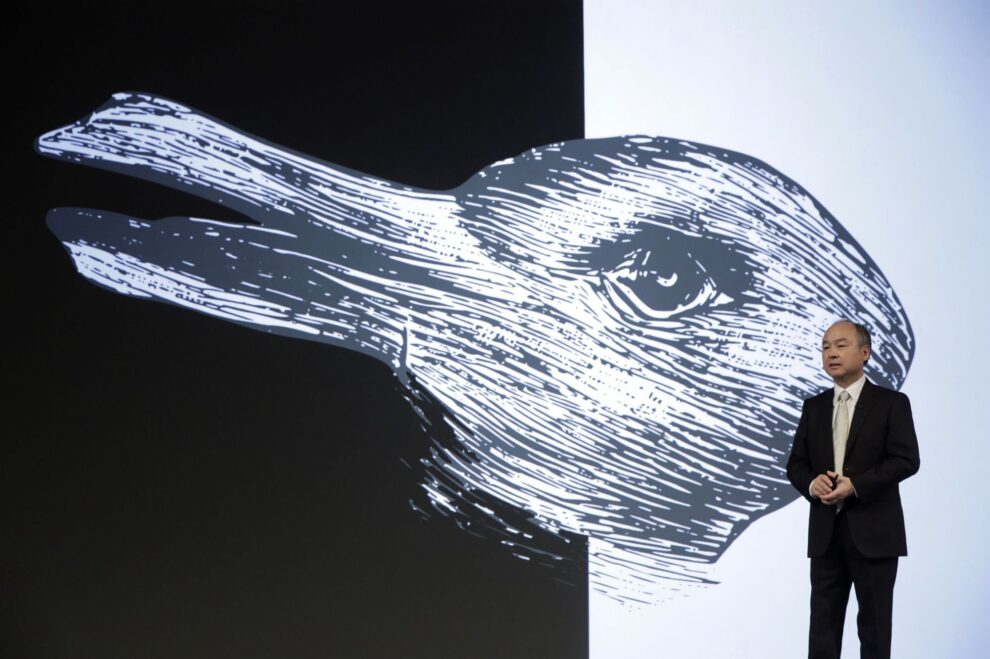

(Bloomberg Opinion) — It seems like everyone’s launching a special purpose acquisition company these days, but you could have bet on Softbank Group Corp. maestro Masayoshi Son and his lieutenant Rajeev Misra finding a way of putting an eyebrow-raising spin on the blank-check phenomenon. They haven’t disappointed.

QuickTake: What’s a SPAC?

Their SPAC, SVF Investment Corp., plans to raise at least $525 million from investors in an initial public offering and will use that cash to find a technology company to merge with and take public. The SPAC’s sponsor is controlled by SoftBank Investment Advisers, which also oversees the $100 Billion Softbank Vision Fund.

SVF plans to buy a company SoftBank hasn’t previously invested in, Bloomberg reported.

The surprise twist is that it could indeed decide to merge with a SoftBank-backed business, if it wanted. “We are not prohibited from pursuing an initial business combination with a company that is affiliated with our sponsor, officers or directors,” the prospectus states, leaving the door open for the SPAC to join forces with one of the Vision Fund’s many venture capital investments, for example.

Unlike some sponsors who put little of their own money at risk, SoftBank entities are ponying up at least $250 million to participate in whatever deal the SPAC chooses. Even so, a transaction between two Softbank subsidiaries would create a conflict of interest that’s best avoided.

The conflict arises because the Vision Fund’s goal should be to maximize the value of its investments by negotiating as high a valuation as possible with whoever wants to buy one of its portfolio companies. By contrast, a SPAC should try to acquire a business for as little as possible. This way it maximizes the returns to other SPAC investors, who buy shares hoping to see a “pop” once a deal is announced. It also helps overcome the high costs embedded in the SPAC structure, including the large block of free shares the sponsor receives (known as the “promote”).

SoftBank says this conflict is easily resolved: It will obtain an opinion from an investment bank that the transaction terms are fair. The prospectus acknowledges, however, that potential conflicts may still exist and therefore “the terms of the business combination may not be as advantageous to our public(1) shareholders as they would be absent any conflicts of interest.”

Why blur the lines like this? SoftBank’s companies aren’t short of options for how to join the stock exchange. DoorDash Inc.’s blistering IPO has turned the SoftBank Vision Fund’s $680 million private-market investment in the food-delivery company into a public stake worth about $10 billion.

If a regular IPO or direct listing isn’t attractive to Vision Fund companies, there’s always the couple of hundred other SPACs who’ve raised tens of billions of dollars this year and are looking for bright technology prospects with which to merge.

Still, I can think of three big attractions for SoftBank in having its own SPAC.

Until recently, start-ups were staying private for longer, which meant the Vision Fund had its pick of companies to invest in. Now, it has far more competition — from SPACs. Why would a start-up stay private when it can list via a blank-check company and get a much higher valuation? SoftBank needs a SPAC to remain relevant.

Another attraction is that SPACs provide a route to take a company public while avoiding some of the pricing vagaries that accompany regular IPOs. SPACs agree with the target on a valuation directly and at the outset, not after a long investor roadshow.

In hindsight, SoftBank-backed WeWork was ill advised in trying to persuade institutional investors it was worth at least $47 billion — the valuation Softbank put on the shared-office provider before its disastrous IPO attempt in 2019. A cash-burning start-up like WeWork might have had more luck negotiating with just one party — a SPAC — which could now also be controlled by SoftBank. Retail investors have piled into SPACs, regardless of how rich that agreed valuation might seem.

While I’m not suggesting SVF will try to merge with WeWork, the SoftBank universe can be a strange place so you couldn’t rule it out entirely.

The other big attraction of SPACs is just how lucrative they can be. This week a home-flipping app, Opendoor Technologies Inc., became a public company after closing a deal with one of former Facebook Inc. executive Chamath Palihapitiya’s SPACs, Social Capital Hedosophia Holdings Corp II.

This was a great outcome for the SoftBank Vision Fund, which invested $450 million in Opendoor in 2018 and 2019 when it was still private. It now owns public shares worth almost five times that.

Palihapitiya and fellow sponsor Ian Osborne have done just as well, though. Together the pair invested about $170 million in Opendoor and they now hold shares and warrants worth about $850 million, by my calculation. That’s a five times return on investment for just a few months work.(2)

Son didn’t become a billionaire by gifting others a free lunch. A SPAC gives SoftBank a seat at the feast.

(1) translation: non-Softbank affiliated

(2) Their capital is still at risk of course and subject to a lock-up.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Bryant is a Bloomberg Opinion columnist covering industrial companies. He previously worked for the Financial Times.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.