(Bloomberg) — Singapore’s economy plunged into recession last quarter as an extended lockdown shuttered businesses and decimated retail spending.

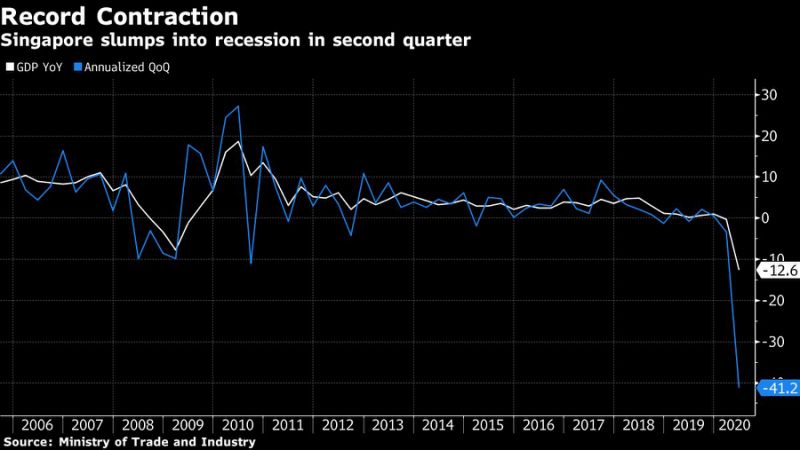

Gross domestic product declined an annualized 41.2% from the previous three months, the Ministry of Trade and Industry said in a statement Tuesday, the biggest quarterly contraction on record and worse than the Bloomberg survey median of a 35.9% drop. Compared with a year earlier, GDP fell 12.6% in the second quarter, versus a survey median of -10.5%.

The deep slump shows the blow Singapore’s economy is taking from all sides amid the pandemic. A plunge in global trade has hit the export-reliant manufacturing industry, while retailers have seen a record decline in sales after partial lockdown measures were imposed for several weeks last quarter. The government, which has projected a full-year economic contraction of 4%-7%, didn’t provide a new forecast Tuesday.

Singapore is one of the first countries to report quarterly GDP data, and the figures show it’s taking a bigger hit than many others in Asia. Japan’s GDP is seen declining more than 20% on an annualized basis in the second quarter from the previous three months, while data this week will probably show China’s economy returned to growth.

The dismal outlook in Singapore is pressuring the ruling People’s Action Party, which had its weakest performance ever in last week’s election. The government has already pledged about S$93 billion ($67 billion) in stimulus to shore up troubled businesses and households and to prevent a surge in retrenchments.

“The road to recovery in the months ahead will be challenging,” Trade and Industry Minister Chan Chun Sing said in a Facebook post. “We expect the recovery to be a slow and uneven journey, as external demand continues to be weak and countries battle the second and third waves of outbreaks by reinstating localized lockdowns or stricter safe-distancing measures.”

Other key details of Singapore’s GDP report, based on annualized quarter-on-quarter data:

Manufacturing plunged 23.1%, compared with growth of 45.5% in the previous three monthsConstruction plummeted 95.6%Services shrank 37.7% with airlines, hotels and restaurants restricted during the partial lockdown, when “circuit breaker” measures were imposed from April 7 to June 1

Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore, said last quarter’s drop was probably the bottom of the cycle “unless Singapore is forced to regress to the harsher iteration of circuit-breaker measures.” Additional stimulus isn’t ruled out, though “the four fiscal packages need time to permeate and cascade,” he said.

Singapore’s dollar slipped 0.1% to S$1.3920 against the U.S. dollar as of 9:05 a.m. local time. The Straits Times Index dropped as much as 0.6% on Tuesday, set for a third day of declines, its biggest losing streak since June 22.

Factory purchasing managers indexes show that manufacturing across Asia started to pick up at the end of the second quarter, as early phases of re-opening in many countries begin to revive demand.

What Bloomberg Economists Say

Though there have been signs of a substantial pickup in activity in 3Q, we don’t expect a return to positive growth until 1Q 2021. A full recovery for this transport hub will require the normalization of global travel and trade.

Click here to read the full report.

Tamara Mast Henderson, Asean economist

Ho Meng Kit, head of the Singapore Business Federation, said the following two quarters will likely be better than the second quarter.

“Even as the economy has opened up since early June, for example small businesses in domestic retail, they are not at the previous levels because there’s still no tourism in Singapore,” he said in an interview on Bloomberg Television. “So, there will be an impact on demand and these sectors will continue to be weak.”

Singapore’s advance GDP estimates are computed largely from data in the first two months of the quarter, and often are revised once the full quarter’s data are available.

“The question is if the second-half recovery will materialize, which will also depend on private consumption coming back,” said Selena Ling, head of treasury research and strategy at Oversea-Chinese Banking Corp. She expects the economy will contract 5.5% for the full year.

(Updates with comments from minister and business association head, and stock levels)

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”43″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”44″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.