenge is that PayPal’s recent growth has been supported by an aggressive cost-cutting strategy. Operating expenses fell by 10% last year and another 2% in the first half of this year. It is unlikely that PayPal can continue cutting costs significantly, meaning operating expenses will likely begin to rise, putting pressure on earnings once again.

The second challenge concerns the impact of interest rates. According to management, interest income accounted for about half of the transaction margin growth in the first half of the year. This growth is expected to decline sharply as the Federal Reserve lowers interest rates, which will pose a headwind through 2025.

However, perhaps the biggest challenge PayPal faces is the increasing competition in the payments industry. Transaction take rates are expected to weaken over time, raising uncertainty about PayPal’s ability to outperform its competitors. For instance, Adyen reported a growth rate of 23% in the past twelve months, significantly higher than PayPal’s 8%.

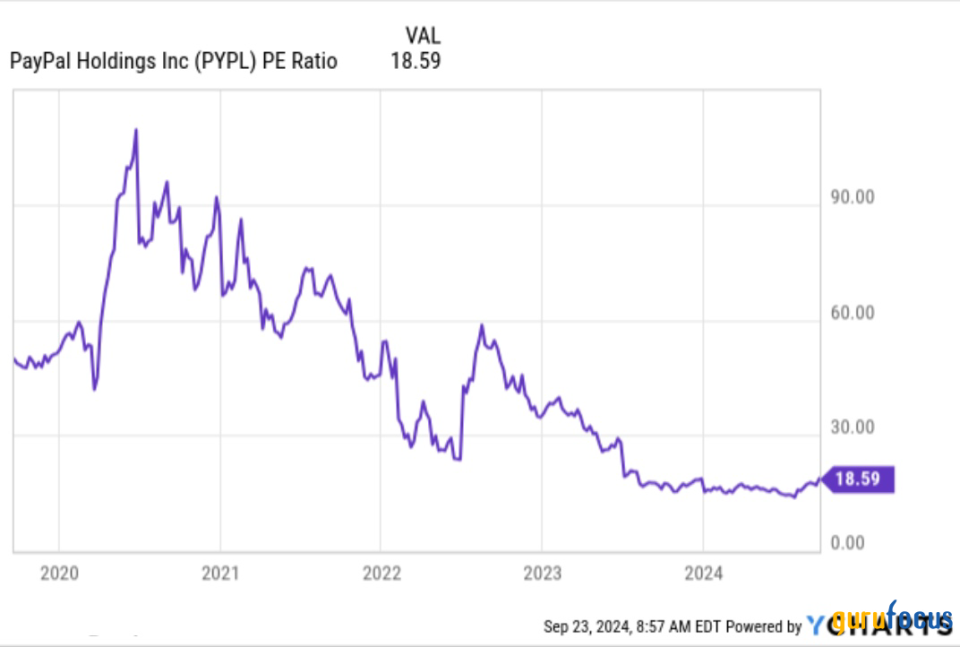

Nonetheless, sentiment around PayPal appears to be improving. When examining long-term moving averages, PayPal is trading well above its 200-day simple moving average (SMA), indicating that the stock’s long-term uptrend has been solid.

Source: YCharts

Examining PayPal’s trading chart over the last five years reveals that many investors who bought shares at the end of 2019, viewing the company as a deep value opportunity, ended up facing significant losses in subsequent years. But is PayPal still a value trap in the current scenario? In my opinion, it is not; quite the opposite.

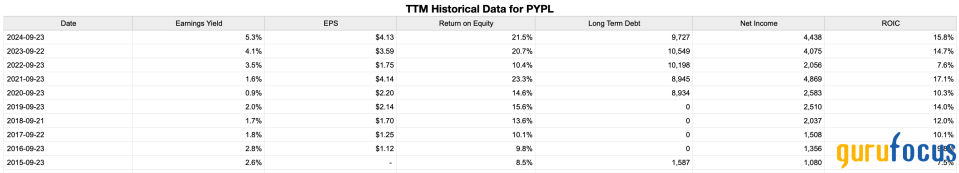

First, let’s define what I consider to be “value.” A company that maintains a consistent track record of generally increasing earnings per share (EPS) without any negative earnings years meets my first criterion. In the last decade, PayPal’s EPS has grown from $1.12 in 2016 to $4.13 in the last twelve months, with gradual increases in all but 2022, which was the company’s worst performing year. Notably, it never approached a net loss.

Source: StockRover

The second point worth discussing is PayPal’s balance sheet. As a highly cash-generative business, PayPal’s operationsdriven by strong transaction volumes and solid growth in digital paymentshave provided enough cash flow to fund its growth and strategic initiatives without relying heavily on borrowing. Until 2019, the company had virtually no debt. After that, PayPal began using debt to finance acquisitions and enhance its market position, such as its $4 billion acquisition of Honey in 2019. Over the last twelve months, PayPal reported long-term debt of $9.72 billion. However, this figure is manageable, especially when compared to its annual earnings; over the same period, PayPal reported a net income of $4.43 billion, meaning its indebtedness is below 2.5 times its earnings.

Two additional points that characterize PayPal as a deep value investment relate to profitability metrics like return on equity (ROE) and return on invested capital (ROIC). Over the last decade, PayPal’s ROE has remained above 14% between 2019 and 2023, except for 2022 when it dipped to 12%. Meanwhile, ROIC stayed above 10% for most of the last decade, peaking at 17% in 2020 and registering 15.5% in the trailing twelve months. Even during its challenging period in 2022, ROIC was a solid 8.5%. This consistency indicates that the company has generated returns substantially higher than its cost of capital, demonstrating the robustness of its management.

However, none of these indicators of value matter if PayPal is trading at a valuation that reflects its reality. To assess this, I consider the earnings yield, which shows how much profit a company generates relative to its market price. Currently, PayPal has an earnings yield of 5.3% over the last twelve months, which exceeds the 10-year Treasury yield of 3.7%. This difference suggests that the market may not yet fully recognize PayPal’s growth potential and cash generation capabilities. If the company can maintain or increase this earnings yield, it will provide a strong argument for its future valuation.

PayPal’s stock has suffered significant declines in recent years, primarily due to its overvaluation and industry pressures that have slowed both revenue and profit growth. However, the company’s fundamentals remain solid, with recent performance reflecting trends consistent with its historically high-value trajectory.

While it may be unlikely for PayPal to reach its previous highs above $300 per share in the near future, its strong fundamentals and attractive metrics, such as earnings yield, suggest there is substantial value yet to be unlocked. Therefore, I view PayPal not as a value trap but as a company with considerable upside potential.

This article first appeared on GuruFocus.