Shares RH, the company formerly known as Restoration Hardware, plunged nearly 19 percent Friday morning after it cut its 2019 forecast, suggesting that the company’s new strategy will take longer to pay off than originally expected.

Late Thursday, RH posted its fiscal fourth-quarter results, which were mixed as revenue fell short of expectations.

The high-end retailer has been shifting to position itself as a luxury lifestyle brand and dropped “Hardware” from its name in 2017. In order to create a more welcoming shopping environment it has been opening so-called RH Galleries, which are expansive museum-style stores.

The company’s strategy of initially focusing on experience rather than profit may have contributed to the mixed earnings, while RH also cited the downturn in the high-end housing market, which has weighed on demand for its products.

RH said it will continue to reshape the company and promote it as a high-end lifestyle brand, saying “Leaders have to comfortable making others uncomfortable.”

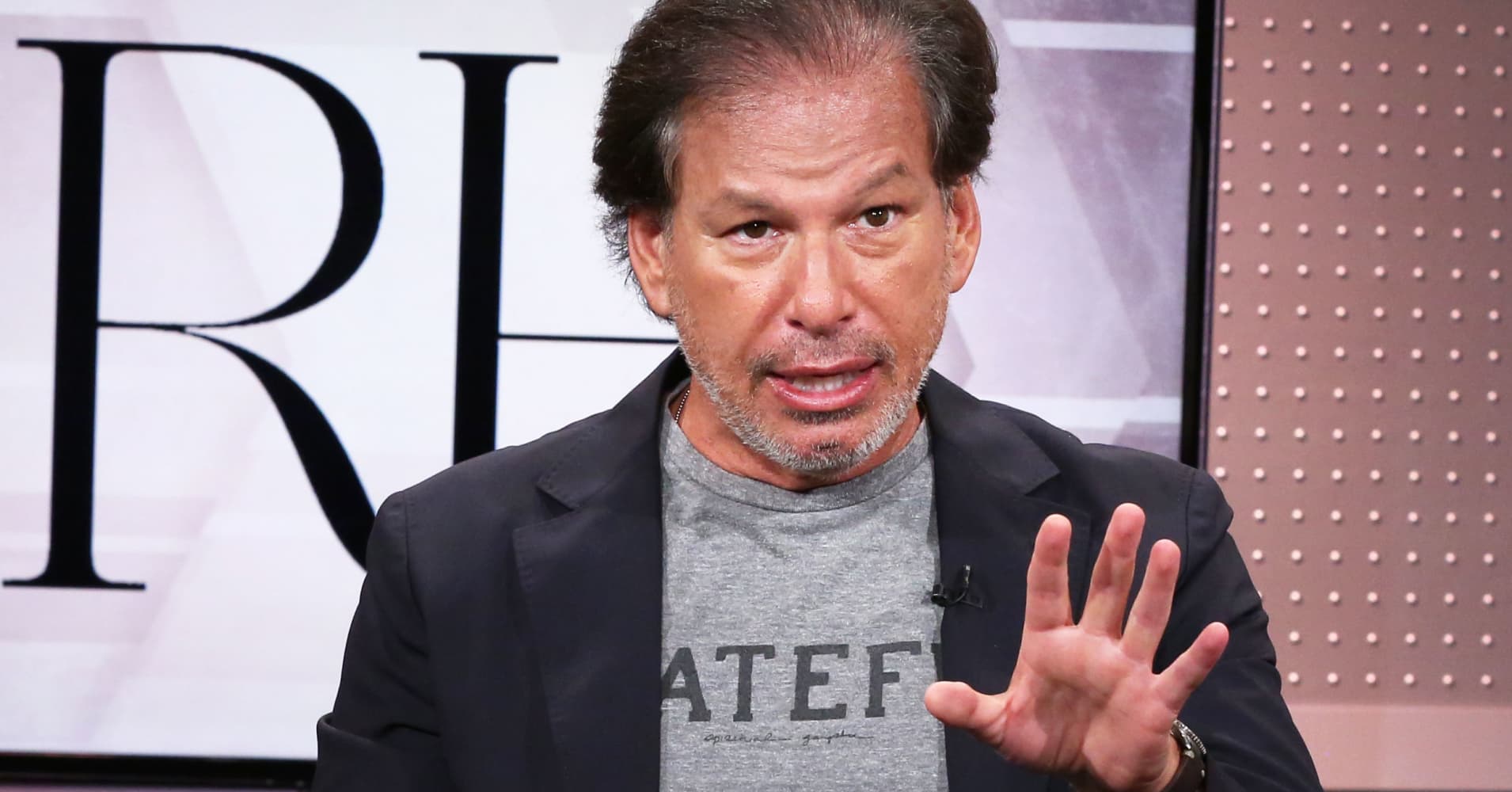

“We also believe, ‘We have to think until it hurts, until we can see what others can’t see, so we can do what others can’t do,'” said RH CEO Gary Friedman in a letter to investors. Instead of moving to a digital-first model, it said, RH will continue to focus on its physical retail locations.

“Speaking of profitability, which is surprisingly absent in the narrative of most retail businesses that are birthed online, we believe what many have overlooked is that the cost of marketing an invisible store is proving to be more expensive than physical experiences,” it said.

RH also noted disappointing fourth-quarter results of Waterworks, the luxury kitchen and bath brand RH acquired in 2016. Its performance forced RH to take additional impairment charges.

“While the acquisition has been financially disappointing, causing a 70 basis point drag to our operating margins, we plan to take aggressive steps to refocus … and still believe in the potential long term synergies and value creation,” it said.

In the latest period, RH net income rose to $36.1 million, or $1.41 per share, from about $261,000 or a penny per share, a year ago. Excluding an impairment charge for Waterworks, RH earned $3 per share, beating Refinitiv estimates of $2.86.

Revenue, however, inched up only slightly to $670.9 million from $670.3 million a year ago, and was below estimates of $686.3 million.

The company now expects 2019 earnings on an adjusted basis to be between $8.41 and $9.08 per share on sales of $2.59 billion to $2.64 billion. Previously, the company expected to earn between $9.30 and $10.70 per share on sales of $2.72 billion to $2.82 billion a year ago.

Deutsche Bank downgraded RH to hold from buy following the earnings report, but other analysts are standing by the retailer. Wells Fargo kept RH as outperform.

Wells Fargo analysts expected shares to open lower on Friday but said, “We believe the headline appears worse than the reality.”

RH shares, which have a market value of $2.3 billion, have gained more than 43 percent over the past year, but are only up 10 percent since January.