(Bloomberg) — Samsung Electronics Co.’s second-quarter profit missed analyst estimates on cooling demand for consumer gadgets, along with the chips and displays they use.

Most Read from Bloomberg

Net income rose to 10.95 trillion won ($8.3 billion) in the three months ended June, South Korea’s largest company said in a statement on Thursday. Analysts on average projected net income of 11.2 trillion won, according to estimates compiled by Bloomberg.

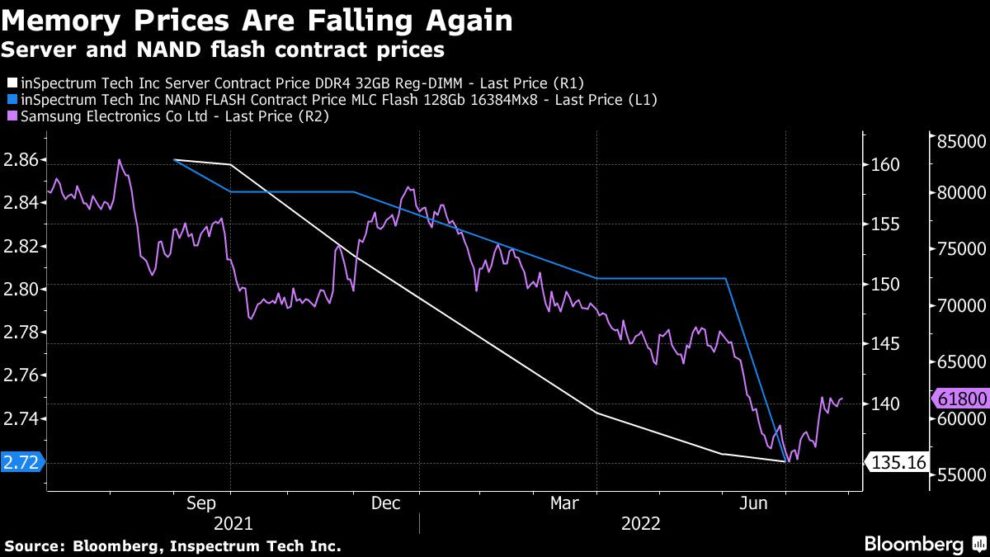

The world’s largest producer of memory chips, smartphones and displays has been navigating rising uncertainties in the global economy as fears over a potential recession prompt customers to cut spending on gadgets and electronics. Memory chip prices have fallen and could drop further in the current quarter if clients delay purchases on sluggish demand.

What Bloomberg Intelligence Says

“DRAM contract prices started dropping slightly from April sequentially, stayed flat in May and ended June slightly lower. Monthly DRAM exports have been steady at about $3.5 billion from July 2021, suggesting the rate of growth may shrink further from July this year.”

– Masahiro Wakasugi, BI analyst

Click here for the full research.

Chip sales are growing much more slowly than expected and will begin to decline in 2023, Gartner Inc. said in a report, marking an end to one of the sector’s biggest boom cycles.

“The global semiconductor market is entering a period of weakness, which will persist through 2023 when semiconductor revenue is projected to decline 2.5%,” Richard Gordon, a Gartner analyst, said in the report. PC shipments will contract 13% in 2022 after two years of growth, Gartner predicts, while smartphone sales will rise just 3.1% this year after surging almost 25% in 2021.

Apple Inc., Amazon.com Inc. and Microsoft Corp., which are all major buyers of chips, are reining in budgets for next year and, in turn, denting chipmakers’ capacity expansion plans, adding to the tepid consumer demand.

Samsung’s rival SK Hynix Inc. said during an earnings call on Wednesday that it revised down its chip shipment growth for the current quarter and added it’d significantly adjust its capex for next year due to a high level of inventories throughout the market. In contrast, Texas Instruments Inc., which has a wider range of chip products, gave a bullish outlook for the current quarter as it sees demand recovery after lockdowns in China hit sales.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.