Yahoo Finance reporter Ines Ferre looks at how the stock market closed out its week and which sectors stood out along the way.

Video Transcript

[THEME MUSIC]

RACHELLE AKUFFO: We’re just minutes away from the closing bell with the major indices. Let’s take a look at the Dow really charging ahead. Let’s bring in Yahoo Finance’s Ines Ferre to break down all this market action. Ines.

INES FERRE: Yeah, that’s right. We are going to end near the highs of the session. We’re looking at the Dow more than 500 points, 600 points higher. You’re looking also at the NASDAQ Composite on our YFi Interactive board, that’s up 1.6%. And the S&P 500, more than 1.7%.

And also, checking out the US dollar index because we have been watching it throughout the week. Today, the US dollar taking a little bit of a reprieve. We’ve got it up above 108, but it was above 109 just yesterday. And with the dollar being a tiny bit weaker, we are seeing stocks being able to gain some.

So we’re looking at the S&P 500 sectors. All 11 sectors being in the green, with financials leading the gains. And I want to show you the bank stocks because these have been rallying today. You’ve got Citi up more than 13% after a beat on the top and the bottom line. You also have Wells Fargo up more than 6%, taking part in the rally with the banks.

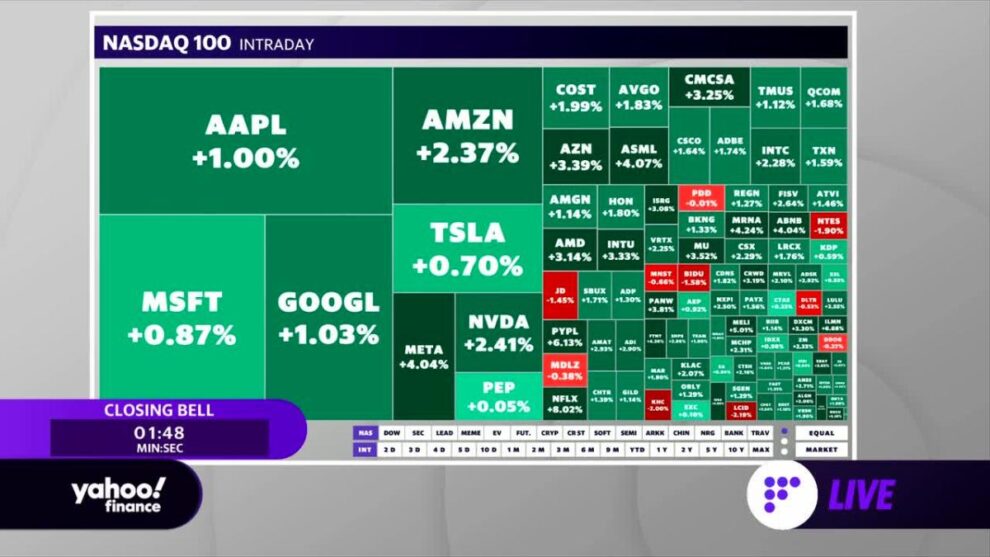

And over on the Dow, we’re watching UnitedHealth Group that’s set to close up more than 5% higher. This is after the company reported its quarterly results and after raising guidance. And over on the NASDAQ 100, just taking a look at some of the Semi– at some of the Semis and also the mega caps here.

You’ve got Meta up more than 4%. You also have Amazon up more than 2%. And as I mentioned, the Semiconductor is seeing quite a bit of gains here. The stocks today that were lagging– Chinese ADRs. So they are off their lows of the session, but if you just pull up a five-day chart, you can see pretty underwater for the last five days.

You’ve got new regulatory probes today that sent to us shares of BABA that were lower. And also China’s GDP came out, and that missed expectations. So Chinese ADRs today, some weakness.

RACHELLE AKUFFO: And Ines, we know that you’re also looking closely at commodities. How were they ending the week?

INES FERRE: Yeah. So commodities have had quite a week. And we’ve seen a lot of volatility when it comes to oil. We really saw oil take a leg lower earlier this week. Today, WTI jumping at 2%, Brent Crude jumping up above $100 a barrel. Remember that oil earlier this week, just yesterday, had touched levels it hadn’t seen since before the Russian invasion of Ukraine, so giving up the gains that were prompted by the Russian invasion.

And again, with the stronger dollar, we have seen that oil prices come down also, of course, because of recession fears. But when you do see this, if the dollar pull back a bit, you will see commodities go higher.

I do want to mention just some other commodities that we’ve been watching. And that being Wheat Futures. Because Wheat Futures have now erased their 2022 gains that were triggered by the war in Ukraine, with the highs coming in in March and giving up those gains. Here’s the closing bell for today, July 15.