Is a stock split in ServiceNow’s future? Here’s what you need to know about stock splits in general, and how a split might affect this software giant in particular.

Business process optimizer ServiceNow (NOW 1.29%) entered the public stock market in 2012. The stock has gained a breathtaking 4,200% since then. If you bought $1,000 of ServiceNow shares on Day One, you’d have $43,140 in your pocket by now. If you bought a single share at the public offering’s closing price, a $24.60 investment would have risen to $1,061.

And it would still be just a single share at a much higher price. ServiceNow has never executed a stock split, and the four-digit stock price is getting cumbersome for investors with limited budgets.

Should ServiceNow split its stock in the near future, and what would a split mean for its investors? Let’s take a look.

What’s the point of splitting the stock?

It might seem like a stock split creates shareholder wealth out of thin air. If I have one ServiceNow share today and the company issues a 10-for-1 stock split, I’ll have 10 shares when it takes effect. Awesome, right?

But that’s not the whole story. ServiceNow would still be the same company after the split, whose entire stock-based market cap adds up to about $219 billion these days. The ownership is just split up into a different number of equal shares. So your $1,60 ServiceNow investment would neither gain nor lose value with a stock split. The morning after a 10-for-1 split, you’d simply have ten times as many shares, but each share will trade for one-tenth of what the pre-split stub was worth.

The math is different but the result is the same. A stock split is really just an accounting trick that adjusts share prices to a comfortable level, without making any difference to the underlying business. This is only more true if your stock brokerage allows the trading of fractional shares. This way, you don’t have to wait for a stock split — just buy one-tenth of a $1,60 share right away.

There are some edge cases where a stock split really does make a difference, but these outliers usually don’t apply to individual investors. For example, ServiceNow lets its employees collect part of their paycheck in the form of stock. This stock-based compensation accounted for 15% of the company’s sales and marketing expenses in the recently reported third quarter. The ratio was 24% in the research and development department. These stock-based paychecks are issued as whole shares, not fractional ones. Splitting the stock would give the company and its employees more granular control over their stock-based compensation amounts.

But again, that’s an issue for company insiders.

Why should ServiceNow consider a split?

The stock is soaring. ServiceNow shares have gained a market-crushing 59% in 52 weeks and 280% in five years. In other words, the stock price is rising from dozens of dollars per share, to hundreds, and now more than $1,000.

Many companies start to fiddle with their split ratios when stock prices reach this lofty level. Recent high-profile examples include chip designer Nvidia (NVDA -3.22%) performing a 10-for-1 split and fast-casual restaurant chain Chipotle Mexican Grill (CMG 3.38%) opting for a rare 50-for-1 exchange.

These two splits took place the same week in June. Nvidia’s stock price dropped from roughly $1,250 to $125 per share. Chipotle’s share price moved from $3,250 to $65. But remember, nobody lost or made any money from these headline-inspiring splits. The stocks just became easier to manage with a limited stock-buying budget.

ServiceNow stands close to Nvidia’s pre-split stock price, and I wouldn’t be surprised to see a split announcement someday soon. But I’m not holding my breath in anticipation, either.

What ServiceNow investors should focus on

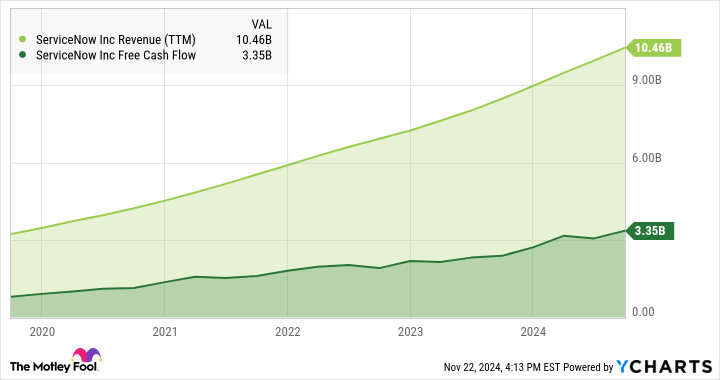

Stock charts can be fun but financial statements are more important. Fortunately, ServiceNow runs a fantastic business. Its sales more than tripled over the last five years while free cash flows quadrupled.

NOW Revenue (TTM) data by YCharts

ServiceNow’s tools for managing operating processes are in high demand. Helping clients orchestrate their cloud computing setups has been a major growth driver in recent years, and now the company focuses on artificial intelligence (AI) systems.

The company looks great from a business perspective. This success story should drive the stock price even higher in 2025 and beyond. I’ll admit that the shares do look pricey in terms of valuation ratios, but the company supports its lofty stock price with impressive growth.

So maybe it’s time for a stock split for cosmetic reasons, and the stock may not be a deep-value play right now. Still, ServiceNow’s shares look interesting to growth investors — with or without a stock split in the near future.

Anders Bylund has positions in Nvidia. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Nvidia, and ServiceNow. The Motley Fool recommends the following options: short December 2024 $54 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.