(Bloomberg Opinion) — A common finance joke is about how to name a hedge fund or alternative asset manager. Simply pick from the following: A type of tree, a body of water, a stone, a medieval structure, a historical figure or a Greek word. Mash them all together, add “Capital,” “Partners,” “Management” or “Advisers” at the end, and you’re all set.

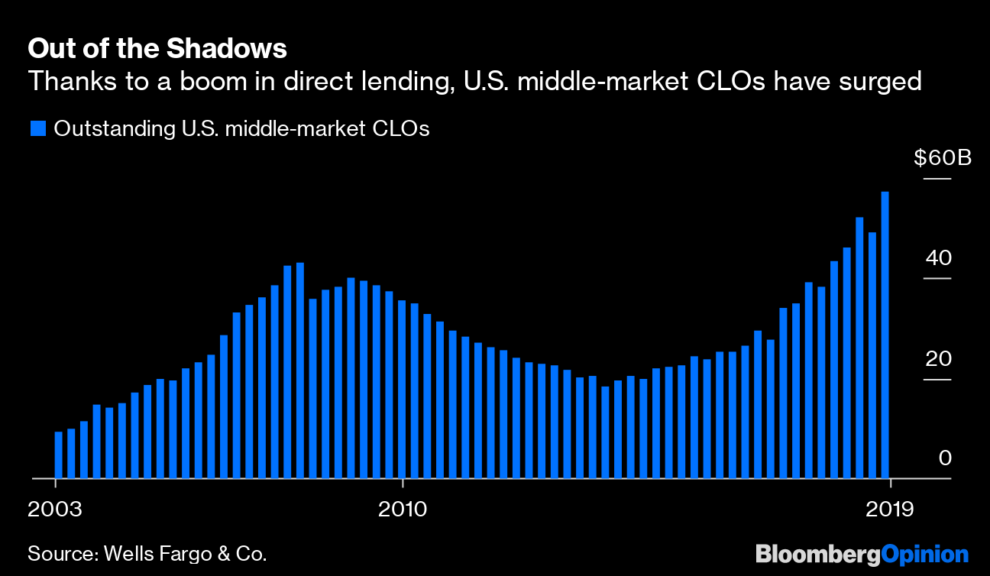

I was reminded of this after seeing some of the biggest firms involved in risky corners of the debt markets, both lenders and investors alike. Bloomberg News’s Lisa Lee reported this week about the burgeoning market for middle-market collateralized loan obligations, which are packed with private loans made to highly leveraged mid-sized companies that banks don’t care to lend to. Two weeks earlier, Bloomberg’s Davide Scigliuzzo highlighted how private equity firms were using “recurring revenue loans” to finance buyouts of businesses that are far from profitable.

For the unfamiliar, it’s easy to get lost in this world. And that’s in no small part because of the firm names tossed around. In recurring revenue loans, according to Scigliuzzo’s reporting, there’s Vista Equity Partners, Thoma Bravo, Warburg Pincus and Marlin Equity Partners doing the buyouts of younger companies, and direct lenders like Ares Management Corp., Golub Capital, Monroe Capital and Owl Rock Capital Partners financing the loans.

Owl Rock, in turn, priced its first middle-market CLO earlier this year, at a size almost $200 million more than it initially expected. It’s currently marketing another CLO, with pricing expected sometime this month. Golub Capital and Monroe Capital also issued such CLOs, though it’s unclear if recurring revenue loans are packaged into these deals. That opacity is a risk, along with the fact that the secondary market for middle-market CLOs is scant.

It’s hard for a typical investor to get interested in those names, as opposed to companies like Tesla or Facebook or General Electric. Plus, at first glance, none of what they’re doing seems overly troublesome. In this era of ultra-low interest rates, it should come as no surprise that the search for returns has led to this sort of behavior. It might seem as if those at risk are merely the aggressive buyout firms and direct lenders.

Of course, it’s not that simple. These sorts of products have a tendency to ultimately affect average investors, one way or another.

Take business development companies, for example. Ares Capital Corp. is publicly traded (ticker ARCC), meaning anyone with an online brokerage account can buy or sell shares. Its business is to pick winners among U.S. middle-market companies. It was up 23% this year as of mid-September, but has since slumped along with other risk assets. Poor performance among BDCs tends to hurt shareholders more than the managers themselves, as the managers’ fees are generally related to the size of their holdings. And the biggest public shareholders in Ares Capital might ring a bell: Morgan Stanley, Wells Fargo & Co. and Bank of America Corp. all rank in the top 10, according to data compiled by Bloomberg data.

Shares of Owl Rock’s BDC (ticker ORCC) began trading in July at $16.13, and closed Thursday at $15.95. Barron’s called it “one of the most closely watched new funds” in alternative investing, in part because its founders came from high-profile positions at Blackstone Group’s credit hedge fund GSO Capital Partners, Goldman Sachs Group Inc. and KKR & Co. The two biggest public owners are the Regents of the University of California and New Jersey’s pension funds, Bloomberg data show.

But that’s just one way a pension fund can get involved in this sort of direct lending. The Canada Pension Plan Investment Board, with $400 billion in assets under management, acquired Antares Capital in 2015. Antares is one of the largest middle-market lenders, with $26 billion of assets. Arguably, an investing behemoth with a long-term time horizon is exactly who should be buying middle-market loans.

But that’s not where the story ends. Antares Capital, like other firms, has packaged loans into middle-market CLOs. It priced a $505 million CLO in April, along with two offerings of more than $1 billion each last year. The various tranches, including the ones that barely have investment-grade ratings, are at least partly in the hands of life insurance companies. Antares and other CLO managers do have to keep a portion of the securities, under a policy known as risk retention. Still, it’s another way that this growth is permeating throughout the financial system. Even the Church of England’s pension board now favors loans to small- and medium-sized companies.

All this is to say, investors shouldn’t just shrug off the explosive growth in direct lending and the push to get a slice of above-market returns. Middle-market CLOs now total $57 billion, almost triple the level of six years ago. It seems like only a matter of time before closed-end funds pop up that invest in these CLOs (if they haven’t already), given that they can sometimes offer 200 basis points more than typical structures. And then, those funds might be suggested to mom-and-pop type investors in search of double-digit yields. Some of the bundles might contain recurring revenue loans. It’s how the cycle goes.

As it stands now, the opaque and illiquid market for direct lending probably isn’t big enough to be the single flash point if the credit cycle turns and these companies flounder. But it is widespread enough to cause a lot of people at least some pain. Just because many of the main players sound like they’re straight out of a name generator doesn’t mean Main Street is entirely off the hook.

To contact the author of this story: Brian Chappatta at [email protected]

To contact the editor responsible for this story: Beth Williams at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”64″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment