Raising capital theoretically just got easier. That’s not always a good thing.

In theory, companies that are looking to raise money just got a big boost. That’s because the Federal Reserve just lowered the federal funds rate by 50 basis points. The interest rates of debt, as well as the cost of equity, should be more affordable for nearly every business. Markets in general are looking at this as a good thing. But there’s one artificial intelligence (AI) stock that might actually be weaker following the rate cut.

Expect AI competition to heat up even more

AI spending has gone gangbusters. According to data from Statista, the overall AI market size has already gone from $93 billion in 2020 to around $184 billion today. That means the market has nearly doubled in just five years. But things are just getting started. By 2030, the market size is expected to exceed $800 billion — roughly 5 times current levels.

From critical hardware components like GPUs to the software models themselves, there’s an arms race for AI infrastructure right now, and everyone — from big tech to tiny start-ups — is spending huge resources to compete. That’s great for AI innovation long-term, and the Fed’s latest rate cut will only accelerate that push. That means even more resources being deployed into innovation, especially from the biggest competitors that can most afford it. If the likes of IBM, Apple, and Alphabet were spending billions per year on AI before, imagine how much they will spend now that capital is even cheaper. That’s especially true considering the Fed signaled that even more cuts were on the way.

SoundHound could be a loser for this 1 reason

In general, innovation in the AI sector will only accelerate following rate cuts. But that’s actually bad news for competitors like SoundHound AI (SOUN -0.80%) that haven’t proven willing to invest heavily into research and development.

SoundHound specializes in voice AI. Basically anywhere a consumer has a voice conversation — say with a vehicle’s entertainment system or a fast food drive-thru window — SoundHound can insert its AI technology to mimic the experience of talking with a human. The company has an impressive portfolio of AI patents backed by a growing customer list. But it’s a relatively small player, with a market cap of just $1.7 billion and a revenue base of only $55 million.

Capital constraints have been serious challenge for SoundHound, especially considering it posted its biggest loss in years last quarter. Consider its ability to ramp up research and development spending over the last three years. At the start of 2022, the company was spending around $60 million per year in research and development. Today, that figure has fallen to around $55 million, even as its sales have increased by around 155% over that time frame.

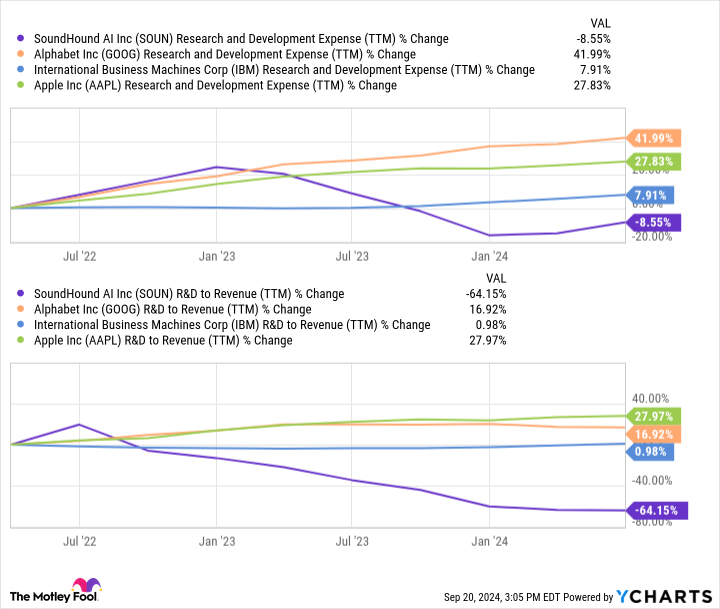

Let’s compare SoundHound’s reduction in research and development spending to that of its big tech competition. Google’s Bard, Apple’s Siri, and IBM’s Watson technologies are already competing directly with SoundHound’s AI platform, and innovation spending from these tech giants will have a direct result on the company’s long term competitiveness. Since the start of 2022, IBM has increased research and development spending by around 8%, while Google and Apple have increased spending by 42% and 28% respectively. While not all of this spending increase went to AI, it paints a clear contrast to SoundHound’s capital allocation strategy.

Another way to view this contrast is by looking at each company’s research and development spending as a percentage of its overall sales. IBM, Google, and Apple have all increased its research and development spending even as sales have continued to grow. SoundHound, meanwhile, has decreased its spending in relation to rising sales.

SOUN Research and Development Expense (TTM) data by YCharts.

What does this data tell us? That big tech — arguably SoundHound’s biggest competitors long term — have been willing to aggressively ramp research and development spending even with high rates. As rates fall and capital gets cheaper, expect this innovation spending to become even more aggressive. And while SoundHound may be able to increase its research and development budget as well, any increase will pale in comparison to what the big tech giants will be able to manage.

In a silo, perhaps SoundHound is a beneficiary of the rate cuts. Its cost of capital will fall, and maybe it can finally up its innovation budget. But its technologies are competing against very well funded peers who have proven willing to invest aggressively even with high rates. Now that rates are falling, SoundHound may not be able to invest aggressively enough to keep its technology competitive over the long term.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Apple. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.