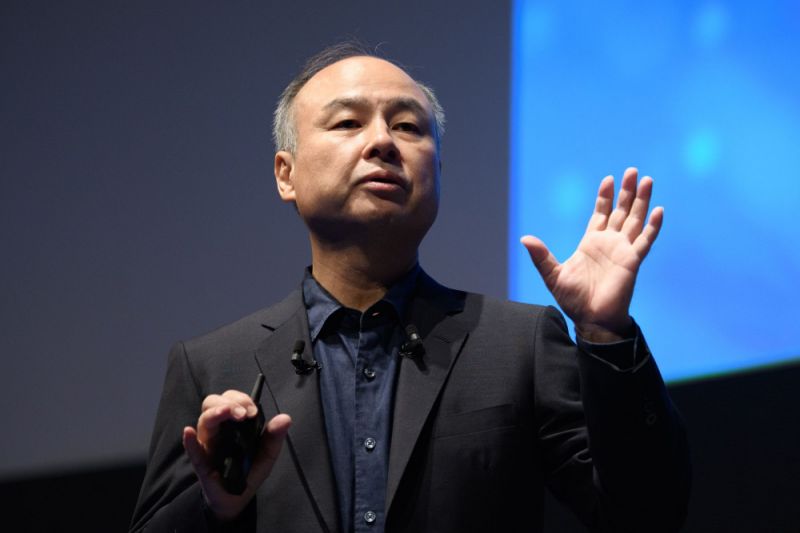

(Bloomberg) — SoftBank Group Corp. founder Masayoshi Son has a solution to Japan’s decades-long economic malaise. Not surprisingly, it involves artificial intelligence.

Japan can boost growth by joining with India and Southeast Asian countries in creating a common AI platform, Son told scientists and government bureaucrats who gathered in Tokyo on Tuesday for the government’s Moonshot symposium. He envisions Japan taking a leading role and believes the combined populations and markets could give the countries a fighting chance against the behemoths of China and the U.S., which share the lead in AI, he said.

“This is the moonshot,” Son said, drawing laughter with a slide that showed a graph of Japanese gross domestic product climbing steeply to exceed those of China and the U.S. “If we can achieve this, the result will be amazing.”

As the first country to confront intractable problems of an aging society, Japan should focus on autonomous driving and DNA-centric medicine as solutions to rising traffic accidents involving the elderly and soaring medical costs, Son said. Southeast Asian countries should join Japan in creating a shared data bank and developing an “AI engine,” he said. Son didn’t explain what he meant by that nor say why developing countries would want to help the wealthy neighbor with its first-world problems.

“If we create Asia’s number one platform, that is a big potential,” Son said.

While many venture capitalists view Son’s sermons about the coming AI age as nothing more than marketing, the billionaire is already pushing his own companies to prepare for the future where every industry is redefined by the technology. Last month, SoftBank announced plans to combine its Yahoo Japan internet business with Line Corp., Japan’s biggest messaging service. The complex deal on his home turf is supposed to create a national champion that can more effectively compete with global rivals like Google and Amazon.com Inc.

Son is as bullish as ever on AI even as his investment strategy has come under fire. SoftBank’s Vision Fund had to write down the value of its ride-hailing portfolio, which includes China’s Didi Chuxing Inc., India’s Ola and Singapore’s Grab Holdings Ltd. after Uber Technologies Inc. fell more than 30% following its listing in May. Son also lost billions of dollars afer pouring money into WeWork, a company that has no discernible AI technology but plenty of hurdles as it tries to turn a profit.

The hype around self-driving cars has died down recently after a number of deadly crashes in cars on AI autopilot made it clear that true autonomy may be many years away. Still, Son said robotaxis can already do better than senior citizens. He played a video of an autonomous vehicle from Cruise, a General Motors Co. self-driving unit where SoftBank has invested $2.25 billion, navigating San Francisco’s crowded streets.

“If you are still doubting the capability of autonomous driving, this is already today,” he said.

Son said the answer to rising medical costs is more DNA analysis, putting a spotlight on one of his portfolio companies, Guardant Health Inc. Shares of the cancer-detection company, one of the Vision Fund’s more profitable holdings, have climbed about fourfold since its stock market debut last year. Son also mentioned Karius Inc., a blood-testing startup in which SoftBank has no reported stake.

Shifting gears, Son said AI should be a subject on college entrance exams in Japan. Earlier this month, he announced a collaboration with the University of Tokyo in opening the Beyond AI Institute, designed to accelerate the transition of AI research from the theoretical to the applied. SoftBank in May named renowned AI expert and Deepcore adviser Yutaka Matsuo to its board, enlisting a specialist in the field for the first time. Matsuo is the president of the Japan Deep Learning Association, which offers certification exams for AI engineers.

“Japan has lost the past,” Son said, and if it doesn’t act swiftly to embrace and capitalize on AI, it “may be losing the future.”

To contact the reporters on this story: Pavel Alpeyev in Tokyo at [email protected];Takahiko Hyuga in Tokyo at [email protected]

To contact the editors responsible for this story: Edwin Chan at [email protected], Vlad Savov, Peter Elstrom

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”32″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.