CFRA Research Senior Equity Analyst Angelo Zino joins Yahoo Finance Live to evaluate Snap earnings and the outlook for the social media platform.

Video Transcript

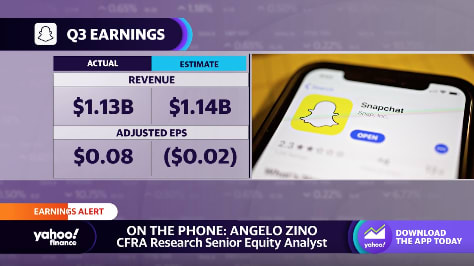

– Snap shares selling off after a disappointing Q3 earnings report. You can see them down 25% on this day. CFRA Research Senior Equity Analyst Angelo Zino joining us on the phone with this earnings alert. Angelo, just your reaction to the earnings report. And are you surprised by the stock reaction?

ANGELO ZINO: So, overall, I’d say for the quarter., I mean, it wasn’t awful, right? I mean, revenue grew about 6% year over year in line with our expectations and I think that of consensus. The daily active user numbers, the DAUs, actually came in better than expected. It grew 19% versus our expectation of about 16% to 17% growth. And that was largely driven by upside outside of the US and more international growth. And the disappointment really came on the average revenue per user side of things, the ARPU number down 11%. We were looking for about down 8%, 9%.

And there’s a number of reasons that we can kind of go into. But as far as the reaction in terms of the stock price, I’m a little bit shocked by the magnitude of the move. Although, I probably shouldn’t, given what we’ve seen in terms of stock movement here in recent quarters. But that said, I mean, overall, I think the biggest disappointment here is the trajectory of the revenue outlook as you look into the fourth quarter, which the company did provide some guidance into, and likely indicates that going into the first quarter of 2023, you’re starting at a lower footprint.

– Angelo, let’s go a little bit deeper into that ARPU number, the average revenue per user number, that you just mentioned there, obviously, coming in a bit light in terms of forecast. I guess, what was the biggest factor in that? And I guess, how do you see that playing out as we look ahead to this current quarter and then into 2023?

ANGELO ZINO: Yeah. I mean, so if you kind of take a step back and actually look at the second quarter, that was actually the first quarter since the company went public back in 2017 that we actually saw a year over year decline in ARPU. And you kind of look at– the declines kind of only intensified here in the third quarter and we think probably will again into the fourth quarter. And there’s a number of reasons for that.

One, I mean, there’s going to be a less favorable mix as you kind of see outsized growth, at least on a relative basis, on the DAU side of things on the international side of things which have a lower ARPU-type number. But again, also, probably more importantly is the fact that, listen, the ad space is clearly struggling right now. Budgets are getting a lot tighter. And you are seeing kind of lower bids per action overall. And that’s driving the lower ARPU number specifically.

– Also the first time that revenue grew in single digits since their IPO in 2017. But Angelo, when you look at the daily active users, which maybe this is just like Netflix when we used to focus more on subs, but you’re talking about a 19% year over year increase to $363 million. In that sense, was it not so bad?

ANGELO ZINO: So, again, I think when you kind of look at the daily active users, it’s great to grow the install base this much. And the fact of the matter is they cater to a great installed base in the fact that it’s largely kind of a younger audience. I mean, 80% of their installed base is essentially kind of 35 and under. And that’s a great kind of problem to have when you kind of look at relative to the Metas of the world, which kind of are struggling with a much older installed base.

But when you kind of look at the DAU growth here, it’s about 4% in North America, the outsized growth. About 11% in Europe. And then the real outsized performance was kind of rest of the world, which grew 34%. And, again, you’re talking considerably lower ARPU-type numbers in those regions. They haven’t been able to monetize that audience yet. And that’s kind of been the problem here, whereas maybe other platforms out there are actually doing a better job monetizing the platform internationally.

– Angelo, when you take a look, though, at the advertisers cutting their spending– in this earnings report, the company saying that we expect the operating environment is going to continue to be challenging in the months ahead. You mentioned the fact that maybe some of the competitors out there do have an advantage, at least when it comes to their competition in regards to Snap. But is this indicative, do you think, of what we would likely hear over the next couple of weeks as we do start to hear from some of those other social media companies?

ANGELO ZINO: I think it’s going to depend. I mean, listen, I think, overall, the ad space is definitely struggling right now. It’s the first area to get hit when we’re talking about softer macro conditions. And we clearly started seeing things rolling over in the second quarter. And it’s only gotten more pronounced here in Q3 and Q4. And we do think it likely bottoms probably sometime in the first half of the year.

So it likely gets uglier before it gets better. I mean, I’d say that the news for Snap probably worse for Meta, just given kind of the audience that they cater to and how they’re kind of more exposed to the iOS ecosystem and the mobile platform. When you think about a company like Pinterest, they were able to buck the trend last quarter relative to Snap. If you recall, they actually kind of popped significantly on the results.

And the reason for that is because they’re actually finding ways to better monetize the platform. They’re actually growing ARPU, while a company like Snap is seeing ARPU declines because of what they’re doing in areas like shopping experiences and stuff like that. So I think it’s going to depend on these individual companies. And this definitely kind of drops the sentiment as we kind of go into the rest of the numbers next week. But on a case by case basis, it’s going to hit we think Meta from a fundamental perspective more than the others.

– Twitter obviously protected by the 54.20 that Elon Musk is going to pay. And that’s probably why you see that not moving much at the moment. So the question is for SNAP, what is the catalyst? What is the comeback story? Evan Spiegel saying today we are going to focus on three things– growing our community, deepening their engagement, re-accelerating and diversifying our revenue growth. And here’s my question. Investing in augmented reality. How significant might that be for Snap? Or where else might lie the comeback story?

ANGELO ZINO: Yeah. Listen, I think augmented reality is the right place for them to be and to invest in. And the reason being, I mean, is there a mobile dependent platform– you kind of look at where a company like Apple is going to, right. I mean, we know they’re migrating towards augmented reality, what they’re doing with developers out there and product wise what we expect for them to come out over the next two to three years, whether it be mixed reality headsets, eventual AR glasses and what have you. So Snap is trying to prepare for that evolution. But that’s going to take a couple of years.

I think kind of when you’re thinking about potential catalysts ahead, in our view, I think at this point in time, we’re just kind of looking for some sort of signs of a bottoming process, which is really too early to be talking about because we’re probably at least two quarters away from that happening. And sentiment just completely getting washed out, which you’re probably starting to get close to. But we’ve been saying that I think for a couple of months now.

– Yeah. And look at that. Shares off just around 25% after hours. Angelo Zino, great to have you. Thanks so much for hopping on the phone for us.