The Federal Reserve doesn’t love the employment report released Friday, which showed that 528,000 more jobs were created in July while the unemployment rate fell to 3.5%, matching the lowest rate in more than 50 years.

They ought to love the strong market. After all, one of the Fed’s official duties is to foster “maximum employment” and this report shows we are close to that goal. Yay!!

Breaking news: Jobs shocker: U.S. unemployment falls to prepandemic levels as economy adds 528,000 jobs in July

Too much of a good thing

Here’s the catch: More jobs are a good thing, but too much of a good thing can cause problems. Problems such as higher inflation rates. Boo!!

The Fed’s other mandate is price stability, and from that point of view, the July jobs report was troubling because it showed that the labor market might getting so good that it causes inflation.

“The Fed is taking no chances with a wage-price spiral developing. It’s going to break the cycle by making sure wages don’t get too high. And if that means slowing the economy so much that companies will be laying off workers instead of throwing money at them to stay, so be it. ”

That’s why the Fed didn’t love this strong jobs report and that’s why financial markets expect that the Fed will have to get more aggressive about raising its benchmark interest rate FF00, -0.01% to bring down inflation. The stronger the jobs market is, the tougher the Fed has to fight.

Here’s why: The Fed’s fear is that labor markets are so tight and labor is so scarce that companies are being forced to raise wages to attract and retain the employees they need (this is happening a lot), and that they are being forced to raise their selling prices so they can afford to pay their workers more (this isn’t happening very much).

If it did happen at a lot of companies, a dreaded inflationary wage-price spiral would ensue, with higher wages leading to higher prices all across the economy, which would in turn lead workers to demand even higher wages to keep up with inflation, which would force companies to raise prices again. And so on, in a vicious spiral of never-ending inflation.

No wage-price spiral yet

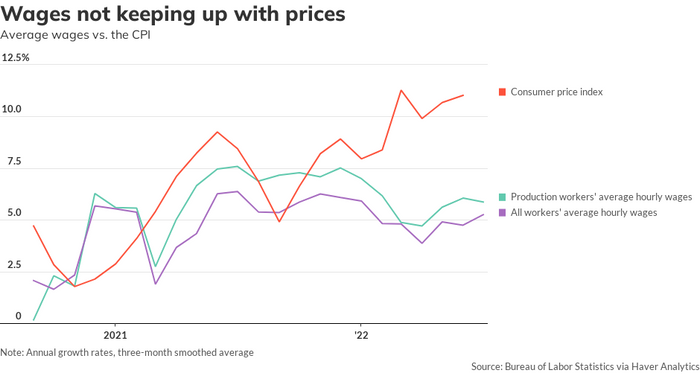

Has the spiral gotten out of control? Not so far. There’s little evidence that higher wages are causing higher prices to a great degree. Most workers’ pay is not keeping up with inflation.

Even after paying higher wages and higher prices for inputs, companies report that their profit margins are still quite high, which means they’ve been pocketing the windfall they get from charging higher prices instead of being forced to hand it over to their workers.

The Fed is ultracautious right now. It got burned in 2021 when it ignored accelerating inflation by thinking it was temporary. So now the Fed is taking no chances with a wage-price spiral developing. It’s going to break the cycle by making sure wages don’t get too high. And if that means slowing the economy so much that companies will be laying off workers instead of throwing money at them to stay, so be it.

What’s the latest evidence on wages? Over the past three months, average wages have risen at a 5.3% annual rate, while average wages for production workers rose at a 5.9% annual rate, the Bureau of Labor Statistics reported Friday.

Wages are growing a bit faster than they were in the spring, but slower than they were for most of 2021. Depending the period you compare them with, you could say wages are accelerating slightly or decelerating a little. That’s the same message the Fed took from the second-quarter employment cost index, which showed compensation costs rising at a 5% annual rate.

(A quick aside: The quarterly ECI has one advantage over the average wage data that are reported in the monthly jobs report: it’s adjusted for the changing composition of workers, which means that it wasn’t fooled into assuming that wages rose by 20%-plus in the spring of 2020 when 22 million lower-earning workers lost their jobs—and everyone else kept theirs—when the pandemic shut the economy down.)

Considering the evidence that wages are rising at a 5% to 6% pace, there’s no reason for Fed policy makers to believe that they’ve done enough to bring the growth rate in wages (or prices) down.

On the other hand, there’s also no reason for the Fed to think higher wages have become the ultimate cause of our inflation problem. Global supply and demand explain inflation quite well enough.

We don’t have any inflation data for July yet, but over the period from April through June, the consumer price index increased at an 11% annual rate, about twice as fast as wages rose. Early expectations are that the CPI moderated in July, but by how much we don’t yet know.

Friday’s jobs report showed that wages are still rising much slower than inflation; workers are still falling behind with every paycheck. That fact ought to be at least a bit reassuring to the Fed, but right now the Fed is in no mood to be reassured by anything but firm evidence that inflation has been broken.

More: There was one red flag in a shockingly strong U.S. jobs report. Or was there?

Rex Nutting is a columnist for MarketWatch who’s been writing about the economy for more than 25 years.

Hear from Ray Dalio at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The hedge-fund pioneer has strong views on where the economy is headed.