Contrary to what you may read elsewhere, the U.S. economy did not slump in the second quarter of the year.

True, real gross domestic product slowed to a 2.1% annual pace from 3.1% in the first quarter, but as I’ve reported before, GDP is a poor measure of the economy’s health over the short or medium term. It’s distorted by accounting entries that can sometimes make good news seem bad.

Read this: Here’s why you should ignore quarterly GDP numbers

That’s what happened last quarter: The good news was hidden. Much of the slowdown in GDP in the second quarter stemmed from businesses prudently drawing down their inventories of unsold goods in face of a slowing global economy.

This inventory factor subtracted nearly 1 percentage point from growth, but it should be seen as a positive that businesses don’t have a lot of inventories piling up. Fewer inventories now mean fewer layoffs later when sales moderate. Too many recessions have resulted from an overbuild of inventories.

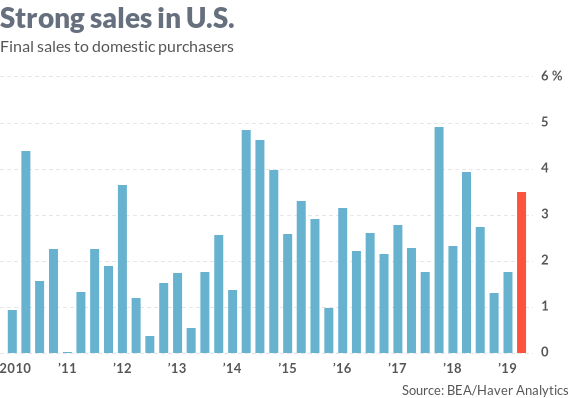

Where it really counts — what Americans bought and sold — the report released Friday by the Bureau of Economic Analysis showed a slight improvement over the first quarter.

Final sales to domestic purchasers — the best measure of demand within the United States — rose at a 3.5% annual pace in the spring, the best growth in a year.

Consumers were particularly exuberant: Consumer spending increased at a 4.3% annual pace, the most in six quarters. Spending on durable goods, such as autos, washing machines and computers, increased at a 8.3% pace, the fastest growth since 2006, when homeowners were buying SUVs with their home-equity loans.

(Fortunately, most consumers are keeping their debts at manageable levels nowadays.)

Business investment was the weak spot last quarter, with fixed investments sinking 0.6%, the first decline since 2015. Investments in structures, such as offices, oil wells and factories, plunged at a 10.6% pace, with big declines in oil drilling and commercial space such as stores. That’s not good.

Investments in new factories fell for the seventh quarter since Donald Trump vowed to bring back manufacturing. Investments in new equipment, however, rose 0.7%, partially reversing a small first-quarter decline, and that category is a much bigger number than money spent on factories.

Business investment is expected to remain tepid in coming quarters, as businesses wait to see what will happen with Trump’s tariffs and global growth.

The weakness in the business sector was made up for in the spring by the biggest boost in federal spending since the end of 2009, largely as payback for the government shutdown in the first quarter.

The headline said the economy suffered in the second quarter. There was a big soft patch on the investment side. But consumers and the public sector filled in the gap.

That’s not to say that the economy doesn’t have its problems, especially as global growth and trade moderate. But the sky did not fall in the second quarter. By the best measure, it actually improved.

Also read Tim Mullaney: This bad GDP report is all Trump’s fault

If the Federal Reserve does cut interest rates next week as expected, it won’t be because of a “bad GDP” report. It will be because of threats the Fed sees going forward, not what it sees in the rearview mirror.