Salesforce(NYSE:CRM) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include strong Q2 revenue growth and advancements in AI, juxtaposed against concerns over valuation and geographic performance variability. In the discussion that follows, we will explore Salesforce’s core strengths, critical weaknesses, growth opportunities, and key threats to provide a comprehensive overview of the company’s current business situation.

Click to explore a detailed breakdown of our findings on Salesforce.

Strengths: Core Advantages Driving Sustained Success For Salesforce

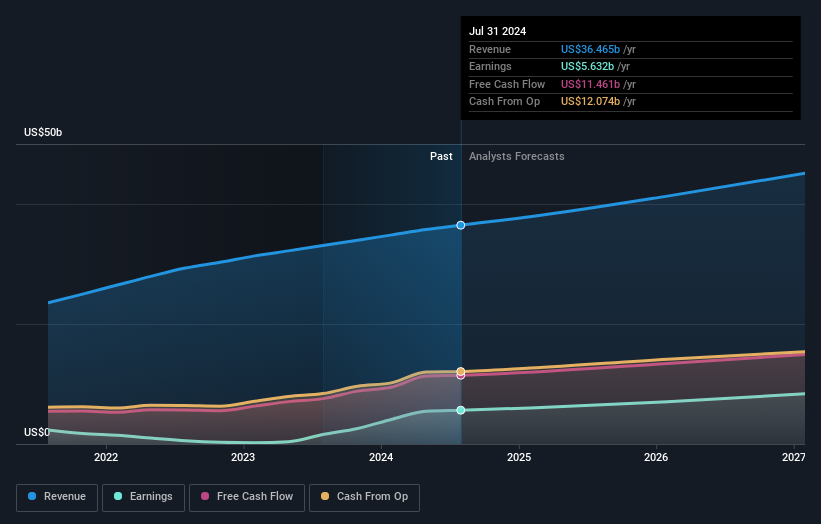

Salesforce has demonstrated strong revenue growth, delivering $9.33 billion in Q2, up 8% year-over-year in nominal terms and 9% in constant currency, as highlighted by Marc Benioff, Chair and CEO. The company’s market leadership is evident, being ranked the #1 CRM provider by IDC Software Tracker for the 11th consecutive year. Salesforce’s innovation in AI, particularly with Agentforce, is a significant strength, with high customer satisfaction scores and strong performance across revenue, cash flow, and margins. The non-GAAP operating margin of 33.7%, up 210 basis points year-over-year, underscores its financial health. Furthermore, Salesforce’s valuation reflects a mixed outlook, being considered expensive compared to the industry average but good value compared to its peers, with a current share price trading below the estimated fair value.

Weaknesses: Critical Issues Affecting Salesforce’s Performance and Areas For Growth

Salesforce faces several weaknesses. The company’s Price-To-Earnings Ratio of 45.2x is higher than the US Software industry average of 39x, indicating a potentially overvalued stock. Geographic performance variability is another concern, with constraints in the U.S. and parts of EMEA, as noted by Amy Weaver, President and CFO. Additionally, Salesforce’s dependence on license revenue poses a risk, with expected deceleration in license revenue growth in the latter half of the year. The company’s Return on Equity (ROE) is forecasted to be low at 17.1% in three years, suggesting room for improvement in profitability metrics.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Salesforce has several opportunities to leverage for growth. The integration of AI, particularly through partnerships with NVIDIA and the expansion of Agentforce, offers significant potential. The number of paid Data Cloud customers grew 130% year-over-year, with customers spending more than $1 million annually doubling, as highlighted by Amy Weaver. International expansion and industry-specific solutions also present avenues for growth, with strong momentum in the industries business and the ability to help customers save time and money. These strategies can enhance Salesforce’s market position and capitalize on emerging opportunities in AI and data cloud services.

Threats: Key Risks and Challenges That Could Impact Salesforce’s Success

Salesforce faces several threats that could impact its success. Competition in AI is intense, with customers appreciating the power of generative AI but also facing misconceptions about its value, as noted by Marc Benioff. Economic factors, particularly a measured buying environment, have impacted Salesforce’s largest business segments, as mentioned by Brian Millham, President and COO. Additionally, customer misconceptions about AI investments pose a risk, with significant amounts of money potentially wasted on ineffective AI solutions. These external factors threaten Salesforce’s growth and market share, necessitating strategic responses to mitigate these risks.

Conclusion

Salesforce’s sustained revenue growth and market leadership in CRM, coupled with its innovative advancements in AI, particularly with Agentforce, position the company strongly for future success. However, its high Price-To-Earnings Ratio and geographic performance variability highlight areas needing strategic attention. Opportunities in AI integration and international expansion present significant growth potential, but the company must navigate competitive and economic challenges effectively. The current share price, trading below the estimated fair value, suggests that while Salesforce may appear expensive relative to the industry average, it offers good value compared to its peers, indicating a balanced outlook for investors considering its strengths and inherent risks.

Make It Happen

Got skin in the game with Salesforce? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes. Discover a world of investment opportunities with Simply Wall St’s free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.