Warren Buffett’s Berkshire Hathaway has a significant stake in the oil and gas company.

Occidental Petroleum (OXY -0.12%) has struggled over the past several months, and the stock is down 28% from its 52-week high (set in April). The company’s significant upstream operations make it susceptible to fluctuations in oil prices, and the recent downward trend in crude-oil prices affected its performance.

Despite these challenges, Warren Buffett continues to increase his company’s stake in Occidental. Over the past year, Berkshire Hathaway has acquired an additional 31 million shares, bringing its total shares owned to 255 million, making it the company’s sixth-largest holding at the end of Q2.

Buffett showed confidence in Occidental, but is it right for you? Let’s dive into the business to find out.

Berkshire Hathaway’s huge stake in Occidental

Over several years, Berkshire Hathaway has become one of Occidental’s largest shareholders. At the end of the second quarter, Berkshire held over one-quarter of Occidental’s outstanding shares, which shows Buffett and his team’s belief in the energy company.

Berkshire first got involved with Occidental when it acquired Anadarko in 2019 for $38 billion and assumed its debt. It was one of the largest oil and gas acquisitions ever. As part of the deal, Berkshire Hathaway provided $10 billion in return for preferred stock, earning it an 8% dividend yield.

It also received stock warrants to purchase shares of Occidental. As of June 2024, Berkshire holds warrants to 83.9 million common shares of Occidental Petroleum at an exercise price of $59.62 per share. Today, Occidental trades at a discount to those stock warrants, due to recent weakness in oil prices.

The cyclical business rides the ups and downs

Occidental operates in the cyclical oil and gas industry. The company is heavily focused on upstream operations, exploring and producing oil and gas, making it even more sensitive to oil price changes. This sensitivity can be good when oil prices are rising, as they did throughout 2022 following Russia’s invasion of Ukraine.

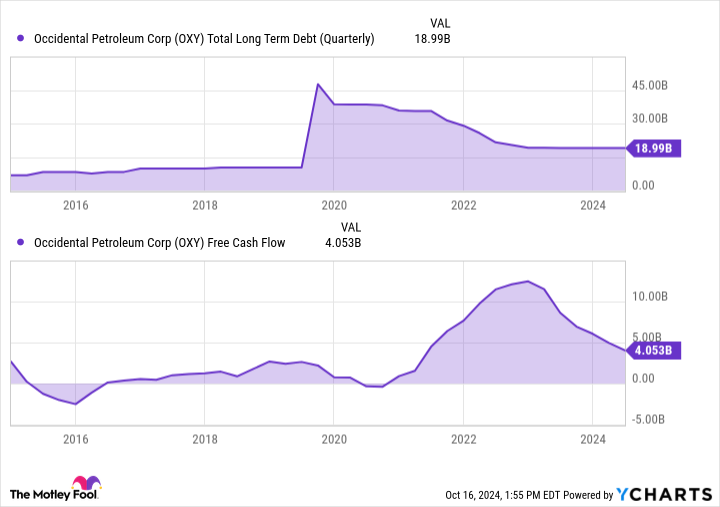

That year, Occidental made significant profits. It used its windfall to pay down $10 billion in debt and reduce interest and finance charges by $400 million annually. Last year, it redeemed 15% of Berkshire’s preferred stock, saving it another $120 million in annual preferred dividends.

The company continued to shore up its financial position this year, reducing its debt by $3 billion through the third quarter as part of its $4.5 billion debt-reduction plan. Its debt has been reduced by 60% from its peak.

OXY Total Long-Term Debt (Quarterly) data by YCharts.

However, recent market conditions have weighed on the oil and gas producer. Despite substantial production cuts from OPEC+, oil prices have fallen during the past several months. Slowing global demand, notably from China, and persistent strong production from the U.S. has put downward pressure on prices.

What’s next for Occidental

OPEC and the International Energy Agency (IEA) lowered their global oil demand growth forecasts in September, citing weaker Chinese consumption this year.

According to the investment firm Macquarie Group, the market will have a “heavy surplus” of oil supplies in 2025. Wells Fargo analysts agree, saying that global oversupply could keep prices lower. The bank projects Brent Crude will average $70 per barrel next year.

Image source: Getty Images.

Looking further down the road, one promising aspect of Occidental’s business is its direct-air-capture (DAC) technology investments. With DAC, the company can capture carbon dioxide from the air and store it underground or create clean transportation fuels.

This technology is highly sought after by companies looking to meet their carbon-neutral goals. In July, Microsoft agreed to buy 500,000 metric tons of carbon dioxide removal credits over six years, one of the largest ever purchases for a DAC facility.

One of its subsidiaries, 1PointFive, received $500 million from the U.S. Department of Energy to support the development of its direct-air-capture hub in Texas. As part of the award, 1PointFive will receive $50 million first to continue its work on the hub. This could potentially increase to $650 million if it develops an expanded regional carbon network in South Texas.

The technology, broadly known as carbon capture utilization and sequestration (CCUS), could grow into a massive market over the coming decades as entities look to reduce their carbon footprints. Occidental CEO Vicki Hollub projects CCUS could grow into a $3 trillion to $5 trillion global market and earn Occidental as much revenue down the road as it currently makes from oil and gas production.

Is it a buy?

Occidental is vulnerable to swings in the price of oil, which have certainly impacted its stock price over the past several months. Oil prices could continue to be depressed in 2025 and be a headwind for the company in the near term. If you’re looking for exposure to the industry with less volatility, integrated oil giants ExxonMobil and Chevron may be a better bet.

That said, Occidental’s balance sheet is getting stronger as the company continues focusing on reducing its debt load. Long-term demand for oil and gas will continue growing, and oil prices will fluctuate as geopolitical risks remain elevated. Disruption in supplies or a possible Cold War scenario, where countries sanction other countries, could affect prices over the longer term.

Occidental’s long-term opportunity with CCUS is another catalyst that could be a strong tailwind for the company’s long-term growth. Considering all that, I still believe Occidental remains a solid stock for patient investors with long investment horizons.

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has positions in Chevron, ExxonMobil, Microsoft, and Occidental Petroleum. The Motley Fool has positions in and recommends Berkshire Hathaway, Chevron, and Microsoft. The Motley Fool recommends Occidental Petroleum and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.