Nvidia’s incredible run of revenue and earnings growth is forecast to continue next year.

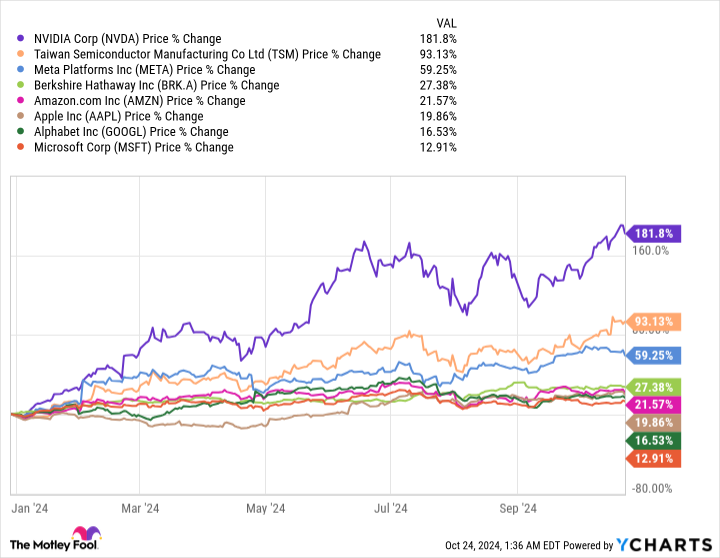

Nvidia (NVDA 0.80%) was the best-performing stock in the entire S&P 500 (^GSPC -0.03%) in 2023, ending the year with a 239% gain. It’s up a further 181% so far in 2024, but that isn’t enough to lead the index — first place is currently held by Vistra Corp.

However, a 181% gain is enough to place Nvidia ahead of every other company worth $1 trillion or more.

Nvidia’s incredible run of performance comes on the back of surging demand for its graphics processing units (GPUs) for data centers, which are the go-to choice among developers of artificial intelligence (AI) models.

The company is about to start shipping its next generation of AI GPUs based on its latest Blackwell architecture, which will reset the benchmark for the entire industry. Nvidia CEO Jensen Huang says Blackwell demand is already “insane,” and I predict this new hardware will be the reason its stock outperforms the rest of the trillion-dollar club yet again in 2025.

Blackwell offers an enormous leap in performance

Nvidia’s H100 GPU set the benchmark for AI training and inference. The chip went into production in late 2022, and it was the top choice throughout 2023 for data center operators like Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL).

Nvidia has since released the H200 GPU, which can perform AI inference at almost twice the speed of the H100. But Blackwell-based GPU systems like the GB200 NVL72 are capable of performing AI inference at a whopping 30 times the pace of the equivalent H100 setups.

Plus, Huang says individual GB200 GPUs will sell for $30,000 to $40,000 each, which is around the same price many data center operators paid for the H100 when it was released. In other words, Blackwell is going to offer a substantial increase in cost efficiency. That means the largest and most advanced AI models will become financially accessible to a wider number of developers and businesses.

In an interview with CNBC in early October, Huang said demand for Blackwell GPUs is “insane.” According to one analyst, Nvidia could ship up to 200,000 GB200 units in the final quarter of 2024, followed by as many as 550,000 units in the first quarter of 2025. That could translate into as much as $30 billion in data center revenue over the next two quarters from that one chip alone!

Nvidia’s revenue is forecast to surge again next year

Nvidia’s fiscal year is different from the traditional calendar year. The company is currently in fiscal 2025, which will end on Jan. 31, 2025 (three months from now). That will then mark the beginning of its fiscal 2026 year.

Wall Street’s consensus estimate (according to Yahoo) suggests Nvidia will deliver $125.6 billion in total revenue for the whole of fiscal 2025, representing a 125% increase from fiscal 2024. The company is expected to follow that up with $179.2 billion in revenue in fiscal 2026.

The data center segment will be responsible for the majority of that growth. It accounted for 87% of Nvidia’s total revenue during the fiscal 2025 second quarter (which ended July 28), coming in at a record $26.3 billion — a whopping 154% increase from the year-ago period.

The incredible demand for Blackwell should drive more record results in the coming quarters. Microsoft is rumored to be one of the biggest buyers of the new GPUs. During its fiscal 2024 (which ended June 30), Microsoft spent a staggering $55.7 billion on capital expenditures, most of which went toward AI data center infrastructure and chips. The company has already stated that it will spend even more in fiscal 2025.

Amazon is also on track to spend over $60 billion on AI infrastructure in calendar 2024, and Meta Platforms has told investors it will spend up to $40 billion. Those numbers are likely to climb further in 2025.

Image source: Nvidia.

Despite its incredible run, Nvidia stock might be cheap

Nvidia’s dominant market share in the data center GPU space has afforded it an incredible amount of pricing power, which is driving a surge in its profits. The company generated $54.9 billion in net income over the last four quarters, which translated to $2.21 in earnings per share (EPS).

Based on that EPS figure and Nvidia’s current stock price of $139.56, it trades at a price-to-earnings (P/E) ratio of 63.1. That isn’t cheap at face value — in fact, it’s almost double the 32.1 P/E ratio of the Nasdaq-100 technology index.

However, Wall Street expects Nvidia to generate $4.06 in EPS in fiscal 2026, placing its forward P/E ratio at 34.3. That might be far too cheap for two reasons.

First, Nvidia stock traded at an average P/E ratio of 58.2 for the last 10 years, and it was regularly above 50 even before the AI revolution gripped Wall Street.

NVDA PE Ratio data by YCharts.

Second, as fiscal 2026 progresses, analysts will start issuing their forecasts for fiscal 2027. If Nvidia appears likely to deliver incredible revenue and earnings growth yet again, investors might be willing to pay a much higher P/E ratio for its stock. In other words, 34.3 might be far too attractive to pass up.

So, if Wall Street’s EPS forecast for fiscal 2026 is accurate, and if Nvidia trades in line with its 10-year average P/E ratio, that implies that its stock could rise by 70% or more over the course of next year.

There is no other company in the trillion-dollar club that has anywhere near as much revenue or earnings growth forecasted for next year, which is why I think Nvidia is the obvious choice to outperform.

Huang believes data center operators will spend $1 trillion building AI infrastructure over the next five years, and if he’s right, Nvidia’s incredible run might have legs way beyond 2025.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.