SoftBank CEO Masayoshi Son recently told investors that he thinks Nvidia stock is undervalued.

Masayoshi Son is one of the most celebrated investors in modern history. As CEO of Japanese holding company SoftBank, Son has a rich history of architecting savvy investments across a host of different industry sectors.

Sure, there have been some clunkers in SoftBank’s portfolio (I’m looking at you, WeWork), but for the most part, Son seems to have a knack for identifying transformative technologies before they take off.

Take semiconductor business Arm Holdings as an example. Back in 2016, Softbank acquired Arm for roughly $32 billion. Today, Arm is a public company and boasts a market capitalization of nearly $150 billion. That’s a pretty solid return on investment.

Speaking of semiconductors, Son recently made an eyebrow-raising remark regarding the world’s most valuable chip business, Nvidia (NVDA 0.48%). During a recent interview with CNN’s Richard Quest, Son put forth the idea that Nvidia is undervalued.

How can a stock that’s gained 880% in two years possibly be considered undervalued? Below, I’m going to dig into why Nvidia stock may look undervalued but explain why I’m not completely aligned with Son’s call.

Why Nvidia looks undervalued

For many years, Nvidia’s primary focus was on the gaming industry — specifically, enhancing visuals and graphics on computer screens for gamers. However, over the last couple of years, Nvidia has found ways to parlay its breakthroughs in gaming to other applications.

Namely, the company’s compute and networking services have witnessed tremendous growth in recent years thanks to an increased appetite for artificial intelligence (AI) products. You see, Nvidia creates advanced chipsets called graphics processing units (GPUs). GPUs are an important piece of hardware as it relates to generative AI. Yet in addition to its GPUs, Nvidia also makes software that layers on top of these chipsets.

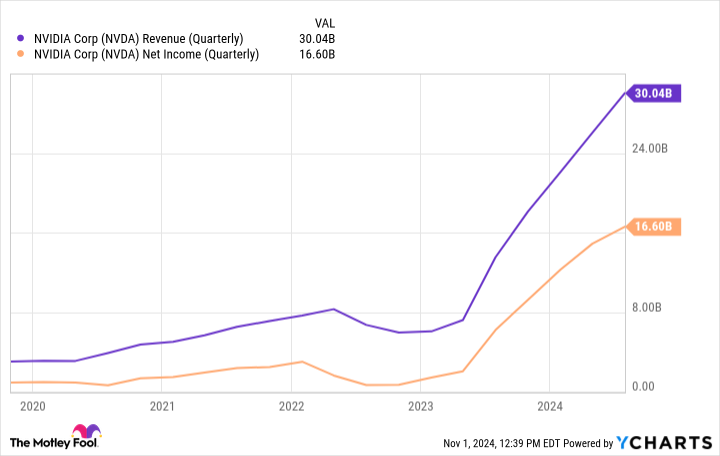

In essence, businesses using Nvidia’s GPUs wind up relying on the company for the majority of their AI backbone — using both its hardware and software. This business model has been incredibly lucrative for Nvidia. Just check out the chart below to get a glimpse of the company’s growth.

NVDA Revenue (Quarterly) data by YCharts

With revenue and profits increasing at such a steep pace, Nvidia’s momentum looks unbeatable. And it’s these trends that may suggest Nvidia stock is undervalued.

As depicted in the chart below, Nvidia stock is trading below its five-year average on both a price-to-earnings (P/E) and price-to-free cash flow (P/FCF) basis. On the surface, this dynamic looks highly convoluted. Just think about how much Nvidia’s business has transformed over the last couple of years thanks to AI. How can the stock be cheaper today than it was five years ago?

NVDA PE Ratio data by YCharts

The literal explanation is that Nvidia’s profit growth is rising at faster rates than the stock price. So even though the company’s share price seems to kick into a new gear every other day, net income and cash flow are actually accelerating even faster.

Although looking at Nvidia stock through this lens may suggest that shares are undervalued, I’m going to detail why I see the discussion around valuation to be a little more nuanced.

Why I’m not totally buying this idea

During Son’s interview, he explained that Nvidia is undervalued because the total addressable market (TAM) for generative AI is expected to get bigger. Translation: Demand for GPUs should remain robust for the next several years, a tailwind that bodes well for Nvidia.

While I agree with Son’s idea of an expanding TAM for AI infrastructure, I have questions surrounding how much of a catalyst that will be for Nvidia.

Big tech companies such as Microsoft, Meta Platforms, Amazon, and Alphabet are all developing their own custom chip architecture to train future AI models. Considering each of these companies are believed to be Nvidia’s largest customers, I see the introduction of new GPUs to the marketplace as a major headwind.

To be upfront, I don’t think any of these customers will cut ties with Nvidia completely. Rather, as more chips enter the landscape, I think Nvidia’s most direct way of competing is through price reductions. Should this be the case, Nvidia’s revenue will likely normalize while its margin profile begins to tighten. The combination of decelerating revenue and deteriorating margins will subsequently take a toll on Nvidia’s profitability.

Generally speaking, when a company’s sales and profits begin to shrink, so does its valuation.

Image source: Getty Images.

Is Nvidia a good stock to buy right now?

On the surface, Nvidia’s valuation multiples might suggest the stock is trading at a reasonable price right now. However, given the rising threat of competition, I actually think Nvidia stock is trading at a premium relative to many other opportunities in the AI realm. And while this premium is well deserved (for now), I question how much longer the stock can sustain its current run.

Only time will tell if Son’s takes on Nvidia holds up. As I expressed in a prior piece, I think Nvidia is more of a trade right now than an investment. In other words, I don’t necessarily see the stock as a buy and hold. To me, timing your buys and sells with Nvidia is going to be pretty important over the next several years. These ideas don’t exactly make the case for an undervalued stock, and for those reasons, I think Son may be off on this one.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.