Nvidia’s competitive advantages may weaken due to this one issue.

When it comes to manufacturing artificial intelligence (AI) chips, Nvidia (NVDA 0.80%) has a heavy lead on the competition. According to most estimates, the company has an 80% to 95% market share for AI graphics processing units (GPUs).

However, with the company’s shares trading at 36 times sales, Nvidia’s stock price will be very sensitive to competitive pressures. And according to one metric, those competitive pressures could arrive sooner than expected.

Nvidia could be underspending in this key area

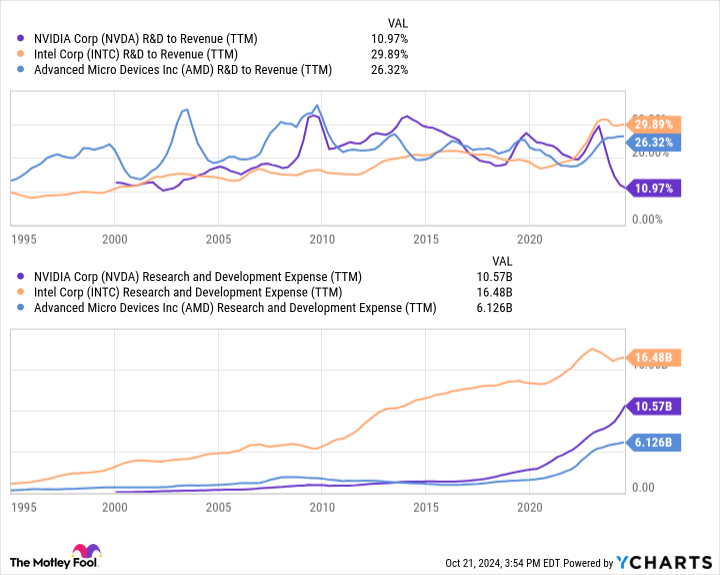

When it comes to cutting-edge AI stocks like Nvidia, monitoring research and development (R&D) spending is a must. Research and development expenses help investors gauge how much a company is investing in innovation. Often, these expenses won’t see a payoff for years, but ignoring this critical area of investment can prevent a business from maintaining its competitive advantages over the long term.

Right now, there’s no doubt that Nvidia has a huge competitive advantage when it comes to AI GPUs. The company is generating gross margins of around 75%, while competitors, including Intel and AMD, are only managing gross margins between 40% and 50% — a strong sign of Nvidia’s pricing power.

Nvidia isn’t trading higher prices for lower volumes, either. Nearly every market estimate pegs the company with a controlling market share for AI GPUs.

There’s just one problem: Nvidia appears to be underinvesting in research and development just as its lead in AI GPUs grows to dominant proportions. Intel is spending billions more per year in research and development, despite having a 95% smaller market cap. Even AMD has a higher research and development spend as a percentage of its revenue.

I’m worried Nvidia is sacrificing future growth by not spending more on research and development.

NVDA R&D to Revenue (TTM) data by YCharts.

How to invest in AI stocks like Nvidia

Here’s the basic truth of investing in chip stocks like Nvidia: This industry is very cyclical. In 2022, the valuations of nearly every chipmaker — Nvidia included — fell by double digits, even as volumes continued to rise on a long-term basis. Then in 2023, the industry’s valuation soared across the board.

However, in 2024, something interesting happened. Nvidia’s share price continued to skyrocket, while AMD’s valuation remained flat and Intel actually lost around one-third of its value.

The past few years aren’t atypical. Each year in the semiconductor space brings new challenges and opportunities, with valuations and market shares shifting dramatically with new innovations and growth categories. But there’s no doubt what the biggest growth driver over the next decade or more will be: AI.

Right now, Nvidia’s GPUs are the go-to option for nearly every AI developer — so much so that businesses are willing to pay significantly more for Nvidia chips than they are for competing options. That’s great news for Nvidia, considering it’s experiencing rising volumes and rising pricing power just as AI infrastructure spending takes off.

But as with previous chip wars, competition is strengthening. Intel is investing billions into its Gaudi 3 and Falcon Shores chips, which recently showed comparable performance to Nvidia’s H100 models. And AMD’s MI325X chip, launching later this year, can handle most AI applications under development today. Meanwhile, a host of private start-ups, like Cerebras and SambaNova, are taking unique approaches to AI GPUs that could eventually render Nvidia’s current approach obsolete.

While Nvidia’s lead and pricing power won’t disappear overnight, rising competitive pressures — and the R&D spending of rivals — lead me to one simple investment strategy: Don’t put all of your eggs in one basket. Most investors betting on Nvidia today are betting on the rise of AI spending, not necessarily on Nvidia’s long-term ability to retain its competitive advantages.

If that includes you, don’t be afraid to allocate some of your capital to out-of-favor chip stocks, like Intel and AMD, which are spending billions to support future launches that may still be years away. Even if 90% of your AI investment is focused on Nvidia, diversifying your portfolio with other chipmakers ensures that no matter where the competitive winds shift, you’ll be in a position to profit from rising AI demand, one of the biggest growth opportunities so far this century.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.