Insights from Coatue Management’s Latest 13F Filing

Philippe Laffont (Trades, Portfolio), the founder of Coatue Management, has once again made significant moves in the stock market as per the 13F filing for the second quarter of 2024. A former protege of Julian Robertson at Tiger Management (Trades, Portfolio), Laffont established Coatue in 1999, focusing primarily on technology-driven investments. The firm, headquartered in New York with offices in New Jersey and California, employs a mix of long and short strategies, emphasizing fundamental analysis and top-down stock picking. With a strong inclination towards the information technology sector, Coatue Management also diversifies across consumer discretionary, healthcare, and other key industries.

Summary of New Buys

Philippe Laffont (Trades, Portfolio)’s recent acquisitions include six new stocks to the portfolio. Noteworthy additions are:

-

GE Vernova Inc (NYSE:GEV) with 3,332,031 shares, making up 2.22% of the portfolio, valued at $571.48 million.

-

Amphenol Corp (NYSE:APH) comprising 6,211,919 shares, which represent 1.63% of the portfolio, with a total value of $418.50 million.

-

UnitedHealth Group Inc (NYSE:UNH) with 97,435 shares, accounting for 0.19% of the portfolio, valued at $49.62 million.

Key Position Increases

Significant enhancements were made to existing holdings, including:

-

Constellation Energy Corp (NASDAQ:CEG), with an additional 2,858,192 shares, bringing the total to 4,907,885 shares. This adjustment marks a 139.44% increase in share count and a 2.23% impact on the current portfolio, valued at $982.90 million.

-

Dell Technologies Inc (NYSE:DELL), with an additional 3,090,934 shares, bringing the total to 7,311,852 shares. This represents a 73.23% increase in share count, valued at $1.01 billion.

Summary of Sold Out Positions

Laffont exited 23 positions in the second quarter of 2024, including:

-

Maplebear Inc (NASDAQ:CART), where all 10,277,443 shares were sold, impacting the portfolio by -1.5%.

-

Block Inc (NYSE:SQ), with all 2,290,763 shares liquidated, causing a -0.76% impact on the portfolio.

Key Position Reductions

Reductions were also prominent in Laffont’s strategy, particularly:

-

Salesforce Inc (NYSE:CRM) was reduced by 2,792,964 shares, resulting in a -59.41% decrease in shares and a -3.3% impact on the portfolio. The stock traded at an average price of $267.58 during the quarter and has seen a -7.54% return over the past three months and -2.61% year-to-date.

-

Netflix Inc (NASDAQ:NFLX) saw a reduction of 444,681 shares, marking a -42.07% decrease and a -1.06% impact on the portfolio. The stock traded at an average price of $624.55 during the quarter and has returned 7.66% over the past three months and 35.69% year-to-date.

Portfolio Overview

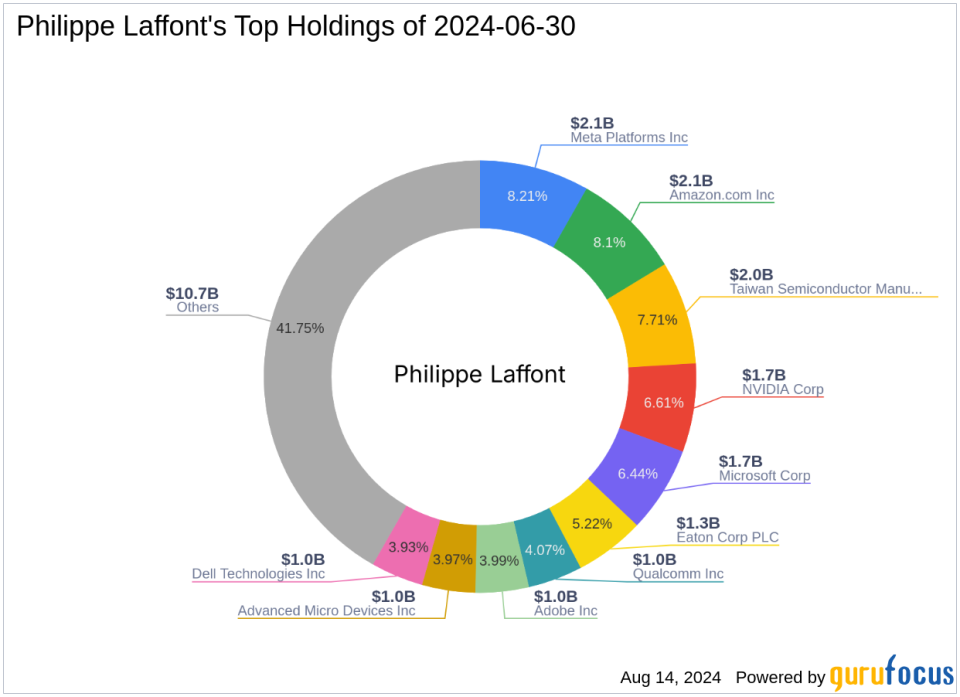

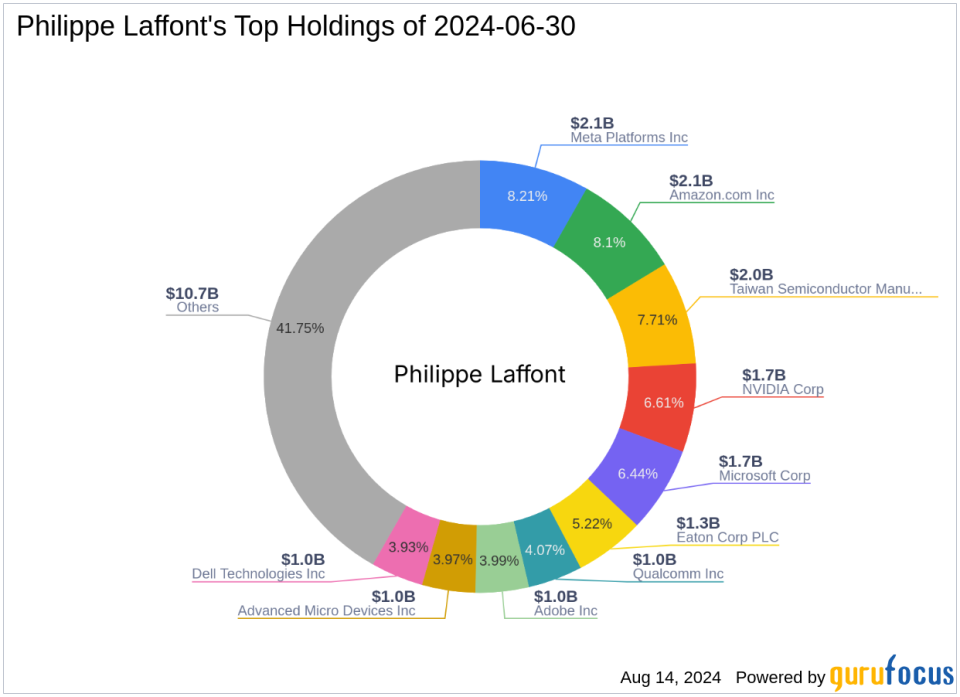

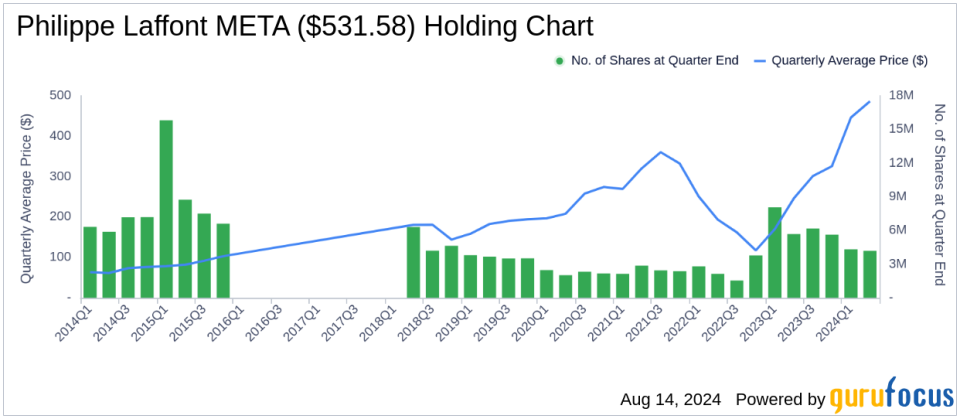

As of the second quarter of 2024, Philippe Laffont (Trades, Portfolio)’s portfolio included 74 stocks. The top holdings were 8.21% in Meta Platforms Inc (NASDAQ:META), 8.1% in Amazon.com Inc (NASDAQ:AMZN), 7.71% in Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), 6.61% in NVIDIA Corp (NASDAQ:NVDA), and 6.44% in Microsoft Corp (NASDAQ:MSFT). The holdings are mainly concentrated in 9 of all the 11 industries: Technology, Communication Services, Consumer Cyclical, Industrials, Utilities, Financial Services, Healthcare, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.