(Bloomberg) — Snap Inc. missed its own forecast for user growth last quarter and held off making projections for the current period, a reminder of how hard it is to predict business direction during the pandemic.

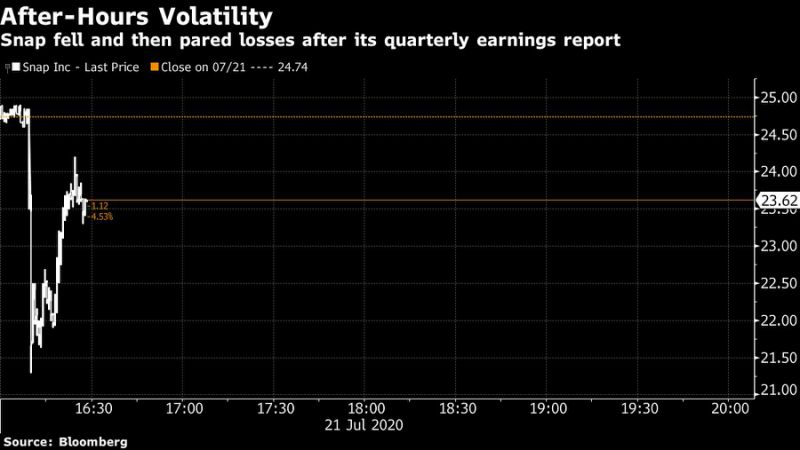

The company, owner of the Snapchat social media app, said that gains in daily active users seen at the beginning of the Covid-19 outbreak have leveled off. Although revenue topped analysts’ estimates and is on track to do so again in the current period, Snap isn’t promising anything. Instead, it said the events that usually drive third-quarter advertising sales — like sports games, movie releases and back-to-school shopping — can’t be counted on. Shares dropped about 6% in late trading.

“At the onset of widespread shelter in place orders, as people sought to stay connected and entertained from home, we observed an increase in daily active users that informed our initial estimate,” Chief Financial Officer Derek Andersen said in prepared remarks to investors. “This initial lift dissipated faster than we anticipated as shelter in place conditions persisted.”

In a statement on Tuesday, Santa Monica, California-based Snap said daily active users in the June period grew 17% to 238 million, compared with the 239 million estimated. Shares fell as low as $21.30 in extended trading before recovering some of the late losses.

“The stock isn’t valued on revenue or profits, it’s valued on users,” said Michael Pachter, an analyst at Wedbush Securities. “Investors don’t like slowing growth.”

The results may serve as a bellwether for the social media industry, where Snap competes with Facebook Inc. and Twitter Inc. for advertising dollars and users’ time. Those companies haven’t yet reported results for the June period, but both said earlier this year that the pandemic was curbing digital ad spending. Facebook now is also confronting a boycott by dozens of major brands, which are pausing spots on the social network to protest its policies toward hateful and misleading posts. Some of the advertisers have said they were also halting spending on other social networks.

Snap, whose app is especially popular with young people and faces less pressure over offensive content than its peers, drew $454.2 million in second-quarter sales, a jump of 17% from a year earlier, while analysts on average had projected $441.6 million.

The company has been working to turn around its business, improving offerings for advertisers after the instability that followed its 2017 initial public offering. In that time, Snap has changed top managers, redesigned its application and improved its Android product, helping the company grow in markets beyond the U.S. and Europe. Optimism for the recovery drove the shares up 52% this year. Now it’s trading close to levels not seen since the days after its IPO.

Analysts said they had high expectations for Snap, especially after the company’s developer summit highlighted opportunities to draw more revenue from users. The company has for years invested in augmented reality for e-commerce — like trying on shoes virtually from home — which has the potential to become mainstream more quickly as consumers are encouraged to stay home.

“This is a 4.5-star result, and buy-side probably expected a 5-star result,” said Rohit Kulkarni, an analyst at MKM Partners.

Snap’s net loss widened to $326 million, or 23 cents a share, from $255.2 million, or 19 cents, a year earlier. Excluding certain items, the loss was 9 cents a share, compared with the average 10-cent loss projected by analysts.

In his remarks, Snap CFO Andersen noted other “challenging circumstances,” like advertisers who temporarily paused their campaigns in order to change their messaging to be “more appropriate for the given moment,” as the U.S. erupted in protest over police violence against Black people.

(Updates with analyst comment in the fifth paragraph.)

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”54″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”55″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment