(Bloomberg) — Southeast Asia’s internet economy is on track to exceed $100 billion this year before tripling by 2025, becoming one of the world’s fastest-growing arenas for online commerce thanks to a youthful population increasingly comfortable with smartphones.

The value of online transactions in areas from internet retail to car-hailing should reach $300 billion by 2025, fueled by an existing population of 360 million online users, according to a research report by Google, Temasek Holdings Pte and Bain & Co. The region, home to ride-hailing Grab and Alibaba Group Holding Ltd.’s e-commerce site Lazada, includes four countries — Thailand, Philippines, Indonesia and Malaysia — in the top 10 globally in terms of time spent by users online, the study showed.

Indonesia, the world’s fourth most-populous country with 264 million people, will anchor a region that also includes Singapore and Vietnam.

The annual report, previously helmed by Google and Temasek, measures gross merchandise value in e-commerce, ride-hailing, online media and online travel and has become a prime reference for the region’s internet industry. Bain joined as a lead partner this year and the study encompassed digital financial services for the first time.

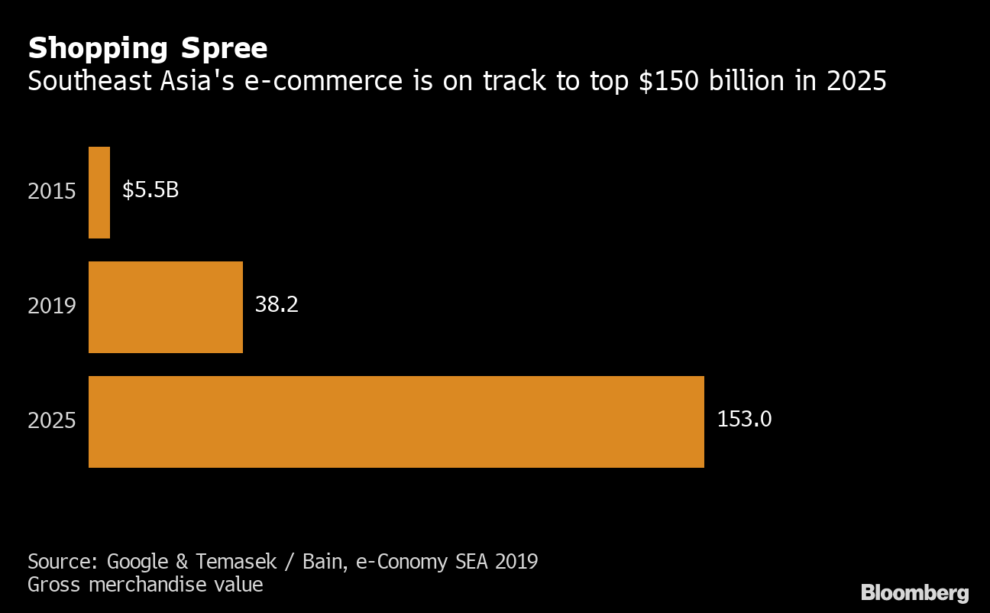

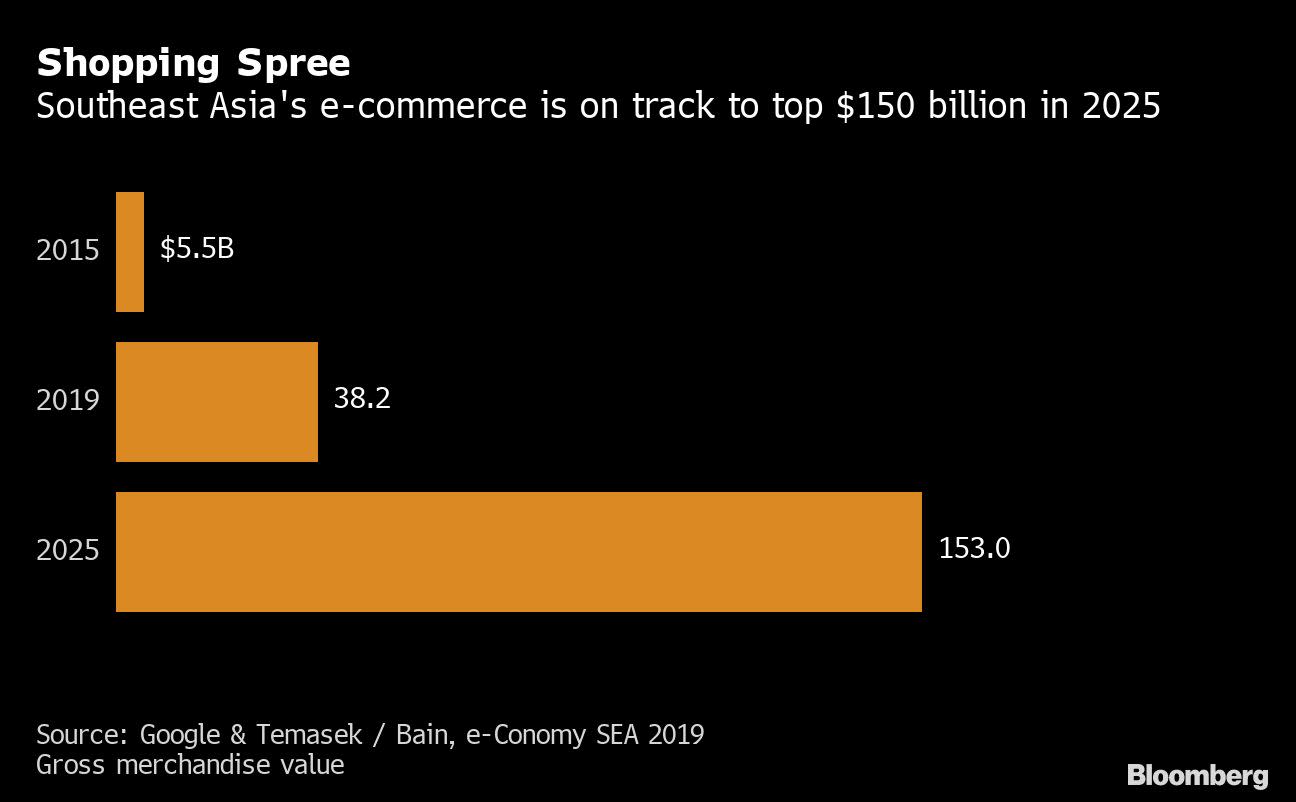

E-commerce remains the brightest spot in Southeast Asia’s internet economy. Aided by online festivals for attractive deals, in-app entertainment and faster delivery, the market is projected to quadruple from $38.2 billion in 2019 to $153 billion by 2025. The bulk of that growth will come from Indonesia, where the e-commerce market is poised to expand from $21 billion to $82 billion.

The regional ride-hailing market is projected to reach $40 billion by 2025 from $12.7 billion in 2019, propelling sector leaders Grab and Gojek. Both see food delivery as a key driver of growth and profitability. That, in turn, intensifies competition with meal delivery companies such as Foodpanda and Deliveroo.

Read more: Grab and Gojek Square Off in an International Food Fight

Vietnam is emerging as the most digital of all economies in the region, with the gross merchandise value of its internet economy set to account for more than 5% of the country’s gross domestic product in 2019. That compares with the 3.7% share for Southeast Asia. E-commerce is a key driver behind the boom in Vietnam, where homegrown marketplaces like Sendo and Tiki compete with regional players including Lazada and Tencent Holdings Ltd.-backed Shopee.

Digital payments are moving into the mainstream and expected to exceed $1 trillion by 2025. Of the 400 million adults in Southeast Asia, 98 million are “under-banked” — people with bank accounts but limited access to other services such as credit. And another 198 million have little recourse to finance whatsoever.

Those expectations of heady growth are helping attract investors despite global headwinds. Southeast Asia’s internet companies raised $7.6 billion in the first six months of this year, up from $7.1 billion a year earlier, the study showed.

Ride-hailing firms led by Grab and Gojek have raised more than $14 billion over the past four years, while e-commerce firms including Tokopedia have attracted almost $10 billion. The late-stage financing rounds for Grab and Gojek are among the largest of their kind globally, according to the report.

To contact the reporter on this story: Yoolim Lee in Singapore at [email protected]

To contact the editors responsible for this story: Edwin Chan at [email protected], Peter Elstrom

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”57″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.