DocuSign, Inc. DOCU has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get the true sense of the quality and sustainability of its growth. The company’s revenues for fiscal 2023 and 2024 are expected to improve 17.5% and 11.1%, respectively, year over year.

Factors That Augur Well

DocuSign remains focused on product innovation and expansion to ensure the addition of Agreement Cloud customers and the widening of its existing customer base. Notably, the company added 44,000 new customers in the second quarter of fiscal 2023, bringing the total worldwide customer count to 1.28 million.

DocuSign’s top line is significantly benefiting from continued customer demand for eSignature. Despite this rising demand, the market for eSignature remains largely untapped, and this keeps DocuSign in a position to expand the same across businesses around the world. The company’s revenues increased 21.6% year over year to $622.2 million in the second quarter of fiscal 2023.

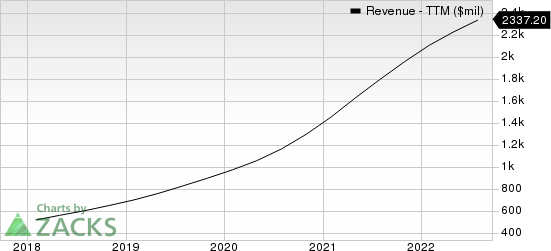

DocuSign Revenue (TTM)

DocuSign revenue-ttm | DocuSign Quote

DocuSign has deepened its relationship with partners such as Salesforce CRM and Microsoft MSFT.

For instance, the company has expanded its global strategic partnership with salesforce. The two companies jointly develop solutions for automation of the contract process and expansion of collaboration among organizations that use Salesforce’s Slack. DocuSign made an eSignature integration with Microsoft Teams last year and is currently an official electronic signature provider in Microsoft Teams’ Approvals app.

Headwinds

DocuSignis seeing an increase in expenses as it continues to invest in sales, marketing and technical expertise. Total operating expenses of $474.6 million increased 34% year over year in fiscal 2022.

DocuSignhas never declared and neither has any plan to pay cash dividends on its common stock currently. So, the only way to achieve a return on investments in the company’s stock is share price appreciation, which is not guaranteed.

DocuSign currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research