Success has some downsides, including a much higher stock price.

Stock splits are back in style. Over the past few months, both fast-casual chain Chipotle and chip giant Nvidia announced plans to split their stocks. There’s no knowing for sure if more such announcements are on the horizon — but shares of some top companies have certainly reached price levels that could warrant such moves. Among them are MercadoLibre (MELI -0.99%), Booking Holdings (BKNG -0.73%), and Regeneron (REGN -0.17%).

1. MercadoLibre

MercadoLibre is riding the wave of the bull market. Though the Latin American e-commerce specialist has faced some headwinds in the past few years, its stock has generally outpaced the broader market. As of this writing, MercadoLibre’s shares are changing hands for an eye-popping $1,631, so a stock split would be appropriate, especially as there are good reasons to think the company will continue to perform relatively well. Consider MercadoLibre’s entire suite of services.

Though it is sometimes called the Amazon of Latin America, its business goes far beyond its e-commerce platform. MercadoLibre has a fintech arm, a logistics business, and an online storefront builder. Its operation boasts several strong competitive advantages, including a powerful network effect benefit and significant switching costs. It is hard to imagine any competitor taking much market share away from MercadoLibre in Latin America.

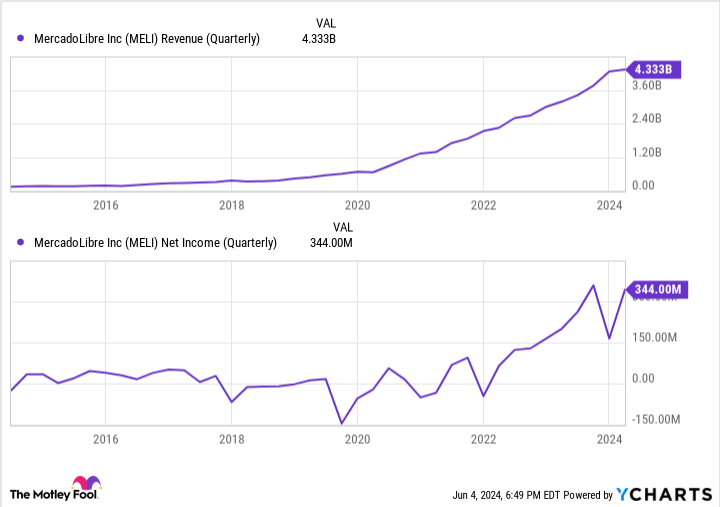

The company has historically delivered strong financial results and superior share price returns. That should continue for a while.

MELI Revenue (Quarterly) data by YCharts.

2. Booking Holdings

Booking Holdings runs platforms that help people with their travel arrangements, from flights and accommodations to car rentals and activities. Despite the disruptions to the travel industry caused by the pandemic, the stock has performed well in the past five years, easily outpacing the broader market. It trades at $3,801 per share as of this writing, hardly an amount the average investor could afford to spend on just one share.

Booking Holdings doesn’t seem to be in much danger of losing significant momentum, although its shares have been volatile this year. Its financial results, though, are still pretty solid. In the first quarter, revenue increased by 17% year over year to $4.4 billion. True, its top-line growth has slowed considerably in recent quarters. Once the period of lockdowns and social distancing had passed, people’s pent-up desire for travel created a boom in the industry, but that couldn’t last forever.

For Booking Holdings, revenue growth of 17% year over year is more or less in line with its pre-pandemic performance. On the bottom line, the company’s adjusted net earnings per share increased by almost 76% to $20.39. It also experienced healthy growth on other metrics, including nights booked and gross travel booking. Booking Holdings benefits from the network effect: The more people use its platform, the more attractive it becomes to businesses like hotels and car rental companies — and the more those companies make their offerings available through the platform, the more incentive travelers will have to use it.

Given its strong position in the industry, its competitive advantages, and the fact that traveling won’t go out of style anytime soon, Booking Holdings should continue delivering outsize returns. If it doesn’t split its stock, shares could hit $5,000 within the next couple of years.

3. Regeneron

Regeneron is one of the leading biotech stocks, and one of the most expensive, at around $994 per share. It has gotten expensive thanks to excellent financial performances, and it seems excellently positioned to keep delivering. The company’s most important growth driver, eczema treatment Dupixent, is close to earning a major new approval as a treatment for chronic obstructive pulmonary disease (COPD).

Regeneron’s other important product, the eye medication Eylea, should also perform well thanks to recent regulatory developments. In the first quarter, Regeneron’s revenue decreased by 1% year over year to $3.15 billion due to a decline in sales from its coronavirus franchise. Excluding its COVID-19 antibody, Regeneron’s top line increased by a decent 7% year over year. Investors should expect stronger year-over-year sales growth if the Food and Drug Administration (FDA) approves the COPD label expansion for Dupixent later this year.

The biotech has also been developing brand-new products, particularly in oncology. It’s awaiting the FDA’s approval decision for linvoseltamab, a potential treatment for heavily pre-treated multiple myeloma. That candidate could earn the green light by late August. Regeneron has several more promising candidates in its pipeline, both within and outside of oncology. That, combined with its strong current lineup, should allow it to keep up the momentum it has had in recent years.

The fractional option

None of these companies has ever conducted a forward stock split. (Booking Holdings did do a reverse stock split some 21 years ago.) So while any of them might opt to relatively soon, it’s also possible that investors will have to wait a while. Fortunately, there is another option. Most stock brokerages now offer their customers the option of buying fractional shares for a corresponding fraction of the price of a whole share. So even with $50, investors can invest in MercadoLibre, Booking Holdings, and Regeneron. There is no need to wait for a stock split to get in on these market winners.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Booking Holdings, Chipotle Mexican Grill, MercadoLibre, and Nvidia. The Motley Fool has a disclosure policy.