Shares of Revlon Inc. continued their recent rocket ride Wednesday, as the cosmetics and hair-care company’s bankruptcy appeared to fuel a “meme”-like buying frenzy among retail investors.

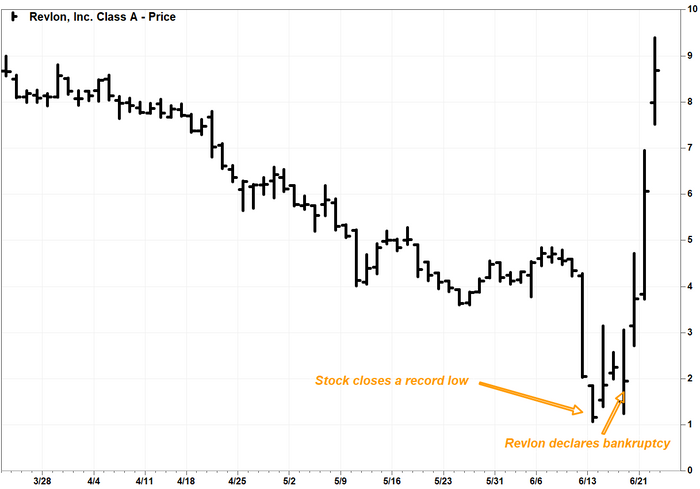

After Revlon said on June 16 that it voluntarily filed for bankruptcy, the stock tumbled 13.3% to close at $1.95, but that was 66.7% above the June 13 record close of $1.17.

The stock REV, +41.09% soared 57.8% in morning trading Wednesday. It has now rocketed 392% since the day it filed for bankruptcy, and has blasted 720% higher off its record-low close.

Analysts at Vanda Research said that with Revlon’s short interest, or bearish bets on the shares, jumped last week to 37.6% of the shares available for trading by the public, or free float. That made the newest “meme” stock a “perfect candidate” for the most speculative retail crowd, Vanda said.

“A spike in social boards chatter and OTM [out-of-the-money] call option volumes over the past week confirm that retail crowds are behind the latest moves higher,” Vanda analysts wrote in a weekly note to clients.

In comparison with fellow “meme” stocks, short interest in AMC Entertainment Holdings Inc. AMC, +4.57% is 21.3% of the public float and in GameStop Corp. GME, +2.29% is 24.6% of the public float.

Vanda says the recent action in Revlon’s stock is similar to when Hertz Global Holdings Inc. filed for bankruptcy in May 2020. The car rental company’s stock had plummeted leading up to and on the day after the bankruptcy filing, then started surging the next day, and had recovered everything it lost in the post-bankruptcy selloff in just a couple of weeks.

Hertz HTZ, -0.06% eventually exited from bankruptcy on July 1, 2021.

Revlon said in its bankruptcy filing that it expects to receive $575 million in debtor-in-possession (DIP) financing from its existing lender base, so it can continue to run its business as reorganizes its capital structure amid liquidity constraints.

The company said in its quarterly filing in May that it had recorded a first-quarter net loss of $63.1 million on $479.6 million in sales, and had $3.31 billion in long-term debt as of March 31.

“Consumer Consumer demand for our products remains strong – people love our brands, and we continue to have a healthy market position,” Chief Executive Debra Perelman said in the bankruptcy filing. “But our challenging capital structure has limited our ability to navigate macroeconomic issues in order to meet this demand.”

Investors should keep in mind that in a bankruptcy, the company’s stock can lose most, and even all, of their value, as debtholders receive priority in payouts over equity investors. The stock will be delisted, and likely start trading over the counter (OTC) under a new ticker.

“Investors should understand that buying common stock of companies in Chapter 11 bankruptcy is extremely risky and can lead to financial loss,” according to the Financial Industry Regulatory Authority, or FINRA.

Also, when a public company emerges from bankruptcy, the old shares are often canceled, and only the reorganized company’s new shares end up having value.

Revlon’s stock has dropped 15.7% year to date, while the S&P 500 index SPX, +0.24% has shed 20.9%.