It would be the first ever for one of these companies.

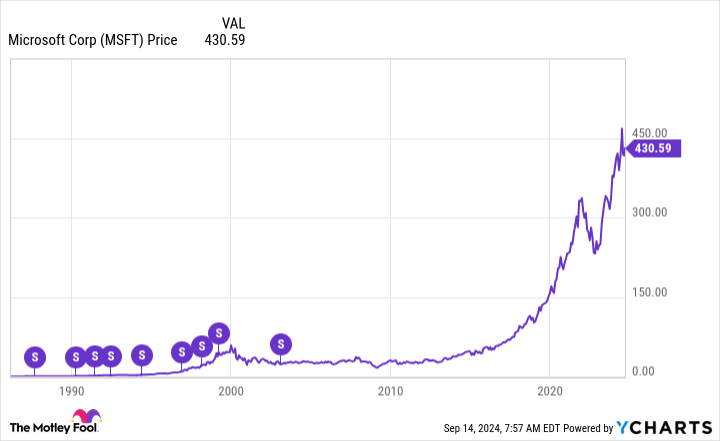

Stock splits are essential to a functional stock market even though they don’t affect the value of a company. Think of a company’s market cap (value) as a pie or a pizza, if you prefer. All the split does is create more slices; it doesn’t make the whole any larger. However, they are still essential, especially for those who aren’t billion-dollar hedge funds. Microsoft (MSFT 0.17%) has split its shares nine times, most recently in 2003. A single share would cost $123,800 today without stock splits. That price is out of reach for many, if not most investors to buy a single share. And, as you can see below, the price is towering again.

Splits also indicate that a company is booming, since the share price must have grown significantly. Unlike Microsoft, ServiceNow (NOW 1.54%) has never split; however, with share prices of $879, this could change soon.

Here is why these companies are having tremendous success.

Microsoft

The release of the generative AI chatbot ChatGPT pushed the AI race to the center of society’s and investors’ consciousness. When Microsoft made a multibillion-dollar investment in its creator, OpenAI, it was full throttle for tech companies to catch up. ChatGPT integrates with Microsoft Bing, which could allow Bing to steal some market share from Alphabet‘s Google Search, which generated $95 billion in revenue in the first half of 2024. Even small inroads for Bing will generate billions in revenue.

Another major AI product is Microsoft Copilot. Copilot integrates into several products, answers questions, summarizes or generates text, creates images, codes, and analyzes data. According to Microsoft, 60% of the Fortune 500 use Copilots, a staggering figure given the technology’s newness. These innovations drove sales growth of 16% in fiscal 2024 to $245 billion. Operating income grew 24% to $109 billion, a terrific 45% margin.

Microsoft stock trades at 36 times earnings, which is higher than its three-year and five-year averages of 33; however, the price-to-earnings (P/E) ratio drops to 33 on a forward basis. Due to the lofty valuation, investors shouldn’t expect the price to skyrocket overnight. Still, Wall Street can justify the current price based on Microsoft’s AI opportunities.

ServiceNow

ServiceNow and Microsoft have partnered for years on many technology initiatives. The latest integrates ServiceNow’s AI product, Now Assist, with Microsoft Copilot. Without boring you with too many technical details, the Now Assist product increases productivity in areas like human resources, IT support, customer service, and others. For example, Now Assist saves customer service agents time by summarizing a customer’s recent interaction so the agent doesn’t have to go through the transcript, allows agents to search vast databases quickly to find answers faster, etc. The increased productivity is invaluable for companies in a highly competitive world.

Around 85% of the Fortune 500 use ServiceNow. The chart below shows just how much ServiceNow’s customer base has grown. Each year that a customer adopts ServiceNow is represented by a different color, and the expansion shows the increased revenue from these customers over time.

ServiceNow

ServiceNow is in a higher growth phase than Microsoft ($2.6 billion in sales on 22% growth last quarter), so sales rather than bottom-line earnings better represent its valuation. Its current price-to-sales ratio is 18, which aligns with its 5-year average. Looking forward, the company expects 2024 subscription sales of $10.5 billion, and $15 billion in 2026. This means the stock price could conceivably return nearly 50% through 2026 by maintaining the same valuation.

Microsoft and ServiceNow are making huge moves in AI, and with soaring stock prices, splits may be on the horizon.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Microsoft, and ServiceNow. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.