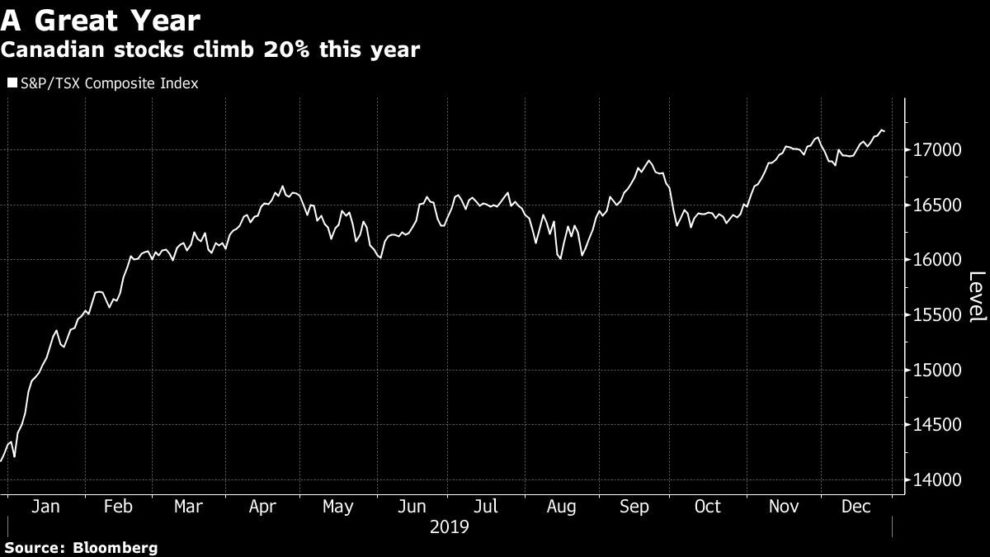

(Bloomberg) — With two trading days left until the end of the year, Canada’s benchmark stock index is on pace for its best run in a decade.

After hitting 59 fresh highs, the S&P/TSX Composite Index has climbed about 23% this year, weathering everything investors could throw at the market: volatile commodity prices; the unpredictability of U.S.-China trade tensions; Canada’s fractious federal election; heightened recession fears and persistent profit concerns.

Here’s a look at some of the biggest winners and losers in Canada’s equity market this year.

Investor Darling

Real Matters Inc., a provider of network services for the mortgage and insurance industries, is the biggest gainer so far this year with a 282% surge. The rally has pushed the Markham, Ontario-based company’s market value beyond the C$1 billion ($819 million) mark. Last month, National Bank Financial upgraded the stock to outperform and said it “did not give enough respect to the correlation of Real Matters business with the market volumes for mortgages.”

The rotation from value to growth this year has been good for tech stocks, making them the country’s best performing group by a mile. The S&P/TSX Info Tech Index has gained more than 65% this year, adding about C$58 billion ($45 billion) in value.

Shopify Inc., the subject of some takeover speculation, is up 183% so far in 2019, the top tech stock and the second-best overall performer on the broader index. Investors have rewarded the Ottawa-based company’s rapid sales growth and its plans to spend $1 billion to set up a network of fulfillment centers in the U.S. In October, Shopify reported an unexpected quarterly loss which may have tempered sentiment. Co-founder and chief executive officer Tobi Lutke took to Twitter on Boxing Day to share his thoughts on his company’s success:

The tech gauge makes up about 6% of the TSX Index but only contains 10 stocks, leading tech-starved investors to turn to newly-listed Lightspeed POS Inc., which boasted Canada’s second-biggest IPO this year and the biggest offering by a Canadian tech firm in almost nine years. The stock has gained 93% this year, making it the second best tech stock on the TSX.

The Pariah

The investor frenzy that characterized the cannabis industry in 2018 quickly faded this year as companies missed earnings expectations and the regulatory landscape proved to be more difficult than expected. Canada’s healthcare index, primarily made up of marijuana companies, is the worst performer this year, and the only one in the red.

Aurora Cannabis Inc., the biggest loser on the TSX, has wiped out C$4 billion in market value in 2019 as it tempered plans to achieve sustained earnings before interest, taxes, depreciation and amortization in the quarter ended June 30. The Edmonton, Alberta-based firm reported an adjusted Ebitda loss of C$39.7 million for the quarter ended Sept. 30.

Gatineau, Quebec-based Hexo Corp. came in a close second, erasing about half its value this year. The company cut almost a quarter of its workforce weeks after saying it wouldn’t meet revenue guidance this year or next. Earlier this week, beleaguered Hexo announced a share shale at a “massive” discount that sent the stock tumbling yet again.

Pot exchange-traded funds in the U.S and Canada have suffered: ETFMG Alternative Harvest ETF has slumped 57% since its March peak and the Horizons Marijuana Life Sciences ETF has plunged more than 63%:

Also Rans

So what’s left? Here’s a look at some of the other main moves this year:

Ballard Power Systems Inc. jumped 177% so far this year as it announced a technology breakthrough that replaces most of the high-cost platinum used in earlier designSNC-Lavalin Group Inc. has slumped about 34% despite staging a late comeback as it settled a fraud charge related to bribes paid in Libya a decade ago.Miners have climbed more than 20% in 2019 as the price of gold and silver rose. Canadian energy stocks eked out a 22% gain this year, quietly outperforming their U.S. counterparts as a chorus of positive outlooks on the sector to the north continues.

Markets — Just The Numbers

Chart of The Week

Economy

Canada’s economy contracted in October for the first time in eight months, missing economist estimates for a flat reading, as the United Auto Workers strike in the U.S. weighed on plant production.

Fewer Canadian small and mid-size firms intend to make capital expenditures in the next three months, according to a monthly industry survey by the Canadian Federation of Independent Business.

Next up, Markit Canada manufacturing PMI for December is due on Jan. 2.

#TrendingInCanada

After Canadian broadcaster CBC cut out Donald Trump’s cameo in “Home Alone 2: Lost in New York,” the U.S. President took to Twitter, suggesting Canadian Prime Minister Justin Trudeau may have had something to do with it. CBC said on Friday the edits to the film were made in 2014, before Trump became president, to add for more commercial time.

Click here for our daily Social Media Buzz newsletter.

To contact the reporter on this story: Divya Balji in Toronto at [email protected]

To contact the editors responsible for this story: Kyung Bok Cho at [email protected], Chris Fournier, Carlos Caminada

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”75″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.