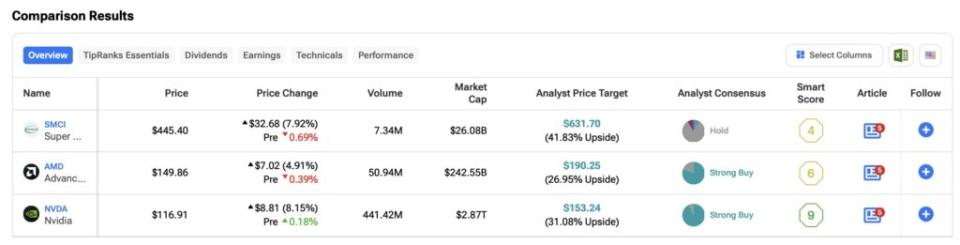

Advanced computing and artificial intelligence (AI) are arguably the most hyped technologies at the moment, making investment decisions in this area challenging. This article compares three major players—Super Micro Computer (SMCI), Advanced Micro Devices (AMD), and Nvidia (NVDA)—using the TipRanks Stock Comparison Tool. I’ll explain why Nvidia, which I currently rate a Buy, is the best option for investors, while I maintain a Hold stance on both Super Micro Computer and AMD.

Before comparing these stocks, it’s important to understand each company’s role. NVIDIA and AMD provide graphics processing units (GPUs) used in servers and data centers, many of which are built by Super Micro Computer. While NVIDIA and AMD focus on accelerating computations, Super Micro supplies the needed infrastructure.

Let’s dive into the details.

Super Micro Computer (SMCI)

From a growth perspective, Super Micro Computer is a strong investment, although I currently rate the stock a Hold. The company’s revenues surged 109.7% over the last 12 months, and its earnings increased 63.9% during the same period, driven by strong AI demand.

Analysts expect Super Micro’s revenue to grow by 88.3% this year, potentially reaching $28.14 billion. However, the company is facing challenges due to a recent report by Hindenburg Research, a notorious short seller, that has leveled claims of accounting manipulation at the company. This has led to a sharp decline in the share price and raised concerns about the company’s management team. Shortly after the Hindenburg report was made public, Super Micro Computer delayed releasing its annual report.

Is SMCI A Buy, Hold, or Sell?

The current situation at Super Micro Computer makes it a risky investment, which is largely why I rate the stock a Hold. On the other hand, the stock, currently trading at $465, down from a peak of $1,229 reached in March of this year, could present a buy-the-dip opportunity if the allegations against the company are proven to be unfounded.

Looking at momentum indicators, the stock is currently below its 10, 50, and 100-day moving averages, signaling short- and medium-term bearish momentum. However, trading below the 200-day average may signal an oversold condition, potentially offering a chance for contrarian investors.

Despite recent downgrades from four analysts, Wall Street remains optimistic about SMCI, with a Moderate Buy consensus rating. The average SMCI price target from 11 analysts is $978.50, implying a potential upside of 119.69%.

Nvidia (NVDA)

Nvidia is a standout technology concern and dominant in the AI field, which is why I rate the stock a Buy. The company’s powerful chips are critical for advanced AI systems and data centers, and it controls about 98% of the data-center GPU market. This impressive market dominance, and positive earnings growth, reinforce my bullish stance on the stock.

In the past 12 months, Nvidia’s revenues have surged 194.7%, with earnings soaring 394.2%. Analysts expect the company to grow its revenue by 106.1% this year, reaching $125.58 billion, and anticipate a 119.2% increase in earnings per share (EPS). While Nvidia’s recent second-quarter financial results exceeded Wall Street’s expectations with 122% year-over-year sales growth and positive guidance, it fell short of the exceptionally high growth seen in previous quarters when sales rose more than 200% year-over-year.

Is NVDA A Buy, Hold, or Sell?

NVDA stock is definitely a Buy. It seems foolish to bet against this leading chipmaker, given the 140% gain in its share price this year. While recent results have raised concerns about slowing growth, I believe the long-term outlook for Nvidia remains strong.

However, investors should expect some short-term volatility in Nvidia’s stock due to its big run. Technical indicators show bearish trends in the short and medium term, though long-term indicators remain bullish. This suggests that, despite potential short-term weaknesses, long-term investors in Nvidia are likely to profit.

Wall Street remains extremely bullish on Nvidia. Among 42 analysts, 39 hold a Buy rating on the stock, with an average NVDA price target of $153.24, implying 31.08% upside from current levels.

Advanced Micro Devices (AMD)

My Hold rating on AMD is due to the company’s unimpressive financial growth. While the company posted a 6.4% increase in revenue and a 30.5% rise in earnings over the last 12 months, this growth pales in comparison to that of its main rival, Nvidia. This relative underperformance is driven by AMD’s continued focus on hardware efficiency.

Analysts forecast a nearly 13% increase in revenue for AMD this year, reaching $25.62 billion, along with a 27.6% rise in EPS. While the outlook is strong, AMD’s recent results have been disappointing. Despite a 115% year-over-year revenue increase in the company’s Data Center segment during Q2, AMD’s revenue from chips and processors used in video game consoles fell by 59% to $648 million. In contrast, Nvidia’s gaming revenues increased by 16% year-over-year. This performance gap suggests that AMD might not be the most attractive microchip designer to invest in right now.

Is AMD a Buy, Hold, or Sell?

Another reason I rate AMD stock a Hold is the company’s recent $4.9 billion acquisition of ZT Systems. This deal, financed with 75% cash and 25% stock, has raised concerns about potential share dilution, which could impact annual earnings. So far this year, AMD stock has risen less than 10%, trailing most of its peers and the technology-laden Nasdaq index, which has gained 20% year-to-date.

In terms of momentum indicators, short-term signals are currently a Buy, while medium- and long-term indicators suggest a Sell. This implies that, while there may be short-term gains, long-term investors should exercise caution due to bearish sentiment.

On a positive note, Wall Street’s consensus remains a Strong Buy for AMD stock. Of the 32 analysts covering AMD, 26 recommend a Buy, and the average price target of $190.25 indicates potential upside of 26.95%.

Conclusion – NVDA Is the Best Investment

While each company—Super Micro Computer, Nvidia, and AMD—has individual strengths, Nvidia currently offers the most compelling investment opportunity due to its dominance in AI and impressive growth. Super Micro Computer and AMD should be viewed with caution, given some underlying issues at each company. Assessing all three chip stocks, Nvidia holds a clear advantage in both performance and market outlook.