(Bloomberg) — Peloton Interactive Inc. suffered its worst stock rout in seven months after the fitness company gave a bleak forecast for the current quarter, with losses piling up and sales falling more steeply than Wall Street expected.

Most Read from Bloomberg

Revenue will be $625 million to $650 million in the fiscal first quarter, the company said Thursday, far short of the $772 million analysts were predicting. Its loss on an adjusted basis will be $90 million to $115 million, compared with an average estimate of about $93 million.

The outlook follows a similarly dire fourth quarter, when sales plunged 28% to $678.7 million and the adjusted loss was $288.7 million. On a net basis, the loss was $1.2 billion — about four times the size of the company’s loss a year earlier.

The numbers suggest that a turnaround plan under Chief Executive Officer Barry McCarthy still has a long way to go. He took the reins in February and slashed expenses — cutting thousands of jobs and shuttering operations — but the company is facing sluggish demand and a buildup of inventory. On Wednesday, Peloton announced plans to begin selling its bikes and accessories on Amazon.com Inc.’s site, aiming to broaden its distribution.

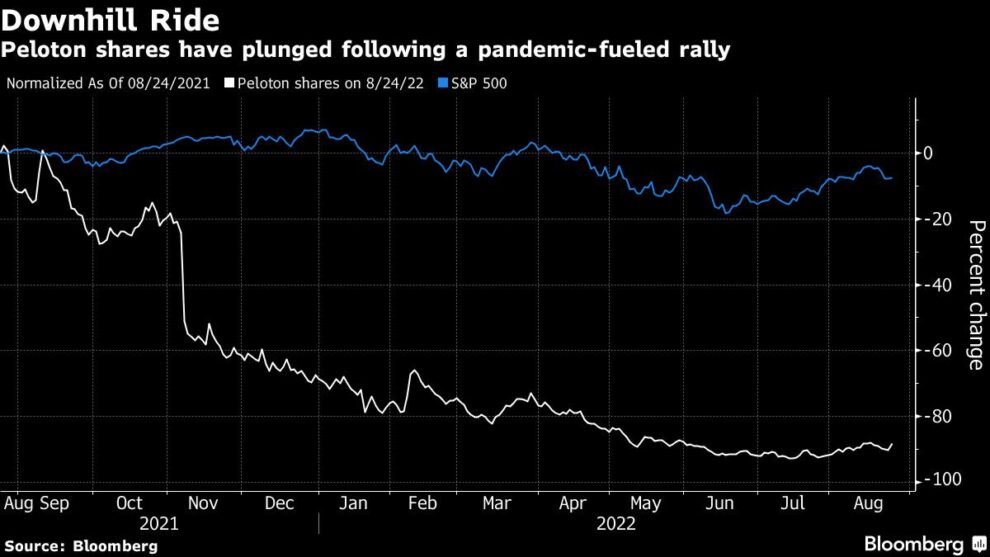

The shares fell 18% to $11.01 in New York, marking the biggest one-day decline since Jan. 20. The stock is down more than 90% in the past 12 months.

McCarthy was blunt about the challenges in a letter to shareholders Thursday, but said Peloton is making headway.

“The naysayers will look at our Q4 financial performance and see a melting pot of declining revenue, negative gross margin and deeper operating losses. They will say these threaten the viability of the business,” McCarthy said. “But what I see is significant progress driving our comeback and Peloton’s long-term resilience.”

The net loss in the fourth quarter, which ended June 30, included $415 million in costs related to the comeback plan.

A slowdown in subscriber growth has added to Peloton’s challenges. Last quarter, it had 2.97 million connected fitness subscribers — people who receive content on Peloton equipment — up 27% from a year earlier. But the figure was flat from the previous quarter.

“Peloton’s turnaround may be a ways off,” Bloomberg Intelligence analyst Geetha Ranganathan said in a report. “Limited visibility into demand gives little confidence.”

Workouts on Peloton equipment fell 4% from a year earlier and 20% from the last quarter. The company had seen a surge in use during the pandemic, when stuck-at-home consumers snapped up its equipment. But even with the slowdown, engagement is “tracking well above pre-Covid levels,” Peloton said. The connected fitness number is expected to stay around 3 million in the coming quarter.

McCarthy’s goal is to make Peloton cash flow positive in the second half of the coming fiscal year. “We continue to make steady progress, but we still have work to do,” he said.

In an interview earlier this month, McCarthy said the company should prioritize its digital offering over hardware and that it’s exploring allowing subscribers to beam content from their smartphone to non-Peloton fitness equipment.

In recent weeks, the company also announced a plan to outsource all manufacturing to third-party factories, cut its customer service operations in half, shift away from in-house deliveries and warehouses, and lay off hundreds of workers. It’s also planning to shut stores next year. The move is designed to let Peloton reallocate $50 million in annual spend, McCarthy said on a call with analysts Thursday.

In an effort to increase cash flow, the company also hiked prices for its Bike+ model and Tread treadmill by $500 and $800, respectively.

“Our Q1 outlook reflects near-term demand weakness associated with our recent hardware price increases as well as typical seasonal demand softness,” the company said Thursday.

Peloton believes its new leasing program — which combines a bike and content into a monthly price without a down payment — may help with the turnaround, saying that churn for the initiative is low and that it will expand its marketing for the program in September.

“Our test results show the program is driving increased traffic to the top of our marketing funnel and clearly appeals to a younger, more value-conscious consumer,” McCarthy said.

On the call with analysts, McCarthy said the company is currently seeing a run rate of about 40,000 leases per year from the leasing program, but he hopes to raise that to about 150,000 leases annually. The company also said it hopes to have $1 billion of cash on hand at all times.

The company isn’t giving full-year guidance for fiscal 2023, citing “broader macroeconomic uncertainties and the pace and number of changes we’re making to our business.” It also will no longer report quarterly engagement metrics.

In describing Peloton’s challenges, McCarthy reflected on his time working on a cargo ship in high school.

“After midnight on my second voyage, I was asleep when the alarm for general quarters woke me,” he said in the shareholder letter. “The ship was healing sharply to starboard and the steel hull was shuddering. The captain was trying to turn the ship around, but a ship that big, going that fast, takes miles and miles to change direction.”

Peloton, he said, is like that cargo ship. “We’ve sounded the alarm for general quarters. Everyone’s at their station,” McCarthy said. “When will the ship respond is the question. Our goal is FY23.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.