(Bloomberg Opinion) — Sony Corp. has halved the price of its PlayStation Now subscription games service. Competition from console rival Nintendo Co. as well as new offerings from Alphabet Inc.’s Google and Apple Inc. are the obvious reasons.

In addition, though, PlayStation Now failed to live up to its potential. At $19.99 per month,(1)the product was way overpriced. After four years, Sony has just 700,000 paid subscribers. That’s less than 1% of the 96.8 million PlayStation 4 units the company sold by the end of March.

As Sony, Nintendo and Microsoft Corp. enjoy loyalty and ongoing revenue streams from subscribing services for games, both Apple and Google enjoy a clear advantage in something far more valuable: attention.

What these companies are really competing for isn’t share of the games market but consumer time. A minute watching Netflix or swiping Tinder is a minute not spent playing GTA or Super Mario Kart.

In that respect, Google and Apple are both able to grab user attention multiple times per day thanks to their iOS and Android smartphones. Even Nintendo’s handheld Switch can’t compete.

Complicating the matter for Now is Sony’s own rival offering,: PlayStation Plus, which goes for $9.99 per month. Now is a streaming service like those provided by Netflix Inc. or Spotify Technology SA, while Plus is more of a community that allows online multiplayer games, offers just two free PS4 titles per month, and provides some other benefits.

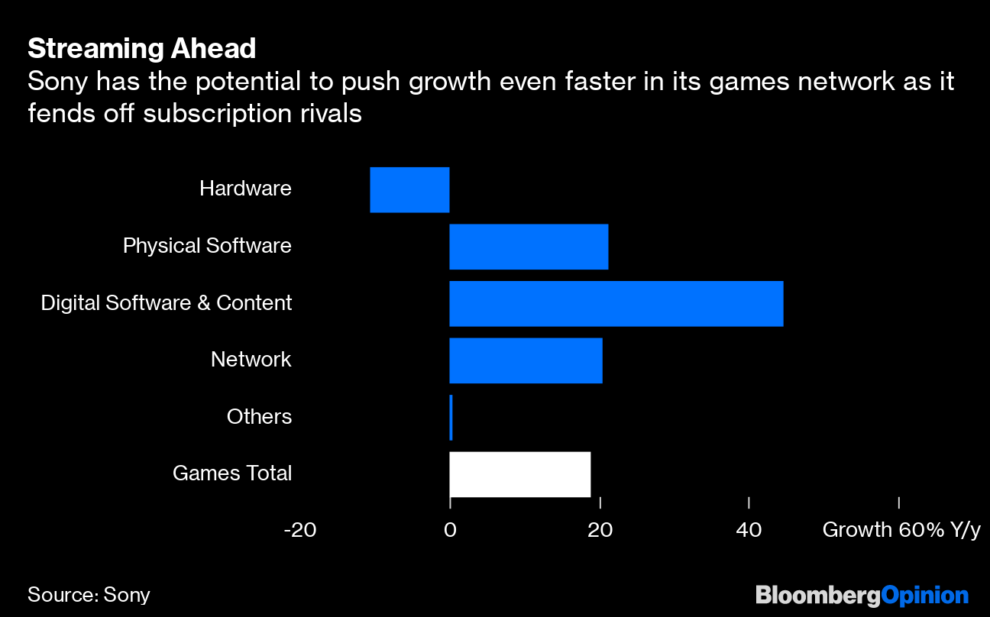

By cutting Now to $9.99 per month, Sony’s gross margins and average selling price on that service will suffer. Yet the unit economics mean that longer-term revenue and operating profit in this division can expand. By my reckoning, Sony should be able to hit 1.5 million paid Now members by the end of September 2020; if not, then I would consider PlayStation Now a failed product that needs to be reassessed.

As proof, we can look at Plus. It offers a lesser games catalog than Now, albeit with other compelling features, but had 36.4 million subscribers at the end of March – that’s 50 times more than Now. Price is a major factor in users’ purchase of a subscription, according to Nielsen Co.’s Superdata. So with that hurdle lowered, Now ought to be attractive enough to get the same level of attention.

Yet if loyal consumers want both access to the deepest catalog of games, and interactive features and other benefits, they shouldn’t be forced to shell out twice. Instead of milking customers, Sony would be better served by either folding Now and Plus into one service or offering a steep discount to have both.

This isn’t just out of fairness to customers, but a matter of survival. Nintendo’s Switch Online is just $3.99 while Microsoft has Xbox Game Pass at $9.99. Apple’s Arcade is $4.99, and Google’s Stadia costs $9.99. By asking for double its nearest rival, Sony is throwing away the advantage it enjoys by having a superior product for the sake of a few dollars more. That’s reminiscent of its failures with Memory Stick storage cards and BluRay DVDs, mistakes it ought not to repeat.

With five big names now offering games subscriptions, it’s clear that the business model is evolving beyond single-unit sales. By selling all-you-can-eat packages, Netflix and Spotify schooled Apple at a time when the iPhone maker was still charging per song and per movie.

Sony can also learn from Netflix and Home Box Office Inc. that offering competitive set-price packages doesn’t mean you need to forgo blockbuster titles. In fact, Sony’s access to the highest-quality games is the moat that rivals will struggle to cross.

The move toward games subscriptions will be good for the entire industry by bringing in more total revenue. That also makes it Sony’s battle to lose.

(1) It’s discounted for longer-term subscriptions.

To contact the author of this story: Tim Culpan at [email protected]

To contact the editor responsible for this story: Patrick McDowell at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”62″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.