UiPath’s growth has come to a screeching halt, and I think the company could get acquired soon.

The S&P 500 and Nasdaq Composite have both posted returns of roughly 10% so far in 2024. One of the biggest catalysts driving these returns is artificial intelligence (AI).

While this might make the technology sector particularly tempting, smart investors know that not all opportunities are equal.

One stock that got ahead of itself amid AI euphoria is UiPath (PATH -2.04%), a developer of robotics processing automation (RPA) software to help office workers with administrative tasks. At the beginning of the year, shares of UiPath were hovering around $25. But now? The stock is down over 50% this year, and shares trade for just $11.

Let’s explore what’s going on at UiPath, and I’ll make the case for why the company will be acquired within the next year.

What’s going on at UiPath?

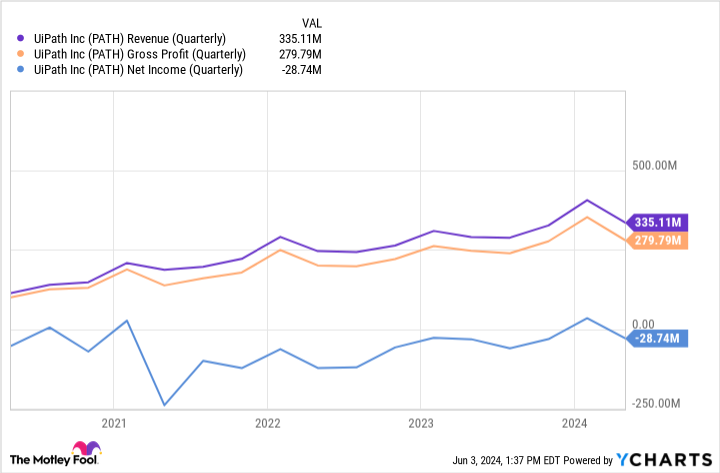

The chart below illustrates some important financial metrics for UiPath over the last five years. On the surface, there are two lowlights.

First, growth in UiPath’s revenue and gross profit are decelerating. Second, this dynamic compounds and is taking a toll on the company’s profitability — or lack thereof.

PATH Revenue (Quarterly) data by YCharts

For its first quarter of fiscal 2025, ended April 30, UiPath only added $44 million of net new annual recurring revenue (ARR). By comparison, during the company’s fiscal year 2024 (ended Jan. 31), UiPath added $260 million in net new ARR — implying an average of $65 million per quarter.

Where will UiPath go next?

At a high level, enterprise software sales have cooled over the last couple of years. Stubborn inflation levels and a rising-interest-rate environment have caused businesses of all sizes to rein in spending and operate under leaner budgets.

While I understand these dynamics, I think pointing to a challenging macroeconomic picture only works for so long. During UiPath’s earnings call, investors learned that sales cycles have become prolonged as prospective customers aren’t exactly champing at the bit to buy the company’s tools.

Another shocking detail revealed during UiPath’s earnings call was that CEO Rob Enslin resigned and is being replaced by the company’s co-founder, Daniel Dines.

Image source: Getty Images.

Who might be interested in acquiring UiPath?

While Dines could very well ignite some newfound energy into the company, I suspect that the board of directors has brought him back for one reason: to broker a sale.

UiPath’s products fit squarely into the overall AI picture. However, the company has steep competition from megacap tech. This is where I see Dines playing a big role.

One potential acquirer for UiPath could be Microsoft. The Windows developer has invested billions into OpenAI, the start-up behind ChatGPT. Over the last year, Microsoft has integrated ChatGPT across its ecosystem, particularly on its Azure cloud computing platform and its workplace productivity tools.

I think that UiPath’s RPA software could complement Microsoft’s existing workplace automation services. Moreover, considering that Dines used to work at Microsoft in the early 2000s, I think there’s good potential for the companies to partner up.

Besides Microsoft, I think Salesforce could be a likely suitor for UiPath. Salesforce is a highly acquisitive company, having spent tens of billions buying businesses such as MuleSoft, Tableau, and Slack. Each of these assets helped broaden Salesforce’s capabilities beyond customer relationship management software. UiPath presents an interesting new layer for Salesforce and can enhance the company’s existing line of AI-powered productivity tools.

The last company I think might be interested in UiPath is ServiceNow, a leading IT workflow management platform. ServiceNow operates across a wide spectrum of generative AI applications, one of which is RPA.

While this gives the company an obvious overlap with UiPath, I should note that ServiceNow is not nearly as acquisitive as Microsoft or Salesforce. The company has mostly grown organically, making a number of smaller acquisitions compared to its big tech cohorts above.

It’s important to note that the ideas explored above are my own. UiPath could very well enter into a turnaround and emerge as a much stronger company than it is today. Moreover, I would not encourage investors to buy shares of UiPath over speculation that it could be acquired.

No matter what happens, one thing is certain: UiPath is at a really interesting juncture right now. I’m excited to see what happens and learn more from management over the coming quarters.

Adam Spatacco has positions in Microsoft. The Motley Fool has positions in and recommends Microsoft, Salesforce, ServiceNow, and UiPath. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.