Bloomberg News/Landov

Bloomberg News/Landov

Keller Williams, the sprawling national real estate franchisor, plans to launch an instant offer service later this year, another indication of the future path of residential real estate transactions. The embrace of a technology-driven approach to buying and selling by the brokerage most keenly associated with real estate agents points more to the increasingly blurred lines between the two approaches than to an affirmation of one over the other.

In May, Keller Williams will launch Keller Offers, a company spokesman confirmed to MarketWatch. The real estate industry has long expected such a step from the company, and founder Gary Keller teased it in a closely-watched public appearance last year, but this is the first time it has been officially reported.

Keller Offers will initially launch in the Dallas/Fort Worth market, and expand to six to eight “major” markets by the end of 2019, it said. The company plans to spend $100 million on instant offers in 2019, and noted, “We see iBuying as an important additional offering for our agents to offer to home sellers.”

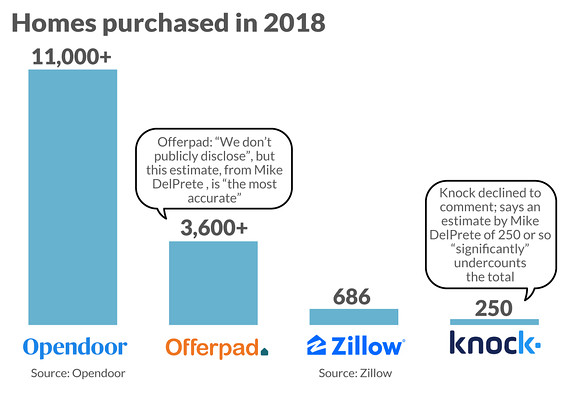

That announcement comes just days after the leading pure-play iBuyer, Opendoor, announced a new initiative it calls the Opendoor Agent Partner Program. Taken together, the steps show the big players of an industry in flux experimenting with ways of being all things to all consumers.

“We’re looking to partner with highly-rated, trusted agents who we can pair with home buyers and sellers when it is the customer’s best option,” the company said. “To start, when someone requests an offer on their home from Opendoor but it’s outside of our buy criteria, our brokerage will refer them to one of our Agent Partners. Not only will this give homeowners peace of mind knowing they are in good hands, but it will provide a new way for agents to build their businesses with high-intent, high-converting buyers and sellers.”

That was precisely the path taken by Zillow Z, -1.89% ZG, -2.01% when it initially launched its iBuying program, Homes. “If you’re thinking about Zillow doing ibuying and you’re not thinking about seller leads, you’re thinking about it the wrong way,” Mike DelPrete, one of the leading independent analysts of the iBuying space, told MarketWatch last November.

See: Zillow reports a bruising quarter, but housing-watchers think the company rules the roost

But Opendoor’s pivot comes just two months after Zillow announced plans to double down on iBuying for its own sake, not just as a lead generation machine.

DelPrete and many other observers think instant offers are likely to become the new first step for any homeowner considering selling.

“It’s like the new Zestimate,” DelPrete said. “That’s why Zillow had to go into this game. For the past decade Zillow has been waiting for an opportunity to really disrupt real estate. Their traditional model was media. That’s not disruptive. They were just waiting, waiting, waiting. Then Opendoor and the other iBuyers came and it was like, here we go, this is the best thing we’ve seen. It’s risky and it’s going to take huge investment but given the situation, our core business is slowing down and if 20% of sellers are getting an instant offer, shoot, we have to do this. In typical Zillow fashion they’re all in.”

Zillow may be all in on iBuying, but they’re hardly out of the older business lines.

“With the consumer as our North Star, the investment in Zillow Offers complements our commitment to our Premier Agents,” CEO Rich Barton said on an earnings call last quarter. “We know most sellers would likely not choose to sell their house directly to us via Zillow Offers, yet it’s our mission to get everyone seamlessly into a place they love and can afford. Our partner premier agents are not only necessary in fulfillment of this mission, they’re fundamental.”

For the upstart iBuyers, the goal is a lot more focused, for now. Agents may play a role, but “the vision is to make it simple and instant to buy and sell your home,” said Dod Frasier, Opendoor’s vice president of capital markets. “When you look at the process today, it’s filled with uncertainty and pain points, and all these different people who have to get coordinated. We make it a few simple clicks. Our goal is to give you a fair value for your home.”

See: Meet the tech-savvy upstarts who think they can finally give Realtors a run for their money

As a spokeswoman for Offerpad, a smaller competitor to Opendoor, put it, “One of the biggest misconceptions about companies like us is ‘they’ll lowball you.’ But if we can’t provide strong offers, we can’t stay in business. Consumers are too educated. Why do people choose us? Certainty and convenience.”

One of the other big misconceptions about iBuyers, the companies say, is that they’re the 21st-century version of “We Buy Ugly Houses.” Offerpad’s spokeswoman is adamant that the company isn’t playing in that space, even though one of their biggest distinguishing factors is a co-founder who also helped start up Invitation Homes INVH, +0.95% , the Blackstone BX, +7.49% venture that snatched up thousands of houses, many distressed, and transitioned them into a massive single-family rental portfolio.

For his part, Frasier sees iBuyers as a sort of housing market stabilizer. He thinks they follow in the footsteps of companies that once disrupted the used-car marketplace, like Carmax KMX, -0.54% and Carvana CVNA, -0.35% . Those companies buy consumers’ used cars, sell different products and services, such as warranties, and “were more profitable through the crisis because they were able to be an institutional support and liquidity provider,” Frasier said. “The reason I think our business model is long-term more scalable is that houses appreciate in value, whereas with autos, they depreciate.”

Opendoor and Offerpad both charge seller fees of about 7%, in contrast to the average of 5.0% charged by real estate agents, according to industry source REAL Trends.

Even if the lines of demarcation between the pure-play iBuyers and companies that once mostly catered to real estate agents are becoming increasingly hazy, one small startup has its own niche – although it, too, hearkens back to an old, unsexy real estate work-around. Knock is the online disruptor version of a bridge loan for people who are ready to move up, but need to rely on the equity in an existing home for a down payment.

Knock co-founder and Sean Black argues that, whatever the iBuyers say, they have to offer a “lowball” offer to make their model work. In contrast, Knock’s approach gives it a different incentive. Rather than being stuck with a home it buys from a customer, the company advances homeowners cash to purchase a new one, then sells the existing property on their behalf once the homeowners are settled in the new home. Knock charges a 6% seller fee.

Read: As the housing market stagnates, American homeowners are staying put for the longest stretches ever

“The traditional guys are all exactly the same,” Black said. “They all provide none of what we provide. It’s hard for me to believe that the experience we provide, because we own the entire solution, it’s hard for me to fathom that an individual agent who’s a 1099 contractor could compete with that. This generation is about on-demand convenience.”

One admittedly unscientific way of gauging how seriously any real estate industry player is taking iBuying may be the way he forecasts its reach in the future. “On the whole, Keller Williams believes the addressable market for iBuyers represents less than 10 percent of the overall housing market,” the company said in the release it shared with MarketWatch. Zillow’s ambitious goal, announced in its last earnings release, to buy 5,000 homes per month, would give it total market share of only about 1%.

When asked if instant offers would gain nearly all the market share in the future, Opendoor’s Frasier laughed and said “no. Real estate is a big market. But we are a great option for a subset of customers.”

“In ten years, it’s likely that most people will be buying and selling homes to and from companies, not individuals. Those companies will look a lot like ours and it will be less expensive than it is today,” Knock’s Black said.

Meanwhile, Mike DelPrete, the independent analyst, thinks we’ve already seen the future of the nationwide housing market, and it is Phoenix. Opendoor has been operating there for years, and Offerpad is headquartered there. Phoenix, DelPrete thinks, is “the best market” for iBuyers. And right now they command just 6% of sales there.

“How many consumers are going to want to see an instant offer alongside a market offer?” DelPrete said. “Really, why wouldn’t you?”

See: Redfin CEO: Technology is finally ready to change how you buy and sell your house