(Bloomberg) — As Chinese consumers curb their spending in a pandemic-stricken economy, one discount e-commerce firm is emerging as a clear stock-market winner.

Most Read from Bloomberg

Shares of Pinduoduo Inc., which sells everything from groceries to beauty products, have soared 43% over the past month, ranking as the top performer in the Nasdaq Golden Dragon China Index, which has slipped 0.9%. The stock has now rallied 167% from its March low, trouncing competitors including Alibaba Group Holding Ltd. and JD.com Inc.

That outperformance highlights just how price-sensitive consumers have become as the economy falters under China’s Covid-Zero policies and mounting debt woes in the property market. Data on China exports this weak added to the signs of a darkening economy.

“Pinduoduo benefits because the Chinese don’t want to spend much on luxury goods. They want to find bargains, so that’s a platform where they will go to,” said Paul Pong, managing director at Pegasus Fund Managers Ltd. “Its outperformance might continue as long as Covid Zero is in force.”

The rest of the world is long past lockdowns because of the coronavirus, and the stock market’s one-time pandemic winners have plunged as a result. But China persists in ordering people to stay home when an outbreak emerges. Chengdu, a megacity housing more people than New York, on Thursday extended a weeklong lockdown in most downtown areas.

Founded in 2015, Pinduoduo has become one of the country’s biggest e-commerce platforms by active users, even briefly surpassing rival Alibaba in 2020. Part of the firm’s appeal is its ability to offer group buying options, an increasing popular trend in China whereby networks of friends or neighbors purchase products together to fetch deeper discounts.

It’s not just about cheap products. The company has been working to trim costs and seek out new areas for growth, including launching coupon campaigns. Pinduoduo is also in the process of entering the North American market as a way to shift from its sputtering domestic economy.

Those efforts propelled the e-commerce firm to be the only one among the Chinese internet players to see a surge in second-quarter profit, with its own net income more than tripling. Meanwhile, bigger rivals like Alibaba and Tencent Holdings Ltd. saw revenue decline for the first time ever.

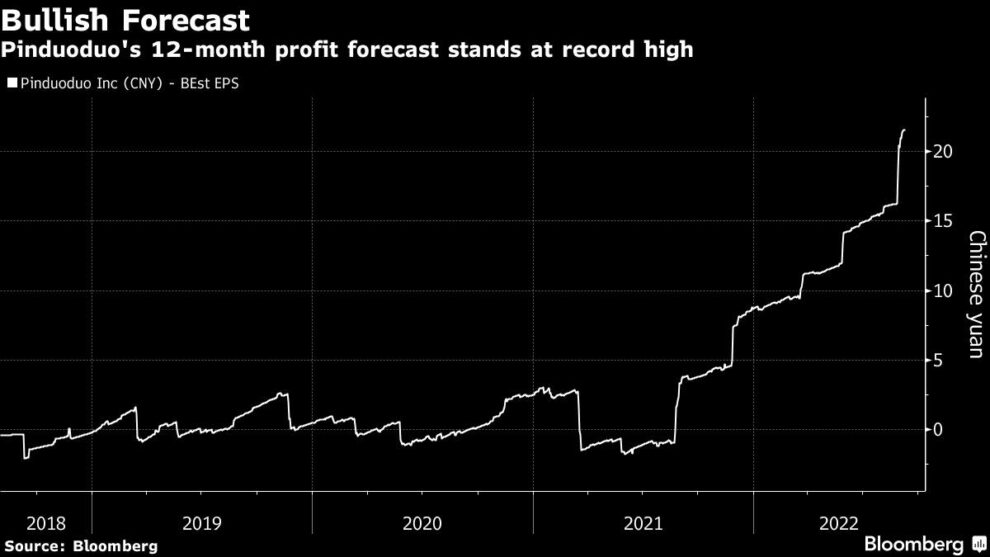

Analysts have lifted Pinduoduo’s earnings consensus estimate by 40% over the last month, among the biggest increases in the 1,379-member MSCI Emerging Markets Index, Bloomberg data show.

There are reasons to be wary. China’s retail sales for July grew at about half the pace that economists projected, underscoring a growing crisis in confidence. Investors say that if the trend holds, eventually all goods, including consumer staples and other lower-margin products, could suffer in the long run.

“We have seen signs of consumption downgrade, as consumers now have muted income growth expectations,” said Jian Shi Cortesi, investment director at GAM Investment Management in Zurich.

Still, Cortesi — who owns the stock — touted Pinduoduo as an overall bright spot thanks to its “value-for-money products.”

Tech Chart of the Day

The Nasdaq 100 Index rose about 1% on Friday as investors assessed whether monetary tightening to tackle inflation in the US is getting closer to being priced in. The technology gauge is set to gain for a third straight session and snap its streak of three weekly declines.

Top Tech Stories

-

Alphabet Inc.’s Google pays billions of dollars each year to Apple Inc., Samsung Electronics Co. and other telecom giants to illegally maintain its spot as the No. 1 search engine, the US Justice Department told a federal judge Thursday.

-

Twitter Inc. paid a whistle-blower who raised questions about operational problems within the social media platform $7 million to secure his silence, according to a lawyer for Elon Musk.

-

Tata Group is in talks with a Taiwanese supplier to Apple Inc. to establish an electronics manufacturing joint venture in India, seeking to assemble iPhones in the South Asian country.

-

Bain Capital is exploring options for Works Human Intelligence Co. including a potential sale that could value the human resources software developer at as much as $2 billion, according to people familiar with the matter.

-

Animoca Brands Corp., Asia’s biggest crypto investor and game developer, raised $110 million in a fundraising round led by Temasek Holdings Pte, bankrolling expansion even after a $2 trillion market meltdown.

(Updates to market open.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.