Reddit CEO Steve Huffman hugs mascot Snoo as Reddit begins trading on the New York Stock Exchange (NYSE) in New York on March 21, 2024.

Timothy A. Clary | AFP | Getty Images

Reddit shares rallied 11% in premarket trading on Wednesday, a day after the company released quarterly results for the first time since its IPO in March.

Here’s how the company did:

- Loss per share: $8.19. That may not compare with the $8.71 loss expected by LSEG

- Revenue: $243 million vs. $212.8 million expected by LSEG

Revenue climbed 48% from $163.7 million a year earlier. The company reported $222.7 million in ad revenue for the period, up 39% year over year, which is a faster rate of growth than at its top competitors.

Digital advertising companies have started growing again at a healthy clip after brands reeled in spending to cope with inflation in 2022. Meta‘s ad revenue jumped 27% in the first quarter, followed by 24% growth at Amazon and 13% growth at Google parent Alphabet.

Reddit reported a net loss of $575.1 million. Stock-based compensation expenses and related taxes were $595.5 million, primarily driven by charges due to the initial public offering.

For the second quarter, Reddit expects revenue of $240 million to $255 million, topping the $224 million expected by analysts, according to LSEG. The midpoint of the guidance range suggests growth of about 32% for the second quarter, up from $183 million from a year earlier.

Reddit, which hosts millions of online forums on its platform, was founded in 2005 by Alexis Ohanian and Steve Huffman, the company’s CEO.

“We see this as the beginning of a new chapter as we work towards building the next generation of Reddit,” Huffman said in a release Tuesday.

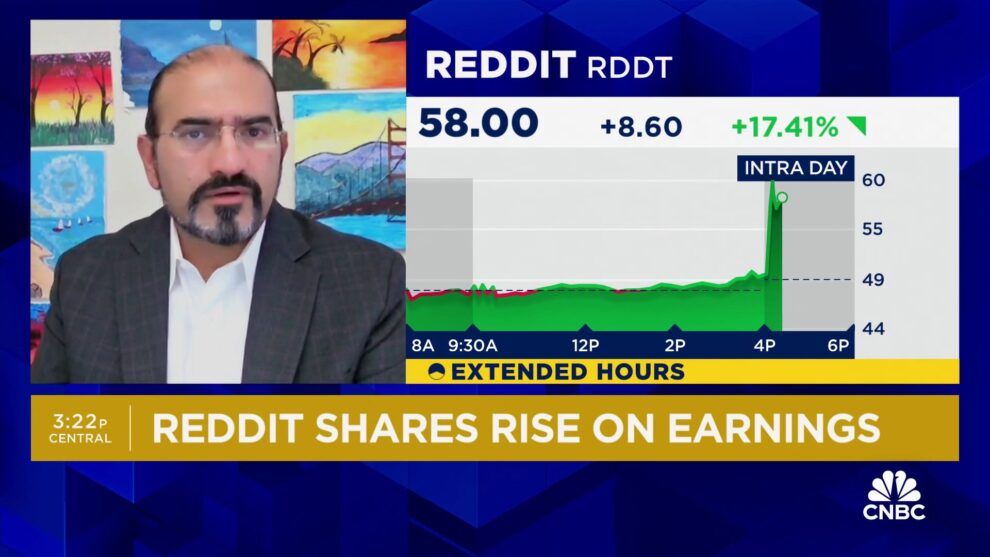

Reddit began trading under the ticker symbol “RDDT” on the New York Stock Exchange in March. The company priced its IPO at $34 per share, which valued the company around $6.5 billion. When tech valuations were red hot in 2021, Reddit’s private market valuation reached $10 billion.

The stock climbed past $58 in after-hours trading on Tuesday before coming back a bit. Should shares close above $57.75 on Wednesday, they would be at their highest since March 26, the fourth day of trading. Reddit closed that day at $65.11.

The company reported 82.7 million daily active users for its first quarter, up from the 76.6 million expected by StreetAccount. Average revenue per user worldwide rose 8% to $2.94 from $2.72 a year ago.