This Magnificant Seven company is making big moves.

What happens when a company’s largest customers become fierce competitors? Imagine that you own the largest chocolate chip company in the land. You sell to all the largest grocery chains because you have the best recipe. But every day, those stores pour money into finding the next-best recipe. If they create it, it could be a recipe for disaster (pardon the pun).

This is Nvidia‘s reality now. Companies like Microsoft, Alphabet (GOOG 0.86%) (GOOGL 0.89%), Meta Platforms, and Amazon are spending billions on Nvidia GPUs while also spending billions developing competing products. The key for Nvidia is to stay one step ahead. But it won’t be easy with such deep-pocketed competitors.

Alphabet is serious competition

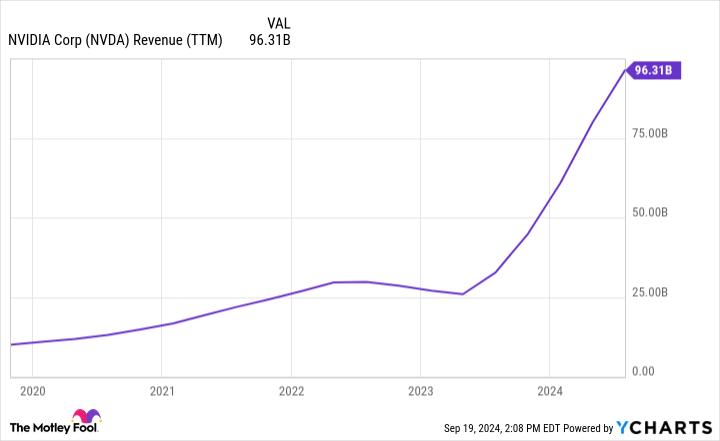

As shown below, the four massive tech companies mentioned above reportedly account for nearly 40% of Nvidia’s revenue, which exploded to $96 billion over the past 12 months.

NVDA Revenue (TTM) data by YCharts

Of this, 85% comes from Nvidia’s data center division. Whatever company can encroach on Nvidia’s massive market share of reportedly 70% to 95% in artificial intelligence (AI) chips will benefit in two ways: increased income and reduced expenses. After all, much of that giant ramp in Nvidia’s revenue, depicted above, comes from other big tech companies’ pockets.

Nvidia is leading due to its groundbreaking H100 GPU, which delivers unparalleled performance. These units are critical for data centers, large language models, and generative AI, so Nvidia can’t keep up with demand and the margins are gigantic.

Alphabet is developing and improving its competing AI product, the Tensor Processing Unit (TPU). It launched the sixth-generation TPU, Trillium, earlier this year. With five times more speed and 67% more energy efficiency, sixth-gen Trillium is a considerable leap over version five.

Trillium doesn’t compete directly on the open market with Nvidia. Instead, customers rent space on Google Cloud, allowing Alphabet a broader customer base. The ability to rent space will be intense competition for Nvidia as companies can choose to rent rather than make capital investments. And, of course, Alphabet uses it internally.

Is Alphabet stock a buy now?

Alphabet can pour capital into AI projects because it is hugely profitable and generates massive cash flow from its core advertising (Google Search and YouTube) and Google Cloud segments. These segments generated $84 billion in sales last quarter, a 14% year-over-year increase that came with $27 billion in operating cash flow.

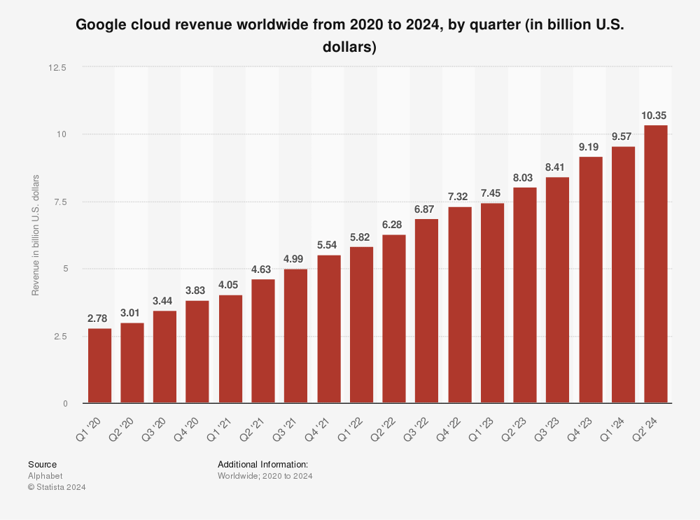

Also impressive is that the operating margin for Google Cloud increased from 5% to 11% year over year. The increase in margin is a clear indication of increased efficiency and growing demand. As you can see below, Google Cloud’s growth has been remarkable in recent years.

Image source: Statista.

Even after growing nearly fourfold since 2020, AI will increase Google Cloud’s sales. For Alphabet, investments in AI, Google Cloud, and generative chatbots that rival ChatGPT, like Gemini, are crucial to the long-term path.

Microsoft Bing is challenging Google Search by harnessing ChatGPT through its billion-dollar investment in its creator, OpenAI. Plus, generative AI may encroach on the search market. However, there is no need to sound an alarm yet; Google Search grew 14% last quarter to $49 billion in revenue and remains far and away the market leader.

Alphabet stock looks like a bargain in a market where many tech stocks are trading well above historical valuations. As shown below, Microsoft trades 14% above its five-year average price-to-earnings (P/E) ratio, while Alphabet trades 12% below.

GOOG PE Ratio data by YCharts

The historical undervaluation, quality core business, and potential to compete for part of Nvidia’s market dominance make Alphabet stock an intelligent buy for tech investors and those looking for GARP (growth at a reasonable price) companies.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.