The train wreck that is Snap’s 2022 continues to roll on.

The social media outfit and part-time camera company is reporting planning to layoff 20% of its more than 6,400 employees, The Verge first reported. Cuts are expected to begin on Wednesday.

Snap didn’t return Yahoo Finance’s request for comment on the layoffs.

Snap stock tanked 7% in pre-market trading on Wednesday and are down 78% on the year. The company’s ticker page was the most visited on the Yahoo Finance platform on Wednesday morning.

In a new note, veteran tech analyst Brent Thill of Jefferies stated that the layoffs suggest further challenging times for Snap amid tough competition from the likes of TikTok and slowing ad revenue.

Here’s what Thill had to say.

On the headcount reductions:

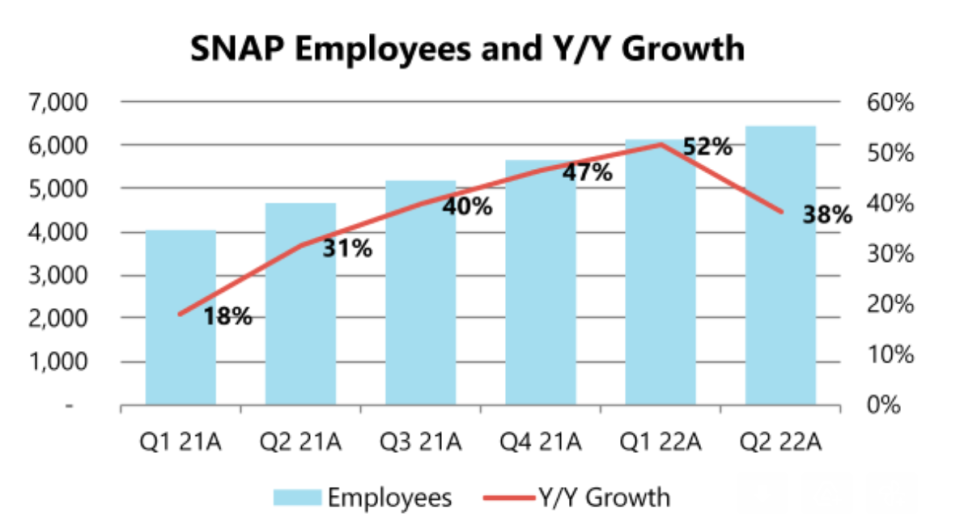

“Headcount reductions were not surprising, but a 20% reduction was more than we had anticipated. There have been several widely-reported articles mentioning Snap’s expected layoffs in areas such as Maps, Minis, and Hardware. These reports have not yet been confirmed by the company. We believe that the decision to cut back in areas that generate little or no revenue is prudent, particularly given revenue growth has slowed from high 30s% in Q1 to now 0% midway through Q3. Although these layoffs seemed inevitable considering the cautious commentary on the Q2 earnings call, the magnitude of the reduction was surprising. We note that Snap had been increasing headcount, including acquisitions, by as much as 52% y/y in Q1.”

The visual:

On the near-term stock price:

“It may take a few quarters for investors to regain confidence in the story. All the recent developments further fuel the bear case for Snap stock. We believe the only way to restore investor confidence is with evidence of rev growth in Q3 (vs. flat y/y through mid-July) and guidance of accelerating growth in Q4. Among the digital ad names in our coverage, Snap was the only one to remove fwd guidance further eroding near-term visibility.”

Why Thill is staying bullish on Snap:

“Heightened focus on profitability and free cash flow should be a positive for investors. While the decision to shrink the employee base in the wake of slowing rev growth is a discouraging sign, the renewed focus on profitability is a prudent decision. Compared to its digital advertising peers Meta and Google, Snap is a significantly less profitable and free cash flow generative company. Assuming many of the headcount reductions are coming from non-revenue generating areas like Hardware and Minis, Snap could start to show a faster pace of EBITDA margin expansion and FCF generation going forward.”

Industry vibes: Social media taking in on the chin

It was a challenging second quarter for social media giants Snap, Meta, and Twitter as the economic slowdown pressured ad revenues. Snap’s second quarter loss came in larger than expected and the company declined to provide third quarter guidance saying “forward-looking visibility remains incredibly challenging.”

Snap stock crashed more than 39% on July 22, the day after its dreadful earnings report and earnings call.

From the Yahoo Finance Live archive: Snap is borderline falling apart

“I feel like the company is going through a near-death experience,” MKM Partners Analyst Rohit Kulkarni said on Yahoo Finance Live. “It’s macroeconomic, Apple and TikTok on top of that customer concentration.”

Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube