This leading streaming company has made its investors a fortune in the past two years.

Stock splits have been in vogue recently. Large technology companies like Amazon, Alphabet, Nvidia, and Tesla have split their stocks after seeing their share prices get close to $1,000 or more. This financial engineering tactic didn’t change anything about these stocks’ underlying businesses, but it can make it easier for individual investors to buy a single share.

One potential stock-split candidate is Spotify (SPOT -0.29%). The audio streaming leader is up over 500% since the start of 2023, and the stock is now approaching $500 per share, or stock-split territory. Here’s why the stock has made a massive turnaround, and whether you should buy shares of Spotify after its big gains.

Efficient spending, expanding margins

Many investors will know Spotify as it is one of the most popular music and podcast streaming services worldwide. With 640 million monthly active users (MAUs), perhaps only YouTube has a larger reach around the world in this niche.

Spotify mostly makes money by selling ad-free music listening through a subscription service. Premium subscription revenue has grown consistently since Spotify went public in 2018 with 24% growth on a foreign currency-neutral basis last quarter. In U.S. dollars, the segment is closing in on $15 billion in annual subscription revenue.

Investors were never concerned about Spotify’s revenue growth. The problems were around profitability. In the third quarter of 2023, Spotify’s gross margin was a measly 26.4%, not much higher than when it went public. Operating margin was only 1.0%, and it had been negative for many quarters before that. One year later, and the story has completely changed. Gross profit margin was 31.1% in Q3 2024 with operating margin exploding higher to 11.4%.

Spotify was able to do this for a few reasons. First, it cut down on its full-time employees, trimming them by over 20% in the past year while seeing no effect on revenue growth. Second, it is seeing more revenue from its high-margin promotional marketplace, which is leading to gross margin expansion. Third, the company has started to raise prices on its subscription services, which — along with the falling employee numbers — has led to operating leverage and the double-digit operating margin.

Can Spotify reach 1 billion users?

Given the stock’s rally and the platform’s 640 million MAUs, investors may worry Spotify will hit user saturation sometime soon. This may be true in its most mature markets like the Nordics (the first market it entered), but it’s nowhere near the case in the majority of countries around the world. Internet penetration in places such as India, Indonesia, and Latin America will continue to grow in the coming years, which should lead Spotify to more MAU gains.

You can see it in the company’s geographical user breakout. The “Rest of World” segment — everywhere except The Americas and Europe — was 19% of overall users in 2020. Last quarter, it reached 33% of MAUs, which equates to over 200 million MAUs. There are billions of potential customers in these countries, even if you exclude places like China, where Spotify doesn’t operate.

But will Spotify be able to monetize these users? They don’t have the wealth or income to pay the same subscription fees as a country like the United States, but it looks like there are people willing to pay up for ad-free listening in most countries around the world. In fact, premium subscribers grew at 12% year over year last quarter, which was faster than MAU growth.

On top of new premium users, Spotify should be able to raise prices consistently in more mature markets. It has raised prices in the United States twice over the last two years with minimal effect on churn figures. This indicates there is room for management to continue raising prices over the next decade, especially if the company keeps adding new features like audiobooks to increase the value of a Spotify subscription.

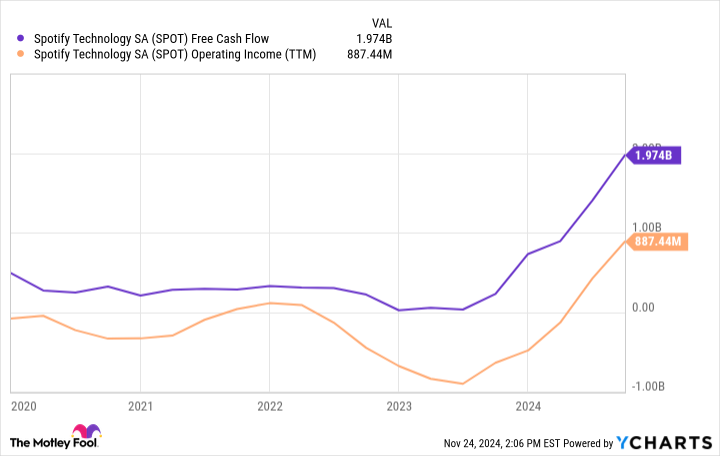

Data by YCharts.

Stock-split watch: Should you buy the stock?

Spotify may decide to split its stock in the future, but if you are thinking about buying shares in anticipation of a split, here’s the frank truth: A stock split is meaningless over the long term. Sure, a stock may rise in the lead-up to a stock split, but it has no bearing on how the underlying business is performing.

But earnings per share (EPS) and cash flow growth are key drivers of a stock’s long-term returns. Spotify’s free cash flow is soaring to record highs due to its cost cuts, hitting around $2 billion over the trailing 12 months. The stock has a market cap of about $95 billion as of this writing, meaning it trades at 48 times trailing free cash flow. And its valuation multiple soars even higher to nearly 130 when looking at trailing earnings per share.

Even though Spotify has solid growth prospects over the next decade, this is an expensive stock following its incredible two-year rally. I’d suggest keeping this one on your watchlist.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet, Amazon, and Spotify Technology. The Motley Fool has positions in and recommends Alphabet, Amazon, Nvidia, Spotify Technology, and Tesla. The Motley Fool has a disclosure policy.