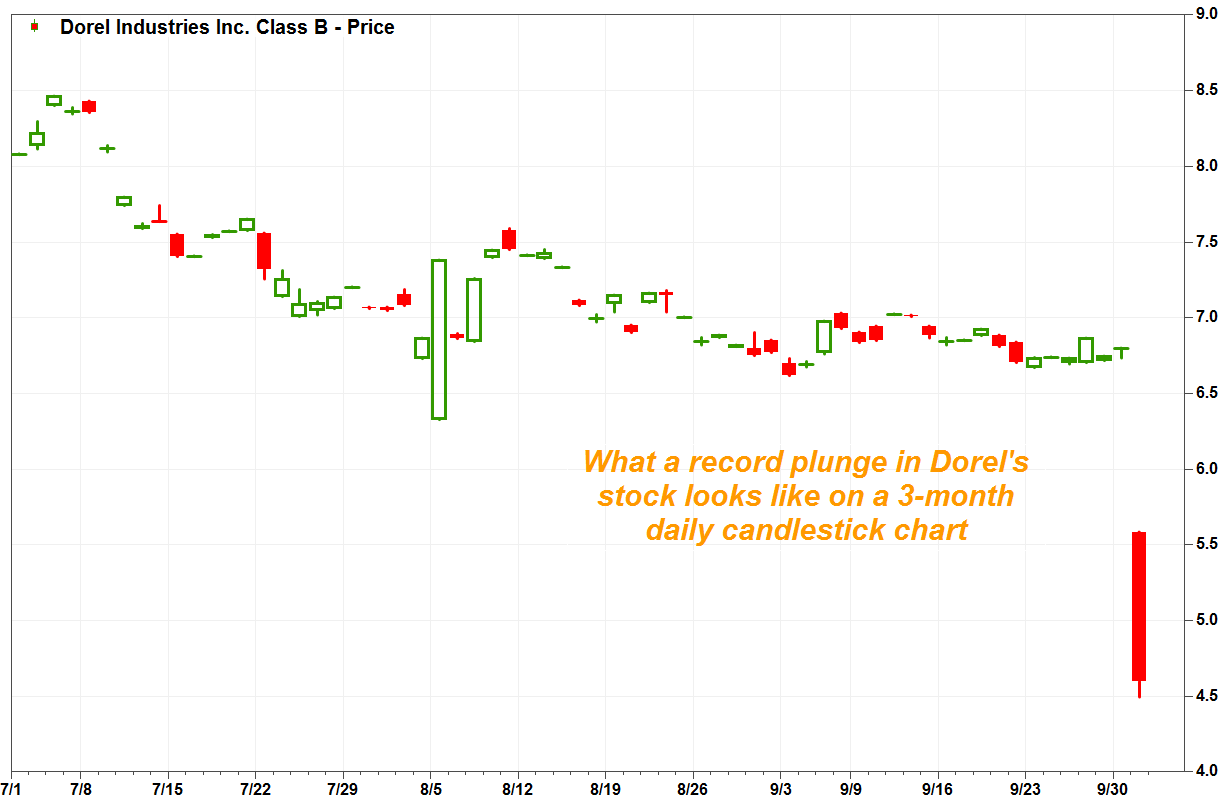

Shares of Schwinn-parent Dorel Industries Inc. were suffering a record plunge Tuesday after the company said it would stop paying its relatively high dividend to investors, blaming “chaotic market conditions” created by tariffs resulting from the U.S.-China trade war.

The Canada-based bicycle, juvenile and home products company DII.B, -32.01%, which brands also include Cannondale, Mongoose and Bébé Confort, said the previously declared quarterly dividend of 15 cents a share to be paid out on Oct. 2 will not be affected.

The U.S.-listed stock DIIBF, -30.99% plummeted 31% to a record low of $4.69. That was by far the biggest one-day decline since it went public in May 1998, breaking the previous record selloff of 19.5% on Oct. 2, 2000.

Dorel’s annual dividend rate was a relatively high 60 cents a share, which based on Monday’s stock closing price of $6.80 for the U.S.-listed shares, implied a dividend yield of 8.82%. That compares with the implied yield for the S&P 500 index SPX, -1.23% of 2.00%, according to FactSet.

“It is prudent to suspend the dividend until the chaotic market conditions created by tariffs are normalized,” said Chief Executive Martin Schwartz.

FactSet, MarketWatch

FactSet, MarketWatch What may have also spooked investors, is that Dorel said it amended its revolving credit facilities and term loan, to “facilitate compliance” with its financial covenants under facilities.

Dealing with tariffs had ‘several negative consequences’

Dorel said the second round of tariffs on Chinese imports announced in May, which raised the tariffs on bicycles, furniture and other sourced goods to 25%, had a “much greater impact” on its business than the original 10% tariff.

Don’t miss: China’s trade with U.S. tumbles as tariff war escalates.

Also read: U.S. wants to make progress in solving China trade dispute: Mnuchin.

FactSet, MarketWatch

FactSet, MarketWatch The company raised prices on its products midway through the third quarter in an effort to mitigate the financial impact, but that had “several negative consequences” on its businesses:

• Not all competitors or retailers raised prices at the same time, which disrupted the retail marketplace.

• Retailers changed their buying routines from suppliers.

• New price points caused some consumers to opt for different items, creating a “considerable” product mix imbalance.

• Elevated warehousing costs are being incurred, as the shift in demand has delayed the company’s inventory balancing program.

• Large U.S. customers have delayed Christmas 2019 deliveries to the beginning of the fourth quarter.

• Gross margins in its mass merchant business have fallen, as although sales remained strong, the sales mix has been negative.

“The net result of these challenges is that Dorel Home’s expected gross margin improvement from first-half levels will be delayed to the beginning of 2020,” Schwartz said.

It wasn’t all about tariffs and trade, however. Dorel said the strengthening of the U.S. dollar relative to other currencies hurt its sports and juvenile segments. The ICE U.S. Dollar Index DXY, +0.13% slipped 0.3% on Tuesday, after closing Monday at the highest level since May 2017. Read more in the Currencies column.

Dollar strength can help reduce costs of imports, but it can also make U.S. products more expensive to overseas customers. Dorel said the financial results of the businesses affected by dollar strength fell between 3% and 8%.

Add Comment