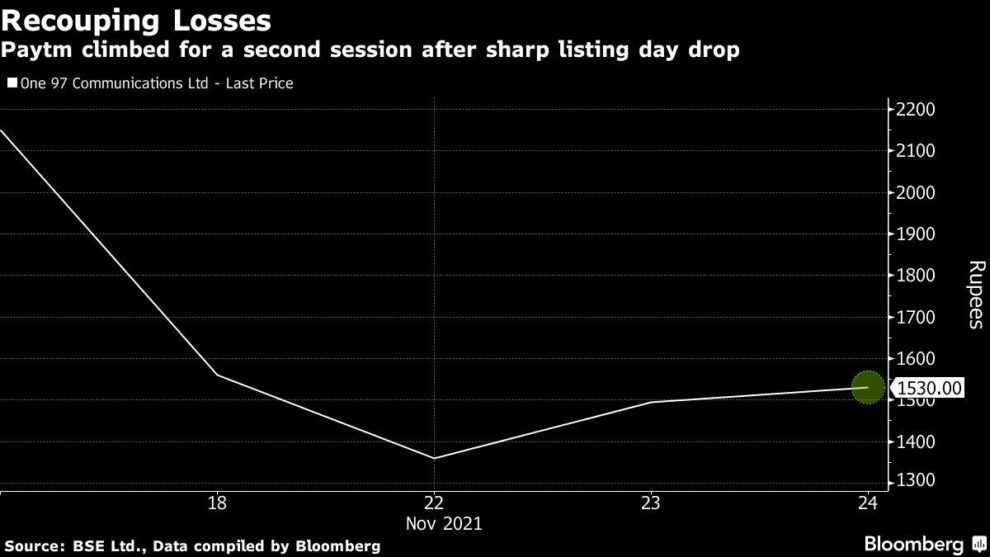

(Bloomberg) — Shares of India’s Paytm rose for a second day on Wednesday, easing a selloff that wiped out about a third of the digital payments startup’s value in its first two trading sessions.

Most Read from Bloomberg

The payments firm climbed as much as 10.3% on Wednesday, but is still down more than 20% from its offer price. Paytm’s parent company, One 97 Communications Ltd., raised $2.5 billion in India’s biggest-ever IPO that had global institutions such as BlackRock Inc. and Canada Pension Plan Investment Board as cornerstone investors. Shares sank 27% last Thursday, marking one of the worst debuts by a major technology company globally.

Paytm’s poor start came after some critics had already questioned its valuation at the time of the initial public offering’s pricing. That now means at least a dozen Indian firms working on IPOs are under extra investor scrutiny, and planned smaller ones could have a harder time pricing shares if there is a reduced appetite for new listings.

What Bloomberg Intelligence is saying:

“Paytm is facing skepticism about its IPO, similar to the initial resistance that Facebook dealt with when it listed,” BI strategists Gaurav Patankar and Nitin Chanduka write in a note. “The public listings of ‘new economy’ startups such as Paytm and Zomato’s MSCI inclusion bolster India’s evolving digital landscape and are part of the $375 billion opportunity that we see in the country.”

Sentiment in the secondary market is turning around after the benchmark S&P BSE Sensex lost 5% from its record touched in October. It was up as much as 0.4% on Wednesday.

(Updates share moves)

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.