Yahoo Finance’s Ines Ferré joins Yahoo Finance Live to discuss market movers in early Monday trading.

Video Transcript

BRAD SMITH: For right now, let’s get on over to Yahoo Finance’s Ines Ferre over at the YFi Interactive. Innes?

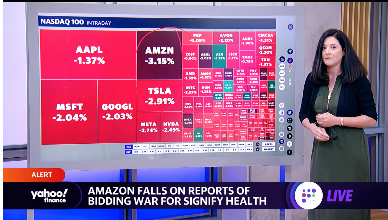

INES FERRE: And Brad, stocks continuing to sell off from last Friday. Take a look at the NASDAQ. It’s down 1.7%. Do want to point out the 10-year Treasury note yield that is pushing up towards 3%.

Also want to point out the US dollar index at 108.67. Remember that we’ve seen this before. When that dollar goes higher, we are seeing stocks that tend to go lower. So let’s take a look under the hood.

We’re watching consumer discretionary. Energy stocks, these are losing the most right now. Consumer discretionary, a lot of this has to do with Amazon, down more than 3%, Tesla down almost 3% as well. Do want to point out Netflix down 5% after a downgrade at CFRA.

Also want to point out the semiconductors. These are seeing weakness. Citi came out with a warning about memory chips and pricing weakness going forward there. So we are seeing a little bit of a pullback there.

Want to mention the energy stocks, because we had seen that this is one of the biggest decliners. So a pullback with some of these names. But also, when we take a look at WTI, Brent Crude, just want to mention that we’re watching Brent down more than 2% the last time that I checked.

Oh, 4% right now. And we are looking at WTI extending its losses down more than 4% as well for WTI. Just want to mention also though, natural gas hitting another 14-year high, guys.

JULIE HYMAN: Interesting. And that’s also as we watch what’s going on in Iran, that affecting the price of oil. Natural gas closely tied to Russia and what’s going on in Europe. So a lot moving. Thank you so much on the energy front.