Amazon’s stock is back to trading around all-time highs.

As hot as the markets have been this year, some tech stocks have been doing even better. Online retail giant Amazon (AMZN -1.61%) is up 19% this year, outperforming the S&P 500, which has risen by 11%. Investors are bullish on Amazon again but it wasn’t that long ago that the stock was nosediving, when its shares crashed by nearly 50% in 2022.

Part of the problem then was that amid shaky economic conditions, Amazon’s elevated price made it vulnerable to a steep sell-off. Well, Amazon’s stock’s is now trading at even higher levels than where it was at the start of 2022. With the business slowing and Amazon not being the growth machine it has been in the past, is the prudent move for investors to step away from the stock and wait for it to come down in price? Or should you invest in Amazon anyway?

Amazon’s growth isn’t what it used to be

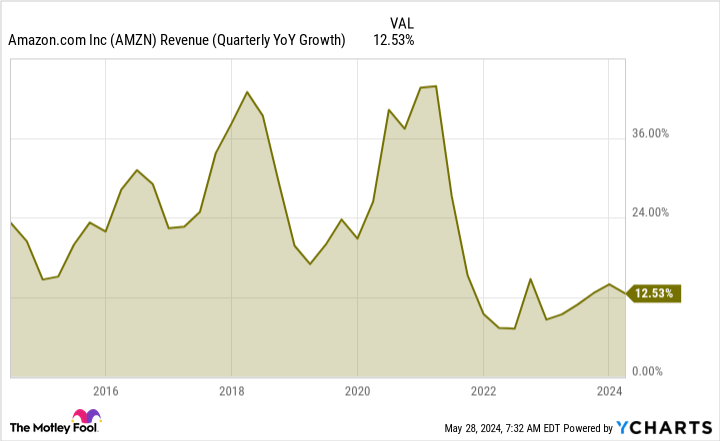

Amazon’s business is continuing to grow, just not at such a fast pace anymore. During the first three months of the year, the company reported $143.3 billion in revenue, which was 13% more than in the same quarter least year. Even its once fast-growing cloud business, Amazon Web Services, reported relatively modest 17% growth during the period.

When you consider Amazon’s growth rate in the past, these numbers aren’t terribly impressive. And Amazon expects its growth rate to slow even further — to between 7% and 11% for the current quarter.

AMZN Revenue (Quarterly YoY Growth) data by YCharts

There is the potential in the long run for Amazon’s growth rate to improve, especially due to artificial intelligence (AI). One example is the company’s plan to upgrade its Alexa voice assistant and enhance it with generative AI features. Amazon will charge a subscription fee for the upgraded assistant, which has the potential to be a new source of revenue growth for the business. But it will be difficult to move the needle much given how significantly large the tech company’s top line already is.

Although it’s great to see that Amazon’s business is growing and looking for new opportunities amid some challenging economic conditions, the days of double-digit growth may no longer be the norm. And if the business has slowed, then it’s arguably not worth as high of a premium anymore.

Amazon’s stock is trading at more than 50 times earnings

It hasn’t been uncommon in the past for growth investors to pay a high premium for Amazon’s stock. But at 50 times trailing earnings, it may be more difficult to justify such a high price for a business that may only be growing in single digits moving forward.

Compared to the average tech stock in the Technology Select Sector SPDR Fund, which trades at 35 times its trailing earnings, it’s hard to make the case that Amazon’s stock provides investors with good value right now.

Even if you are to consider the future growth that analysts are estimating, the stock is trading at a price-to-earnings-growth, or PEG, of around 2, which is nowhere near the cutoff of what a cheap price for a growth stock is — a PEG of 1.

Should you wait to buy Amazon stock?

Amazon has a solid business, but with the stock trading at such elevated levels and the business growing at a fairly modest rate, that puts investors at risk. The stock could again be vulnerable to a sell-off if economic conditions worsen in the near future, so there isn’t much, if any, margin of safety with the stock at its current valuation.

Even if you’re bullish on Amazon’s stock in the long run, there may be better growth stocks to consider buying today. The risk is that at these levels, you would already be paying for a lot of future growth, and that can make generating a strong return from the stock much less likely. While Amazon has a good business, unless you’re prepared to hang on for 10+ years, you may be better off holding off on buying the stock until its valuation comes down significantly, to perhaps a multiple of 40 times earnings or less.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.