There’s a rumor going round stipulating Netflix (NFLX) might be considering bringing Roku (ROKU) under its wing. Recall, the two have much shared history, with Roku actually starting out as part of Netflix before CEO Anthony Wood’s project was spun off back in 2008.

Netflix’ apparent renewed interest comes at a time when it is mulling over finally adding an ad-driven tier to its service, an act it has constantly refused to consider during its history. However, the lack of new sub growth has now forced its hand.

So far, a rumor is all it is, but even if Netflix ultimately does not make a lunge for its fellow streaming giant, Needham analyst Laura Martin thinks Roku still stands to benefit from adding advertising to Netflix’s service. Why?

For one, advertising revenue depends on “maximum reach,” and with Roku installed on 61 million devices across the globe, it is a “must have” for Netflix. Therefore, unless it signs an advertising rev-share contract with Roku, it won’t be seen on Roku devices.

The next reason revolves around “awareness.” To make consumers aware of its new ad-driven, lower priced tier, it needs to get on Roku’s “large home page ad unit” (as well as on Vizio’s, Samsung’s, and others). Since each Roku viewer is essentially a streaming consumer, its audience has “zero waste for streaming companies.”

Next, just like Disney – which is also adding an ad-driven tier and uses Roku’s home page to build awareness regarding new content – Martin expects Netflix’ content marketing to utilize the same tactic. “As streaming matures and the fight for new customers intensifies, NFLX must buy more Roku ad units to tell the largest base of streaming customers what new content is coming to NFLX and why they should watch it,” Martin explained.

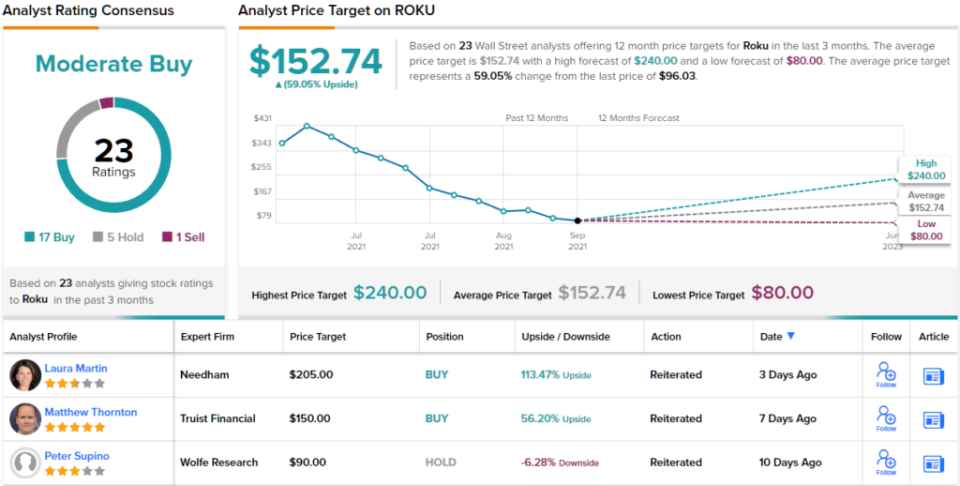

So, down to business, what does it all mean for investors? Martin reiterated a Buy rating on ROKU shares, while her $205 price target makes room for 12-month gains of a considerable 113%. (To watch Martin’s track record, click here)

Martin is currently Wall Street’s most prominent ROKU bull, but by no means the only one – the analysts’ $152.26 average target implies shares will appreciate to the tune of 76% in the coming year. Overall, the stock’s Moderate Buy consensus rating is based on 17 Buys, 5 Holds and 1 Sell. (See Roku stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.