15 November 2023, Bavaria, Munich: Flags with the word “Siemens” in front of the company’s headquarters.

Karl-Josef Hildenbrand | Picture Alliance | Getty Images

Shares in German technology giant Siemens fell by over 5% on Thursday after the company posted a decline in earnings in the fiscal second quarter and said its automation division had slowed.

The company’s industrial profit came in at 2.51 billion euro ($2.73 billion) in the three months ending in March, down 2% from the same quarter last year. The figure was also below the company-compiled analyst forecast of 2.68 billion euro which was reported by Reuters.

Net income fell to 2.2 billion euro in the three months to the end of March, down 38% year-on-year, while sales shed 1% to 19.16 billion euro.

Shares in Siemens were trading around 5.1% lower at 11:49 a.m. London time.

Siemens focuses on automation and digitalization and produces technology for a range of sectors such as transport and healthcare.

The company said that its automation division, which is part of its digital industries business, declined sharply.

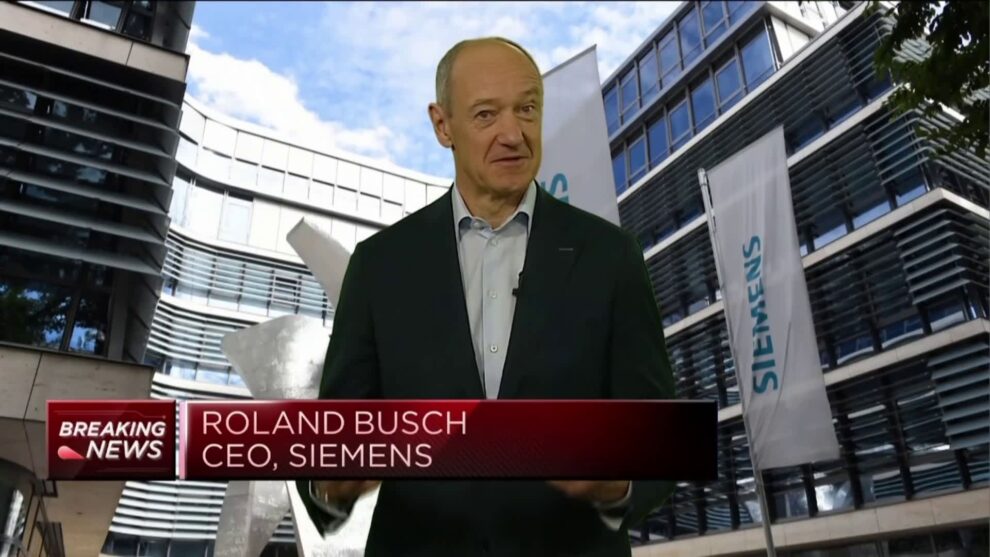

“We see a decline of minus 20%. However you have to see that against the backdrop of a record-high prior quarter and you see still a weakness in the Chinese market, so overall there are no structural reasons for that,” Siemens CEO Roland Busch told CNBC’s Annette Weisbach on Thursday.

The quarter was overall “solid,” Busch said. “Demand for our products is strong and our growth drivers digitalisation and sustainability they’re full intact.”

Busch said there had been a “huge uptick” in demand for automation in recent years, which drove stock levels higher. Reducing this now is taking some time and causing a “destocking effect,” he said.

“It takes a little bit longer because of the demand is not that high and we are reducing the stock as we go,” Busch added.

Lower demand in China is driven by weaker private consumption, exports not accelerating and less direct investment in the country, he said — but there was “no doubt” that China will be back eventually.