(Bloomberg) — US equity futures erased declines, trading little changed, as strong results from Snowflake Inc. helped spur software stocks. Oil advanced with investors on edge about the war in Ukraine, while Bitcoin closed in on the $100,000 mark.

Most Read from Bloomberg

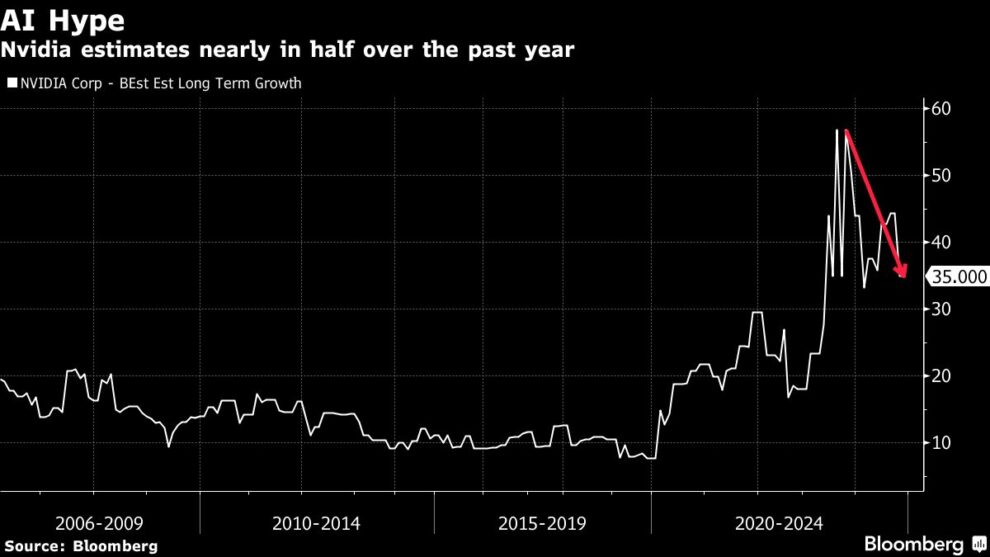

S&P 500 contracts pointed to a flat open on Wall Street as traders weighed a lackluster forecast from Nvidia Corp. against Snowflake’s 20% premarket surge, which also lifted its peers. With Bitcoin closing in on the $100,000 level, MicroStrategy Inc., the largest publicly traded corporate holder of the crypotcurrency, rallied as much as 11% in early hours trading. Ten-year US government bond yields and the dollar were steady.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen

Fears the Russia-Ukraine war is escalating helped lift oil and gold prices, while European natural gas futures hit the highest in a year. Ukraine reported that Russia fired an intercontinental ballistic missile during an overnight attack, while a Kremlin spokesman called Kyiv’s earlier use of UK Storm Shadow missiles a new escalation.

Traders are watching US initial jobless claims later Thursday for signs on the strength of the economy and the Federal Reserve’s interest-rate path. An expected decision on President-elect Donald Trump’s nominee for Treasury secretary is also in focus.

“Trump’s win has brought with it an increase in geopolitical uncertainty and that too is weighing on sentiment,” said Daniel Murray, Zurich-based chief executive officer of EFG Asset Management in Switzerland. “Ukraine now has an incentive to gain as much strategic advantage as possible ahead of Trump’s inauguration.”

Federal Reserve Bank of Boston President Susan Collins said more rate cuts are needed, but policymakers should proceed carefully to avoid moving too quickly or too slowly. Swaps market pricing indicated a chance of around 50% that the Fed will cut rates again in December.

Bitcoin, Adani

Meanwhile, Bitcoin topped $98,000 for the first time on optimism Trump’s support for crypto heralds a boom for the industry as the US pivots to friendly regulations in place of a crackdown. Trump’s transition team has begun to hold discussions over whether to create a White House post dedicated to digital-asset policy.

In Asia, shares of India’s Adani Group units tumbled and the conglomerate scrapped a $600 million dollar bond sale. US prosecutors charged Gautam Adani, one of the world’s richest people, with participating in a scheme that involved promising to pay more than $250 million in bribes to Indian government officials to secure solar energy contracts. The company denied the US allegations.

Adani Charged by US in $250 Million Bribery Case, Shaking India

Key events this week:

-

Eurozone consumer confidence, Thursday

-

US existing home sales, initial jobless claims, Philadelphia Fed factory index, Thursday

-

Eurozone HCOB Manufacturing & Services PMI, Friday

-

US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 6:50 a.m. New York time

-

Nasdaq 100 futures fell 0.1%

-

Futures on the Dow Jones Industrial Average rose 0.2%

-

The Stoxx Europe 600 was little changed

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.2% to $1.0519

-

The British pound fell 0.1% to $1.2637

-

The Japanese yen rose 0.6% to 154.51 per dollar

Cryptocurrencies

-

Bitcoin rose 3.8% to $98,014.01

-

Ether rose 2.1% to $3,144.59

Bonds

-

The yield on 10-year Treasuries was little changed at 4.40%

-

Germany’s 10-year yield declined two basis points to 2.33%

-

Britain’s 10-year yield declined two basis points to 4.45%

Commodities

-

West Texas Intermediate crude rose 2% to $70.12 a barrel

-

Spot gold rose 0.8% to $2,670.73 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson and Divya Patil.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.