It’s hardly a revelation that Americans are pretty divided these days. But not on everything. For example, citizens on both sides of the political spectrum worry about having enough money to retire comfortably. Some new data from a March survey by Echelon Insights on behalf of the Economic Innovation Group reflects this concern. Some quick bullet points from their findings:

- Majorities of Americans are extremely or very concerned about retirement security, particularly the ability of low-income Americans to save for their own retirement.

- More than nine out of 10 Americans believe Social Security will not be enough.

- A majority of Americans support having the federal government match retirement contributions

None of this is surprising. Surveys for years have indicated widespread concern among Americans about their retirement finances.

But despite these worries. Echelon’s findings—based on weighted demographic and turnout characteristics of registered voters—also reveal optimism.

Read: Can you afford to retire?

More than three-quarters of respondents—76%—said, for example, that they would be able to improve their financial situation over their lifetime. Less than a fifth—19%—said their situation would not improve, while 5% weren’t sure.

How about the future? A plurality—50%—said “the next generation will be financially better off.” And 36% said the next generation would not be better off, and 14% weren’t sure.

Now the gloom. In the old days (as in 30 or 40 years ago), a secure retirement was often compared with a three-legged stool. One stool was a company pension. One was personal savings. The third was Social Security. These days, that’s largely gone the way of rotary phones and black-and-white TV.

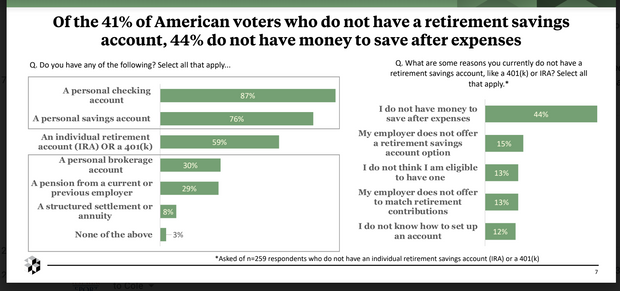

Echelon’s data says only 29% of respondents said they have a pension from a current or previous employer. Lack of a pension ups the pressure to save more in things like an individual retirement account (IRA) or 401(k), but 41% don’t have them. So for tens of millions of workers, that’s two legs of the retirement stool that simply don’t exist.

And of those 41% who don’t have a retirement account, even if they did, 44% of that group says they don’t have enough left over to save anyway.

This leaves Social Security. The pessimism runs deep. An overwhelming majority—92%—agreed with the statement that “Social Security is not enough for someone to get by in retirement.”

Because so many Americans lack one or two other legs of the retirement stool, Social Security becomes all the more important. I’ve mentioned before how millions of Americans are utterly dependent on it—here are the latest figures, as provided by the Social Security Administration:

- Among elderly Social Security beneficiaries, 50% of married couples and 70% of unmarried persons receive 50% or more of their income from Social Security.

- Among elderly Social Security beneficiaries, 21% of married couples and about 45% of unmarried persons rely on Social Security for 90% or more of their income.

The average monthly benefit this year is $1,544. Not a lot of wiggle room for those who need that check—really need it—each month.

Modest as this is, remember that the Social Security trustees themselves have warned that the system’s giant trust fund could be depleted by 2034. After that, Social Security would be dependent on whatever is coming in from payroll taxes; current projections say that would cover just 76% of scheduled benefits. The COVID-19 pandemic has probably accelerated this, because last year’s economic crash destroyed millions of jobs, forcing many Americans into early retirement—and thus speeding up the depletion of the trust fund.

What can be done about all this? The Economic Innovation Group, which commissioned the study, offers some ideas:

- Every worker should have access to a retirement plan—an IRA or 401(k); 91% of those surveyed agreed with this.

- Every worker should have access to the same savings plan as (federal) government employees (who get matching contributions and a variety of investment options); 78% of those surveyed agreed with this. If you’re not familiar with what federal workers get, one of the study’s co-authors, Kevin Hassett—chairman of the Council of Economic Advisers in the Trump administration—explains. “The 5% match (on worker contributions) in the Thrift Savings Plan (TSP) has proven quite successful at helping even lower income federal employees accumulate wealth.” Hassett points out that the TSP is a tax-deferred program, “So the long run budget cost is smaller than a short run score would suggest.”

- More than 40% suggested that the government provide a basic minimum income to all workers, payments for having children and so-called “baby bonds,” in which every child at birth would receive a publicly funded trust account.

One broader point to these proposals: It would, Hassett and co-author Teresa Ghilarducci of The New School say, “dramatically alter the wealth distribution in the United States,” and provide lower-income workers, particularly minorities, with greater financial security. “Reforms to provide more retirement plan access to less well-off families.” They write, “would not only increase the retirement security of millions of low-income Americans, but would also boost their overall wealth and allow them to pass it along to future generations, thereby helping close the wealth gap in the process.”

You can read the full study here.