Even Nvidia’s stellar earnings report didn’t prevent its recent decline.

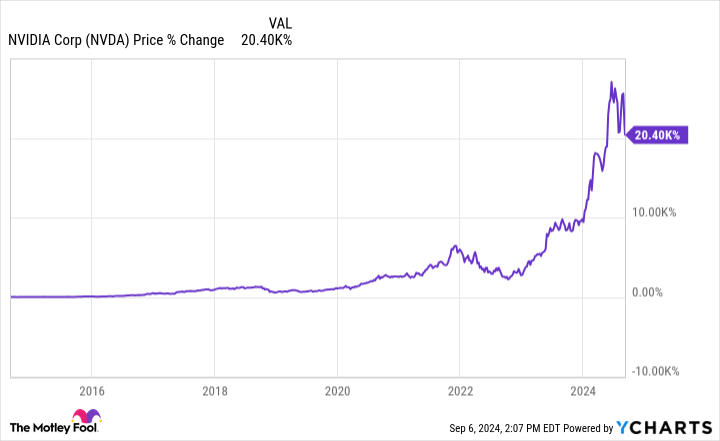

Perhaps no stock has risen more so fast than Nvidia (NVDA 1.53%). At one point, it was up by about 1,000% in less than two years, briefly taking its market cap north of $3.2 trillion before it pulled back.

However, the run-up in the company’s stock was so extreme that even its stellar earnings report for the second quarter of fiscal 2025 (ended July 31) failed to prevent a significant sell-off in its stock. Between the company’s likely overvaluation and a momentum shift, investors should probably avoid the semiconductor stock for the remainder of 2024.

The state of Nvidia

In light of the recent pullback, investors need to exercise some perspective. The scorching demand for AI chips and Nvidia’s considerable lead in this niche of the chip industry arguably make it the premier semiconductor stock.

The growth in the AI chip market has been so explosive that Allied Market Research forecasts a compound annual growth rate (CAGR) of 38% through 2032. This is far above the 6% CAGR that Allied forecast for the overall chip industry through 2031.

Additionally, Nvidia appears poised to begin shipping its next-generation AI chip Blackwell in the fourth quarter. This should help it maintain its market lead as its competitors struggle to catch up to the chip giant.

Considering Nvidia’s technical lead, current shareholders should probably stay in the stock because it will likely remain a long-term winner. In time, it may even replace the struggling Intel as a Dow 30 stock.

So, what happened?

Despite Nvidia’s huge potential, the short-term outlook for its stock looks increasingly bleak. Amid several quarters of triple-digit revenue growth, the company eventually fell short of increasingly elevated expectations. Consequently, the stock is down by about 25% from its 52-week high.

Admittedly, its gains may have appeared justified from the perspective of its price-to-earnings ratio (P/E). At just 48 times earnings, Nvidia may look undervalued when considering the company’s triple-digit percentage revenue and earnings growth.

Still, the other metrics may have left investors questioning Nvidia’s current price. Its price-to-sales (P/S) ratio had exceeded 40 as recently as July, and the current sales multiple of about 27 makes it expensive by just about any measure.

Also, its valuation looks more stratospheric when taking into account its price-to-book value ratio of 43. With AMD and Qualcomm selling at a respective 4 times and 7 times book value, Nvidia may have trouble justifying its huge premium.

Moreover, investors tend to sour on stocks with slowing growth, even when the growth rate is robust. This may not be fair, but the fact is that triple-digit growth numbers are unsustainable over the long term. Also, customers are likely to turn to the company’s competitors’ slower but available AI chips as Nvidia struggles to meet demand.

Additionally, investors need to keep the history of Nvidia stock in mind. Despite the gains of more than 20,000% during the past 10 years, the stock has also fallen by more than 50% twice during that period.

Such sell-offs tend to occur because the chip industry and its stocks move in cycles. While the upward moves in this stock have handsomely rewarded shareholders, they have also had to endure brutal sell-offs. With Nvidia likely in a bear phase now, investors may want to wait until 2025 before they consider adding shares.

Nvidia stock’s future

Given Nvidia’s momentum and its high valuations, investors should probably refrain from adding the company’s shares in the last months of 2024. Admittedly, the bull market in AI chips is likely not over, and current shareholders should benefit in the long term by staying in the stock.

Nonetheless, both investor expectations and the stock price appear to have become too detached from the fundamentals. Thus, investors should probably wait a few months before adding to positions in Nvidia stock.

Will Healy has positions in Advanced Micro Devices, Intel, and Qualcomm. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Qualcomm. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.